Formulario 480 7c

What is the Formulario 480 7c

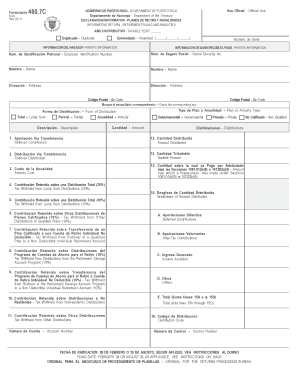

The Formulario 480 7c is a tax form used primarily in the United States for reporting specific types of income. This form is essential for individuals and businesses that need to declare certain payments made throughout the year. It is particularly relevant for those who have received income that may not be reported through standard employment channels. Understanding the purpose and requirements of the Formulario 480 7c is crucial for accurate tax reporting and compliance.

How to use the Formulario 480 7c

Using the Formulario 480 7c involves several key steps to ensure that all necessary information is accurately captured. First, gather all relevant financial documents that pertain to the income being reported. Next, fill out the form with precise details, including the amounts received and the sources of income. It is important to review the completed form for accuracy before submission to avoid potential delays or issues with the IRS. Utilizing digital tools can streamline this process, allowing for easier data entry and signature collection.

Steps to complete the Formulario 480 7c

Completing the Formulario 480 7c requires careful attention to detail. Follow these steps for a smooth process:

- Collect all necessary documentation related to the income being reported.

- Access the Formulario 480 7c through a reliable source, ensuring you have the latest version.

- Fill in the required fields, including personal information and income details.

- Double-check all entries for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form according to the guidelines provided by the IRS.

Legal use of the Formulario 480 7c

The legal use of the Formulario 480 7c is governed by specific regulations that ensure compliance with tax laws. To be considered valid, the form must be filled out accurately and submitted within the designated deadlines. Additionally, it is important to retain copies of the submitted form and any supporting documentation for future reference. Utilizing a secure electronic signature solution can enhance the legal standing of the document, providing a digital certificate that verifies authenticity and compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 480 7c are crucial to avoid penalties and ensure compliance. Typically, the form must be submitted by a specific date each tax year. It is advisable to check the IRS guidelines for the exact deadline, as it may vary annually. Marking important dates on your calendar can help you stay organized and ensure timely submission of the form.

Required Documents

To complete the Formulario 480 7c, certain documents are necessary. These may include:

- Proof of income received, such as 1099 forms or other income statements.

- Personal identification information, including Social Security numbers.

- Any additional documentation that supports the income being reported.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete formulario 480 7c

Effortlessly Prepare Formulario 480 7c on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Formulario 480 7c on any platform using airSlate SignNow apps for Android or iOS, and enhance any document-centered workflow today.

The Easiest Method to Edit and eSign Formulario 480 7c with Ease

- Obtain Formulario 480 7c and click on Get Form to begin.

- Utilize the available tools to fill in your document.

- Emphasize important sections of your documents or black out sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of missing or misplaced documents, tedious form searching, or mistakes that necessitate printing new document duplicates. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Modify and eSign Formulario 480 7c while ensuring excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 480 7c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 480 7c and how does it work with airSlate SignNow?

480 7c is a key feature that allows businesses to enhance document workflow efficiency. With airSlate SignNow, you can upload your documents, apply eSignatures, and manage approvals seamlessly. This feature simplifies the signing process, making it ideal for organizations looking to streamline operations.

-

How much does it cost to use the 480 7c feature in airSlate SignNow?

The cost of using the 480 7c feature in airSlate SignNow varies based on the subscription plan you choose. Our plans are designed to be cost-effective, providing excellent value for businesses of all sizes. You can explore our pricing options on the website to find the best fit for your needs.

-

What are the key benefits of implementing 480 7c with airSlate SignNow?

Implementing 480 7c with airSlate SignNow brings signNow benefits, such as improved turnaround times for document signing. Businesses can expect reduced paperwork, faster approvals, and enhanced collaboration among team members. This feature ultimately contributes to greater productivity and efficiency.

-

Does airSlate SignNow provide templates that utilize the 480 7c feature?

Yes, airSlate SignNow offers a variety of customizable templates that leverage the 480 7c feature for quick and efficient document preparation. This allows users to easily create and modify documents tailored to their specific needs. By using templates, your team can save time and ensure consistency in documentation.

-

Can I integrate 480 7c with other applications using airSlate SignNow?

Absolutely! airSlate SignNow supports integration with numerous third-party applications, making it easy to connect 480 7c with your existing software ecosystem. Whether you're using CRM systems, project management tools, or other solutions, our integrations enhance workflow and collaboration.

-

Is it easy to get started with airSlate SignNow's 480 7c feature?

Getting started with airSlate SignNow's 480 7c feature is straightforward and user-friendly. Our platform is designed with ease of use in mind, allowing anyone to quickly understand and utilize its functionalities. Additionally, we provide tutorials and customer support to help you on your journey.

-

What types of documents can I sign using the 480 7c feature?

You can use the 480 7c feature in airSlate SignNow to sign a variety of document types, including contracts, agreements, and forms. Our platform supports multiple file formats, ensuring flexibility regardless of the document you need to sign. This versatility makes it an ideal choice for different industries.

Get more for Formulario 480 7c

Find out other Formulario 480 7c

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online