City of Louisville Tax Form

What is the City of Louisville Tax Form

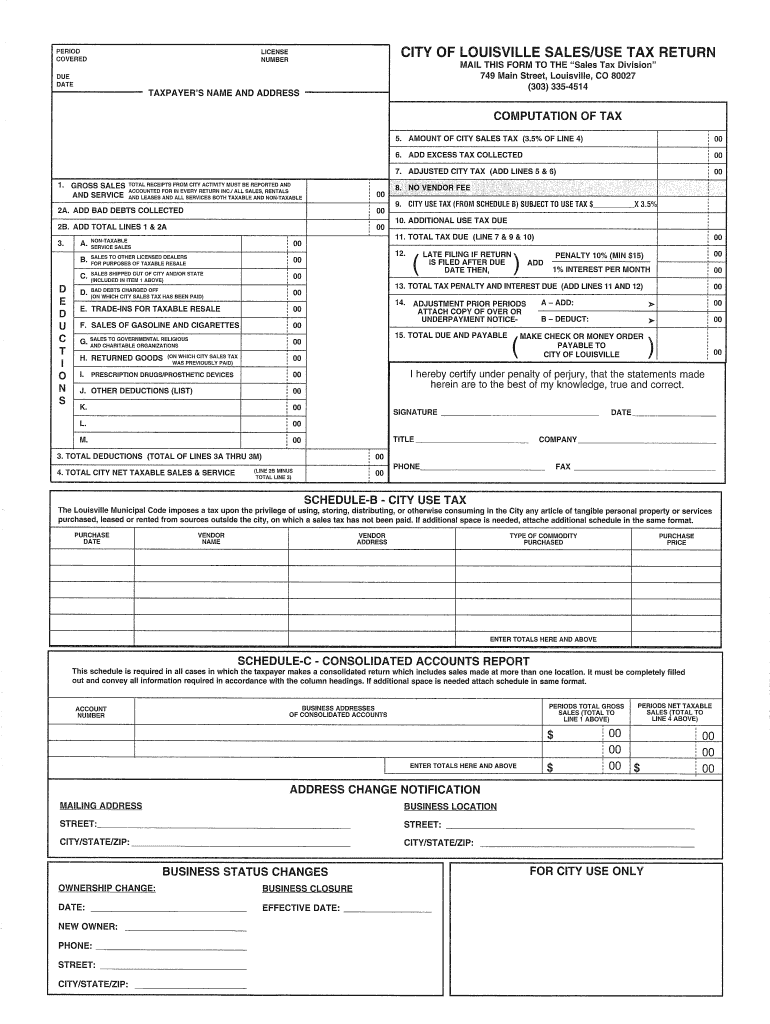

The City of Louisville tax form is a document used by residents and businesses to report and pay sales and use taxes to the local government. This form is essential for ensuring compliance with local tax regulations and is designed to capture relevant financial information accurately. It typically includes sections for reporting taxable sales, deductions, and the total amount of tax owed. Understanding this form is crucial for both individuals and businesses operating within the city limits.

Steps to Complete the City of Louisville Tax Form

Completing the City of Louisville tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including receipts and invoices related to sales. Next, fill out the form by entering your business information, including name, address, and tax identification number. Report your total sales, any exempt sales, and calculate the total tax owed based on the applicable rate. Finally, review the completed form for accuracy before submitting it to the appropriate city department.

How to Use the City of Louisville Tax Form

The City of Louisville tax form can be used for various purposes, primarily for reporting sales and use tax. To utilize the form effectively, start by determining if your business activities require you to collect sales tax. If so, complete the form with the necessary details of your sales transactions. Ensure that you include all relevant information, such as the types of goods sold and the corresponding tax rates. Once completed, the form can be submitted online or via mail, depending on your preference and the specific guidelines set by the city.

Legal Use of the City of Louisville Tax Form

The legal use of the City of Louisville tax form is governed by local tax laws and regulations. It is important to ensure that all information provided on the form is accurate and truthful, as discrepancies can lead to penalties or audits. The form must be submitted by the designated filing deadline to avoid late fees. Additionally, businesses should retain copies of submitted forms and supporting documentation for their records, as they may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the City of Louisville tax form are crucial for compliance. Typically, the form must be submitted on a quarterly or annual basis, depending on the volume of sales. It is important to check the specific due dates for each filing period, as late submissions may incur penalties. Keeping a calendar of these important dates can help ensure timely filing and prevent unnecessary fees.

Form Submission Methods (Online / Mail / In-Person)

The City of Louisville tax form can be submitted through various methods to accommodate different preferences. Online submission is often the most efficient option, allowing for immediate processing and confirmation. Alternatively, the form can be mailed to the designated city office or submitted in person. Each method has its own advantages, and taxpayers should choose the one that best fits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete city of louisville salesuse tax return

Your assistance manual on how to prepare your City Of Louisville Tax Form

If you're wondering how to finalize and submit your City Of Louisville Tax Form, here are some straightforward instructions on how to simplify tax filing.

To begin, simply register for your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to edit, generate, and complete your income tax forms effortlessly. Using its editor, you can toggle between text, checkboxes, and eSignatures, making it possible to return and modify information as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your City Of Louisville Tax Form in just a few minutes:

- Set up your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; sift through variations and schedules.

- Click Get form to access your City Of Louisville Tax Form in our editor.

- Populate the necessary fillable fields with your details (text, figures, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Save your changes, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to digitally file your taxes with airSlate SignNow. Keep in mind that submitting on paper can raise return mistakes and delay refunds. Of course, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

Can someone guide me which form to use to file Philadelphia city tax return?

I’m not from PA, but this website may be of interest to you: PSD Codes | EIT Rates | TaxSorry I can’t help you further. Hope you have a nice day.

-

Is my employer notified when I fill out my tax return using the information on the W-2 form they sent me?

No, and really, your employer does not care what you do with it. Their responsibility for your taxation reporting ends with their issuance of the form to you.You do realize that the I.R.S. also get a copy of it, don’t you? And, in handy computer data files.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

Create this form in 5 minutes!

How to create an eSignature for the city of louisville salesuse tax return

How to make an eSignature for your City Of Louisville Salesuse Tax Return online

How to create an electronic signature for the City Of Louisville Salesuse Tax Return in Chrome

How to create an electronic signature for signing the City Of Louisville Salesuse Tax Return in Gmail

How to generate an eSignature for the City Of Louisville Salesuse Tax Return right from your smartphone

How to create an eSignature for the City Of Louisville Salesuse Tax Return on iOS devices

How to generate an eSignature for the City Of Louisville Salesuse Tax Return on Android devices

People also ask

-

What is the sales use city Louisville template offered by airSlate SignNow?

The sales use city Louisville template is a customizable document template that simplifies the process of signing and managing sales-related documents in Louisville. This template is designed to streamline compliance and ensure that all necessary information is included for local businesses. By using this template, organizations can save time and avoid common pitfalls in document handling.

-

How does the sales use city Louisville template improve my workflow?

The sales use city Louisville template enhances your workflow by providing a structured approach to handling sales documents. It minimizes the chances of errors and ensures that all required signatures are captured efficiently. Moreover, this template integrates seamlessly with your existing processes, allowing for a smoother transaction experience.

-

Can I customize the sales use city Louisville template to fit my business needs?

Yes, you can easily customize the sales use city Louisville template to match your specific business requirements. airSlate SignNow provides users with an intuitive interface to modify fields, add branding elements, and tailor content. Customization ensures that the template aligns perfectly with local regulations and your business's unique needs.

-

What are the pricing options for using the sales use city Louisville template?

airSlate SignNow offers various pricing plans to accommodate different business needs when using the sales use city Louisville template. Plans are designed to be cost-effective, providing options for small teams to large enterprises. Detailed pricing information is available on the airSlate SignNow website to help businesses select the best fit for their budget.

-

What benefits does the sales use city Louisville template provide for my business?

The sales use city Louisville template offers numerous benefits, including reducing the time spent on document preparation and ensuring compliance with local laws. It enables efficient tracking of document status and provides audit trails, which are essential for maintaining transparency. By utilizing this template, businesses can improve their overall productivity and customer satisfaction.

-

Is the sales use city Louisville template compatible with other software tools?

Yes, the sales use city Louisville template is designed to work seamlessly with various software tools and applications. airSlate SignNow supports numerous integrations with CRM systems, project management software, and more, so you can easily incorporate the template into your existing workflow. This compatibility enhances usability and boosts overall efficiency.

-

How secure is my data when using the sales use city Louisville template?

When using the sales use city Louisville template, data security is a top priority for airSlate SignNow. The platform employs industry-leading encryption protocols to protect sensitive information and ensure compliance with data privacy regulations. Additionally, regular security audits and updates help maintain a robust security framework for all users.

Get more for City Of Louisville Tax Form

- Caremark pa 5596949 form

- Patient hipaa consent form remedy weight loss

- Deutscher sparkassenverlag selbstauskunft form

- Ds1 form nj

- Request form bureau veritas labs

- A brief history of the usa listening comprehension correction form

- Form w 9 sp rev march request for taxpayer identification number and certification spanish version

- Statepef grievance form professional scientific pef

Find out other City Of Louisville Tax Form

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement