Nj 1040 Instructions Form

What are the NJ 1040 Instructions?

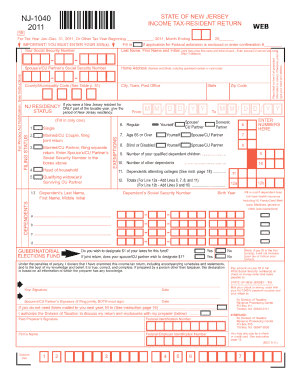

The NJ 1040 instructions provide essential guidance for New Jersey residents filing their state income tax returns. This document outlines the necessary steps, required information, and specific forms needed to accurately complete the NJ 1040 form. Understanding these instructions is crucial for ensuring compliance with state tax laws and avoiding potential penalties. The instructions detail how to report income, claim deductions, and calculate tax liabilities, making it easier for taxpayers to navigate the filing process.

Steps to Complete the NJ 1040 Instructions

Completing the NJ 1040 instructions involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Review the NJ 1040 instructions to understand the specific requirements for your filing status.

- Fill out the NJ 1040 form accurately, ensuring all income and deductions are reported correctly.

- Double-check your calculations and ensure that all required signatures are included.

- Submit your completed NJ 1040 form by the designated deadline, either electronically or via mail.

How to Obtain the NJ 1040 Instructions

Taxpayers can obtain the NJ 1040 instructions through several methods. The instructions are available online on the New Jersey Division of Taxation website, where users can download the PDF version for easy access. Additionally, printed copies can be requested from local tax offices or obtained through various community resources. Ensuring you have the latest version of the instructions is important, as tax laws and requirements may change annually.

Legal Use of the NJ 1040 Instructions

The NJ 1040 instructions are legally binding documents that guide taxpayers in fulfilling their obligations under New Jersey tax law. Accurate completion of the NJ 1040 form, following these instructions, is essential for compliance. Taxpayers must ensure that the information provided is truthful and complete, as discrepancies can lead to audits or penalties. Utilizing the NJ 1040 instructions helps mitigate risks associated with incorrect filings and supports the legal standing of submitted tax returns.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for taxpayers. The due date for submitting the NJ 1040 form typically aligns with the federal tax deadline, which is usually April fifteenth. However, taxpayers should verify specific dates each year, as extensions or changes may occur. Additionally, understanding deadlines for estimated tax payments and any applicable penalties for late submissions can help taxpayers avoid unnecessary fees.

Required Documents

To complete the NJ 1040 instructions accurately, taxpayers must gather several required documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Proof of residency in New Jersey

- Any supporting documentation for additional income or adjustments

Having these documents ready will streamline the filing process and ensure compliance with state requirements.

Quick guide on how to complete nj 1040 instructions

Complete Nj 1040 Instructions effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Handle Nj 1040 Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Nj 1040 Instructions with ease

- Locate Nj 1040 Instructions and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method of delivering your form, either by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Nj 1040 Instructions to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2012 NJ 1040 instructions and why are they important?

The 2012 NJ 1040 instructions provide essential guidelines on how to correctly file your New Jersey income tax return. Understanding these instructions ensures compliance with state tax laws, helping you avoid penalties and maximize your potential refund. With airSlate SignNow, you can efficiently sign and submit any related documents.

-

Where can I find the 2012 NJ 1040 instructions?

The 2012 NJ 1040 instructions can be accessed through the New Jersey Division of Taxation’s official website or through trusted tax software that includes New Jersey tax forms. For a streamlined experience, use airSlate SignNow to easily eSign and send your tax documents securely.

-

How can airSlate SignNow assist with completing the 2012 NJ 1040 instructions?

airSlate SignNow simplifies the process of managing your 2012 NJ 1040 instructions by providing tools to electronically sign and send documents quickly. This service ensures that you can easily keep track of your submissions and maintain a digital record for your files. It's a cost-effective solution tailored for your tax needs.

-

Are there any fees associated with using airSlate SignNow for the 2012 NJ 1040 instructions?

airSlate SignNow offers competitive pricing for its eSignature services, allowing you to sign and manage your 2012 NJ 1040 instructions without breaking the bank. Depending on your usage, our plans cater to individual users as well as businesses with multiple document needs. Explore our pricing page for more details.

-

What features does airSlate SignNow offer for handling tax documents like the 2012 NJ 1040 instructions?

airSlate SignNow offers a range of features perfect for handling tax documents, including document templates, customizable signing workflows, and secure cloud storage. These features facilitate a smooth process when completing the 2012 NJ 1040 instructions, allowing you to focus on what truly matters. Additionally, the platform is designed for ease of use by anyone.

-

Can I integrate airSlate SignNow with other tax preparation software for the 2012 NJ 1040 instructions?

Yes, airSlate SignNow can be integrated with various tax preparation software, enhancing your workflow when managing the 2012 NJ 1040 instructions. This integration allows for seamless document transfer and eSigning capabilities, making tax filing more efficient. Check our integrations page for specific compatibility options.

-

What are the benefits of using airSlate SignNow for the 2012 NJ 1040 instructions?

Using airSlate SignNow for the 2012 NJ 1040 instructions saves you time and reduces the hassle of traditional paper-based processes. With eSigning, you can complete your documents from anywhere, at any time, which adds convenience to your tax filing experience. Moreover, our service enhances document security and compliance.

Get more for Nj 1040 Instructions

- Surplus lines statement sl 8 form and instruction professional

- Member claims mc 0010 form

- Ca 7 llc form

- Oklahoma license horse racing form

- The childrens hospital collection labeling and transport of form

- Member appointment form

- Email new jersey state disability claim your standard form

- The medicaid program will pay providers of non institutional pediatric continuous private duty form

Find out other Nj 1040 Instructions

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself