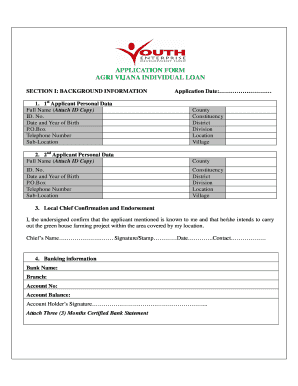

Agric Vijana Form

What is the Agric Vijana?

The Agric Vijana loan is a financial product designed to support young farmers and agricultural entrepreneurs in the United States. This loan aims to provide accessible funding for various agricultural activities, including purchasing equipment, seeds, and livestock. By facilitating financial assistance, the Agric Vijana loan encourages innovation and growth within the agricultural sector, helping young individuals establish and expand their farming operations.

How to Obtain the Agric Vijana

To obtain the Agric Vijana loan, applicants must follow a structured process. First, individuals should research eligibility criteria, which typically include age restrictions and agricultural experience. Next, applicants need to gather necessary documentation, such as proof of identity, business plans, and financial statements. Once the required documents are prepared, applicants can submit their loan applications through designated financial institutions or agricultural organizations that offer this loan. It is essential to ensure all information is accurate and complete to enhance the chances of approval.

Steps to Complete the Agric Vijana

Completing the Agric Vijana loan application involves several key steps. Start by reviewing the eligibility requirements to confirm qualification. Next, compile all required documents, including personal identification, agricultural experience, and financial records. After gathering the necessary paperwork, fill out the application form accurately, ensuring all sections are completed. Once the application is ready, submit it through the appropriate channels, either online or in-person, depending on the lender's requirements. Finally, monitor the application status and be prepared to provide additional information if requested by the lender.

Legal Use of the Agric Vijana

The legal use of the Agric Vijana loan is governed by specific regulations that ensure the funds are utilized for approved agricultural purposes. Borrowers must adhere to the stipulations outlined in the loan agreement, which typically include using the funds for purchasing equipment, seeds, livestock, or other essential farming needs. It is crucial for borrowers to maintain compliance with these regulations to avoid penalties or legal issues that could arise from misusing the loan funds.

Eligibility Criteria

Eligibility for the Agric Vijana loan generally includes several important criteria. Applicants must be young farmers or agricultural entrepreneurs, often defined as individuals between the ages of eighteen and thirty-five. Additionally, applicants should demonstrate a commitment to agriculture, which may include having relevant experience or a business plan outlining their farming goals. Financial stability and creditworthiness may also be assessed to determine the applicant's ability to repay the loan. Meeting these criteria is essential for a successful application.

Required Documents

When applying for the Agric Vijana loan, certain documents are typically required to support the application. These may include:

- Proof of identity, such as a government-issued ID or driver's license

- A detailed business plan outlining farming operations and goals

- Financial statements, including income and expense reports

- Tax returns for the previous years

- Any additional documentation requested by the lender

Having these documents prepared and organized can streamline the application process and improve the chances of approval.

Application Process & Approval Time

The application process for the Agric Vijana loan involves several stages, beginning with the submission of the completed application form and required documents. Once submitted, lenders will review the application, which may take several weeks. During this time, applicants might be contacted for additional information or clarification. The approval time can vary based on the lender's policies and the completeness of the application. Generally, applicants should expect to wait anywhere from a few weeks to a couple of months for a decision on their loan application.

Quick guide on how to complete agric vijana

Complete Agric Vijana effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Agric Vijana on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Agric Vijana with ease

- Locate Agric Vijana and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize necessary portions of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Agric Vijana and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the agric vijana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the agri vijana loan?

The agri vijana loan is a financial product designed specifically for young farmers and agribusinesses in need of capital to enhance their agricultural ventures. This loan provides favorable terms, making it easier for new entrants in the agricultural sector to start or expand their operations.

-

How can I apply for an agri vijana loan?

To apply for an agri vijana loan, you can visit our website and fill out an online application form. It requires basic information about your agricultural business and financial needs. Our team will guide you through the process to ensure a smooth application experience.

-

What are the eligibility criteria for the agri vijana loan?

To be eligible for the agri vijana loan, applicants usually must be between the ages of 18 and 35 and demonstrate a viable business plan in agriculture. Additionally, you'll need to provide proof of identity and income to support your application.

-

What are the interest rates associated with the agri vijana loan?

The interest rates for the agri vijana loan are competitive and designed to support young farmers. Rates may vary based on the amount borrowed and the repayment term, providing flexibility to assist applicants in managing their finances effectively.

-

What is the repayment term for the agri vijana loan?

The repayment term for the agri vijana loan can vary from 1 to 5 years, depending on the loan amount and specific terms of the agreement. This structure allows young entrepreneurs in agriculture to plan their finances better and meet their repayment obligations comfortably.

-

What benefits does the agri vijana loan offer?

The agri vijana loan offers several benefits, including low-interest rates, flexible repayment plans, and the potential for growth in your agricultural business. This loan helps young farmers access essential funds to invest in equipment, seeds, and other necessary resources for success.

-

Can I use the agri vijana loan for starting a new agricultural venture?

Yes, the agri vijana loan is specifically designed to support young individuals looking to start new agricultural ventures. This funding can help cover initial costs such as purchasing land, equipment, and other essentials to establish your business.

Get more for Agric Vijana

- Dsar20 notice of intention to submit dissertationthesis unisa ac form

- The selmo bradley scholarship guidelines and application eedlo form

- Raytheon e systems retiree medical bfsa claim formb bb

- Asc rule 13 b501b fees alberta securities commission form

- Tort claim reporting form cl 03 106 1 south carolina irf sc

- Cec cf1r alt 05 e revised 0416 energy ca form

- Ivy tech community college of indiana employment application ivytech form

- Canada bmw financial services form

Find out other Agric Vijana

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple