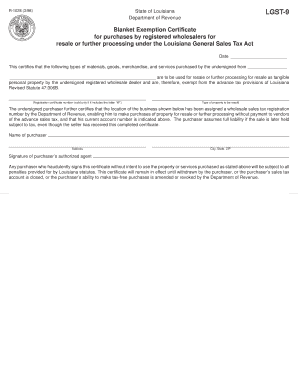

R 1028 398 LGST 9 Department of Revenue Form

What is the R 1028 398 LGST 9 Department Of Revenue

The R 1028 398 LGST 9 Department Of Revenue form is a crucial document used for tax purposes within the United States. This form is typically required by state revenue departments to gather specific information regarding tax liabilities and compliance. It plays a significant role in ensuring that businesses and individuals adhere to local tax regulations. Understanding the purpose and requirements of this form is essential for accurate tax reporting and compliance.

How to use the R 1028 398 LGST 9 Department Of Revenue

Using the R 1028 398 LGST 9 Department Of Revenue form involves several steps. First, gather all necessary information, including personal identification details and financial data relevant to your tax situation. Next, fill out the form accurately, ensuring that all sections are completed as required. Once the form is filled out, review it for any errors before submission. Utilizing digital tools can streamline this process, allowing for easy editing and secure submission.

Steps to complete the R 1028 398 LGST 9 Department Of Revenue

Completing the R 1028 398 LGST 9 Department Of Revenue form requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as previous tax returns and income statements.

- Access the form through the appropriate state department website or a trusted digital platform.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Provide financial details, including income, deductions, and credits applicable to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail, depending on state requirements.

Legal use of the R 1028 398 LGST 9 Department Of Revenue

The R 1028 398 LGST 9 Department Of Revenue form is legally binding when completed according to established guidelines. To ensure its validity, it must be signed by the appropriate parties, which can be facilitated through electronic signatures that comply with legal standards. Understanding the legal implications of this form is vital for maintaining compliance with state tax laws and avoiding potential penalties.

Filing Deadlines / Important Dates

Timely submission of the R 1028 398 LGST 9 Department Of Revenue form is essential to avoid penalties. Each state may have specific deadlines for filing, typically aligned with the overall tax filing season. It is important to check the state's revenue department website for the most accurate and up-to-date information regarding filing deadlines and any potential extensions that may be available.

Required Documents

To complete the R 1028 398 LGST 9 Department Of Revenue form, certain documents are typically required. These may include:

- Previous tax returns for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of deductions and credits claimed.

- Identification documents, such as a driver's license or Social Security card.

Quick guide on how to complete r 1028 398 lgst 9 department of revenue

Complete R 1028 398 LGST 9 Department Of Revenue effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate template and securely archive it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage R 1028 398 LGST 9 Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to modify and eSign R 1028 398 LGST 9 Department Of Revenue with ease

- Locate R 1028 398 LGST 9 Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or hide sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and has the same legal value as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign R 1028 398 LGST 9 Department Of Revenue and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1028 398 lgst 9 department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the R 1028 398 LGST 9 Department Of Revenue?

The R 1028 398 LGST 9 Department Of Revenue is a specific document or form used for tax reporting and compliance. It is essential for businesses to understand its requirements to avoid issues with the Department Of Revenue. By utilizing airSlate SignNow, you can easily prepare and sign this document electronically, streamlining the submission process.

-

How can airSlate SignNow help with R 1028 398 LGST 9 Department Of Revenue submissions?

airSlate SignNow simplifies the submission process for the R 1028 398 LGST 9 Department Of Revenue by allowing users to create, send, and eSign documents securely online. With a user-friendly interface, you'll be able to gather necessary signatures quickly, ensuring compliance and timely submission to the Department Of Revenue.

-

What are the pricing options for airSlate SignNow services related to R 1028 398 LGST 9 Department Of Revenue?

airSlate SignNow offers various pricing tiers tailored for businesses, making it cost-effective for managing documents like the R 1028 398 LGST 9 Department Of Revenue. Depending on your needs, you can choose from individual plans to team and enterprise solutions that provide extensive features for compliance and document management.

-

What features does airSlate SignNow offer for document management related to R 1028 398 LGST 9 Department Of Revenue?

airSlate SignNow provides features such as customizable templates, electronic signatures, and secure storage, all essential for handling documents like the R 1028 398 LGST 9 Department Of Revenue. These tools enhance the efficiency and accuracy of document management processes, ensuring your submissions meet regulatory standards.

-

Are there integrations available with airSlate SignNow for managing R 1028 398 LGST 9 Department Of Revenue documents?

Yes, airSlate SignNow offers a variety of integrations with popular business applications, allowing seamless management of documents related to the R 1028 398 LGST 9 Department Of Revenue. Whether you use CRM systems or accounting software, these integrations help streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the R 1028 398 LGST 9 Department Of Revenue?

Using airSlate SignNow for the R 1028 398 LGST 9 Department Of Revenue provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. The electronic signature capability ensures a faster turnaround on document processing, saving time and effort for your business.

-

Is airSlate SignNow secure for handling sensitive R 1028 398 LGST 9 Department Of Revenue documents?

Absolutely, airSlate SignNow prioritizes security when handling sensitive documents such as the R 1028 398 LGST 9 Department Of Revenue. With advanced encryption and secure access controls, your data remains protected, ensuring that you can confidently manage your important tax documents.

Get more for R 1028 398 LGST 9 Department Of Revenue

Find out other R 1028 398 LGST 9 Department Of Revenue

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament