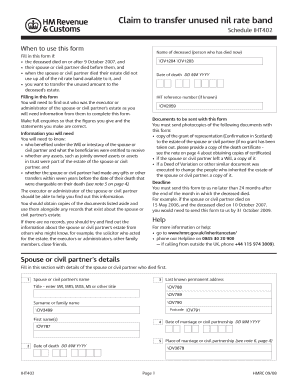

Iht402 Form

What is the IHT402?

The IHT402 form is a crucial document used in the United States for reporting inheritance tax. It is specifically designed for individuals who are responsible for settling the estate of a deceased person. This form provides a detailed account of the deceased's assets and liabilities, which is essential for calculating the estate's tax obligations. Completing the IHT402 accurately ensures compliance with tax regulations and helps facilitate the smooth transfer of assets to beneficiaries.

How to use the IHT402

Using the IHT402 form involves several steps that require careful attention to detail. First, gather all necessary documentation related to the deceased's estate, including asset valuations, debts, and any relevant financial statements. Next, fill out the form systematically, ensuring that each section is completed with accurate information. It is important to provide clear and concise details to avoid delays in processing. Once completed, the form must be submitted to the appropriate tax authority, either electronically or via mail, depending on local regulations.

Steps to complete the IHT402

Completing the IHT402 form involves a series of methodical steps:

- Gather all relevant documents, including wills, bank statements, and property deeds.

- Fill in personal details of the deceased, including full name, date of birth, and date of death.

- List all assets, including real estate, bank accounts, investments, and personal property.

- Detail any outstanding debts or liabilities that the estate owes.

- Calculate the total value of the estate by subtracting liabilities from assets.

- Review the completed form for accuracy and completeness.

- Submit the form according to the guidelines provided by the tax authority.

Legal use of the IHT402

The IHT402 form serves a legal purpose in the estate settlement process. It is required by law to report the value of an estate for tax purposes. Properly completing and submitting this form ensures that the estate complies with inheritance tax laws, thus avoiding potential legal issues. It is essential to adhere to the guidelines set forth by the Internal Revenue Service (IRS) and state authorities to ensure that the form is recognized as valid and enforceable.

Required Documents

When preparing to complete the IHT402 form, several documents are necessary to provide a comprehensive overview of the estate:

- Death certificate of the deceased.

- Will or trust documents, if applicable.

- Bank statements and financial records.

- Property deeds and valuations.

- Documentation of any outstanding debts.

Form Submission Methods

The IHT402 form can be submitted through various methods, depending on the requirements of the local tax authority. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing a hard copy of the completed form to the designated office.

- In-person submission at local tax offices, where available.

IRS Guidelines

Following IRS guidelines is essential when completing the IHT402 form. The IRS provides specific instructions on how to fill out the form, including what information is required and how to calculate the estate's value. Familiarizing oneself with these guidelines helps ensure that the form is completed correctly, minimizing the risk of errors that could lead to penalties or delays in processing.

Quick guide on how to complete iht402

Effortlessly prepare Iht402 on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without delays. Handle Iht402 on any device using the airSlate SignNow apps available for Android or iOS, and enhance any document-driven workflow today.

The simplest way to edit and electronically sign Iht402 with ease

- Find Iht402 and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of the documents or cover sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Edit and electronically sign Iht402 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht402

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht402 and how does it relate to airSlate SignNow?

The iht402 is a specific document or form that can be efficiently handled using airSlate SignNow. This platform allows users to create, send, and eSign iht402 documents seamlessly, ensuring compliance and efficiency in document management.

-

How much does airSlate SignNow cost for managing iht402 documents?

Pricing for airSlate SignNow is competitive and designed to accommodate various business sizes. Plans start at a reasonable monthly fee, providing unlimited access to features necessary for managing iht402 documents, including eSigning capabilities and cloud storage.

-

What are the key features of airSlate SignNow for iht402 document processing?

airSlate SignNow offers a range of features ideal for handling iht402 documents, such as custom templates, advanced authentication, and real-time tracking. These tools enhance the security and efficiency of document management, making the entire eSigning process streamlined.

-

Are there any benefits to using airSlate SignNow for iht402 documents?

Using airSlate SignNow for iht402 documents brings several benefits, including reduced processing time and enhanced document security. Additionally, it allows for a more professional appearance in document handling, which can improve client trust and satisfaction.

-

Can airSlate SignNow integrate with other tools for managing iht402 documents?

Yes, airSlate SignNow offers robust integrations with various tools and software, making it easier to manage iht402 documents within your existing workflows. This includes CRM systems, cloud storage services, and productivity applications, ensuring a seamless experience.

-

Is electronic signing of iht402 documents legally binding with airSlate SignNow?

Absolutely! Electronic signatures created using airSlate SignNow for iht402 documents are legally binding and comply with industry standards and regulations. This ensures that your signed documents hold up in legal situations, providing peace of mind.

-

How can businesses ensure compliance while using airSlate SignNow for iht402 documents?

Businesses can ensure compliance when using airSlate SignNow for iht402 documents by leveraging its advanced security features, like audit trails and authentication methods. These tools help keep your documents secure and provide the necessary records for compliance and legal purposes.

Get more for Iht402

Find out other Iht402

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy