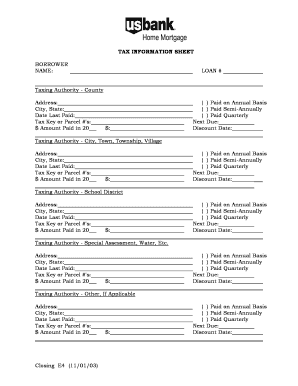

Tax Record Information Sheet

What is the Tax Record Information Sheet

The tax record information sheet is a crucial document used by individuals and businesses to report their income, deductions, and tax obligations to the Internal Revenue Service (IRS). This form serves as a comprehensive summary of financial activities for a specific tax year, ensuring compliance with federal tax laws. It typically includes information such as income sources, filing status, and applicable deductions, which are essential for accurate tax calculations.

How to use the Tax Record Information Sheet

Using the tax record information sheet involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses. Next, fill out the sheet with the relevant details, ensuring that all income and deductions are accurately reported. Once completed, review the information for accuracy before submitting it to the IRS. This document can be filed electronically or via mail, depending on your preference and the specific requirements of your tax situation.

Steps to complete the Tax Record Information Sheet

Completing the tax record information sheet requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as income statements and expense receipts.

- Enter your personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, freelance earnings, and investment income.

- List all eligible deductions, such as mortgage interest, medical expenses, and charitable contributions.

- Calculate your total taxable income and determine your tax liability.

- Review the completed sheet for accuracy and completeness before submission.

Legal use of the Tax Record Information Sheet

The tax record information sheet is legally binding when completed accurately and submitted in compliance with IRS regulations. It is essential to ensure that all information is truthful and verifiable, as submitting false information can result in penalties or legal consequences. Electronic submissions are valid under the ESIGN and UETA acts, provided that the electronic signature complies with legal standards. Utilizing a secure platform for e-signatures can enhance the legal validity of the document.

Required Documents

To complete the tax record information sheet, several key documents are typically required. These include:

- W-2 forms from employers detailing annual wages.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses, such as medical bills and charitable donations.

- Bank statements and investment income reports.

- Previous year’s tax return for reference.

Filing Deadlines / Important Dates

Filing deadlines for the tax record information sheet are crucial to avoid penalties. Typically, individuals must file their federal tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, allowing them to file up to six months later, although any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Quick guide on how to complete tax record information sheet

Complete Tax Record Information Sheet effortlessly on any device

The management of documents online has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Tax Record Information Sheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to alter and eSign Tax Record Information Sheet with ease

- Find Tax Record Information Sheet and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Obscure pertinent sections of the documents or redact sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Dispense with the worry of lost or misplaced files, tiresome form searches, or errors that require new printed document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Tax Record Information Sheet and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax record information sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax record information sheet and why is it important?

A tax record information sheet is a vital document that compiles key tax-related data necessary for completing your tax returns accurately. It's essential as it helps in ensuring compliance with tax regulations and can be used as a reference for auditing purposes.

-

How can airSlate SignNow help in managing tax record information sheets?

airSlate SignNow aids in managing tax record information sheets by providing secure eSigning and document management solutions. This ensures that your tax records are stored safely and can be retrieved or shared easily, streamlining your tax preparation process.

-

What features does airSlate SignNow offer for handling tax record information sheets?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage for your tax record information sheets. These tools enhance efficiency, making it easy to collect signatures and manage tax-related documents.

-

Is airSlate SignNow cost-effective for small businesses needing tax record information sheets?

Yes, airSlate SignNow is a cost-effective solution for small businesses requiring tax record information sheets. With affordable pricing plans, it allows businesses to efficiently manage their documents without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for tax record information sheets?

Absolutely! airSlate SignNow easily integrates with popular accounting software, allowing you to manage your tax record information sheets seamlessly across platforms. This integration simplifies the process of capturing signatures and keeping your records organized.

-

What are the benefits of using airSlate SignNow for tax record information sheets?

Using airSlate SignNow for tax record information sheets offers numerous benefits, including enhanced security, streamlined workflows, and improved document accessibility. These advantages ensure your tax records are handled efficiently and securely.

-

How secure is airSlate SignNow for storing tax record information sheets?

airSlate SignNow employs robust security measures, including encryption and secure access controls, to protect your tax record information sheets. Your sensitive data remains safe, allowing you to focus on your business without worrying about document security.

Get more for Tax Record Information Sheet

- Judicial leave form unified courts of guam guamcourts

- Guam interpreter form

- Small claims court instruction to marshal cancellation of wages instruction to marshal cancellation of wages guamselfhelp form

- Petitioner is parent unified courts of guam guamselfhelp form

- Ia information form

- Warranty deed tenants by the entirety warranty deed tenants by the entirety form

- Standard lease agreement ga amandaswrinkledpagescom form

- Motion substitution form

Find out other Tax Record Information Sheet

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form