Beneficiary Form for Life Insurance 2013-2026

What is the beneficiary form for life insurance?

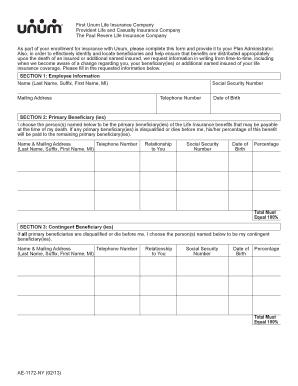

The beneficiary form for life insurance is a legal document that designates the individual or entity that will receive the death benefit from a life insurance policy upon the policyholder's passing. This form is crucial as it ensures that the policyholder's wishes are honored regarding who will benefit financially from the policy. It typically requires the policyholder's personal information, the beneficiary's details, and may include multiple beneficiaries with specified percentages of the benefit. Understanding this form is essential for ensuring that loved ones are provided for in accordance with the policyholder's intentions.

Steps to complete the beneficiary form for life insurance

Completing the beneficiary form for life insurance involves several key steps to ensure accuracy and compliance with legal requirements. First, gather necessary personal information, including the policyholder's full name, address, and policy number. Next, identify the beneficiaries by providing their names, relationships to the policyholder, and contact information. It is important to specify the percentage of the benefit each beneficiary will receive, especially if there are multiple beneficiaries. After filling out the form, review all information for accuracy before signing and dating the document. Finally, submit the completed form to the insurance company according to their guidelines.

Legal use of the beneficiary form for life insurance

The legal use of the beneficiary form for life insurance is governed by state laws and the terms set forth by the insurance provider. This form must be filled out accurately to ensure it is legally binding and reflects the policyholder's wishes. In the event of a dispute, courts typically uphold the designations made on the form, provided they comply with legal standards. It is advisable to keep the form updated, especially after significant life events such as marriage, divorce, or the birth of a child, to ensure that the intended beneficiaries are correctly designated.

How to obtain the beneficiary form for life insurance

Obtaining the beneficiary form for life insurance is a straightforward process. Policyholders can typically request the form directly from their insurance provider's website or customer service department. Many insurance companies offer downloadable versions of the form, which can be printed and filled out. Additionally, agents or brokers who sold the policy can provide the necessary forms and guidance on how to complete them. It is important to ensure that the correct form is used, as different policies may have specific requirements.

Key elements of the beneficiary form for life insurance

Key elements of the beneficiary form for life insurance include the policyholder's identification details, the names and relationships of the beneficiaries, and the allocation of the death benefit among them. The form may also require the policyholder's signature and the date of completion. Some forms include sections for contingent beneficiaries, who will receive the benefit if the primary beneficiaries are unable to do so. Understanding these elements is vital for ensuring that the form is completed correctly and meets the policyholder's intentions.

Form submission methods

The beneficiary form for life insurance can typically be submitted through several methods, depending on the insurance provider's policies. Common submission methods include:

- Online: Many insurance companies allow policyholders to submit the form electronically through their website or a secure portal.

- Mail: Completed forms can often be sent via postal mail to the insurance company's designated address.

- In-Person: Policyholders may also have the option to submit the form in person at a local branch or office of the insurance provider.

It is important to confirm the submission method accepted by the specific insurance company to ensure timely processing.

Quick guide on how to complete beneficiary form for life insurance

Effortlessly prepare Beneficiary Form For Life Insurance on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without hindrances. Manage Beneficiary Form For Life Insurance on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest method to alter and eSign Beneficiary Form For Life Insurance with ease

- Locate Beneficiary Form For Life Insurance and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Beneficiary Form For Life Insurance and ensure outstanding communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the beneficiary form for life insurance

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is a generic life insurance beneficiary form?

A generic life insurance beneficiary form is a standard document that designates who will receive the benefits of a life insurance policy upon the policyholder's death. It allows individuals to specify their beneficiaries clearly to ensure a smooth transfer of funds. Using a generic life insurance beneficiary form helps avoid complications and disputes among potential claimants.

-

How can I obtain a generic life insurance beneficiary form?

You can easily obtain a generic life insurance beneficiary form from various online sources or directly from your life insurance provider. AirSlate SignNow also allows you to create and customize your own beneficiary forms to meet your specific needs. This ensures you have the correct documentation ready to submit when needed.

-

Is there a cost associated with using a generic life insurance beneficiary form?

Typically, the generic life insurance beneficiary form itself is free to download and use. However, if you choose to utilize services like airSlate SignNow for signing and storing your forms, there may be associated costs with their subscription plans. It's important to evaluate these costs against the benefits of an easy-to-use, efficient signing solution.

-

What features does airSlate SignNow offer for managing generic life insurance beneficiary forms?

AirSlate SignNow provides multiple features for managing generic life insurance beneficiary forms, including document creation, eSignature capability, and secure storage. You can customize the form templates to ensure that all necessary information is included. Moreover, the platform allows for easy sharing and tracking of documents, enhancing your workflow.

-

How can I eSign a generic life insurance beneficiary form using airSlate SignNow?

To eSign a generic life insurance beneficiary form using airSlate SignNow, simply upload your form to the platform, and select the 'eSign' option. You can add your signature electronically, which is legally binding and saves time. The process is straightforward and efficient, allowing you to complete your documents quickly and securely.

-

What are the benefits of using a generic life insurance beneficiary form?

The benefits of using a generic life insurance beneficiary form include clarity in beneficiary designation and a streamlined claims process. By using this form, you ensure that your assets are distributed according to your wishes, minimizing potential disputes. It also helps in simplifying the paperwork involved in the insurance claims process.

-

Can I integrate airSlate SignNow with other software to use generic life insurance beneficiary forms?

Yes, airSlate SignNow offers integrations with various business applications, which enhances the usability of your generic life insurance beneficiary forms. You can connect it with platforms like CRMs and document management systems to streamline your processes. This integration allows for better workflow management and data tracking.

Get more for Beneficiary Form For Life Insurance

- Custodyvisitation on an ex parte basis self help form packet

- Child reunified welf ampamp inst code 36621f california form

- Fl 570 notice of registration of out of state support order judicial council forms

- Fl 910 request of minor to marry or judicial council forms

- I have not yet been able to complete the inquiry about the childs indian status because form

- Wwwformsworkflowcomformdetailsorder after hearing on motion to cancel set aside judgment

- Pretrial alcohol education program application form

- Wwwformsworkflowcomformdetailspetition for custody and support of minor children fl 260

Find out other Beneficiary Form For Life Insurance

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form