Tn Claim for Refund Form

What is the Tn Claim For Refund

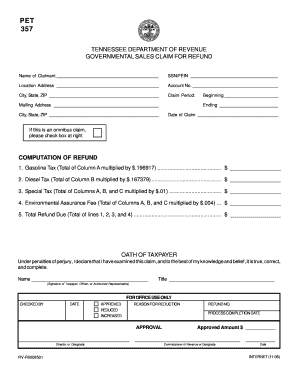

The Tn Claim For Refund is a formal request submitted to the appropriate tax authority, allowing taxpayers to seek reimbursement for overpaid taxes. This form is crucial for individuals and businesses that have mistakenly paid more than their actual tax liability. The claim can pertain to various types of taxes, including income tax, sales tax, and property tax. Understanding the specific reasons for filing this claim is essential, as it ensures compliance with tax regulations and facilitates the recovery of funds.

How to use the Tn Claim For Refund

Using the Tn Claim For Refund involves several straightforward steps. First, gather all necessary documentation that supports your claim, such as tax returns and proof of payment. Next, accurately complete the form, ensuring that all information is correct and reflects your tax situation. After filling out the form, submit it to the relevant tax authority, either electronically or by mail. Keeping copies of all submitted documents is advisable for your records. Following these steps can help ensure a smooth process in obtaining your refund.

Steps to complete the Tn Claim For Refund

Completing the Tn Claim For Refund requires careful attention to detail. Begin by downloading the form from the official tax authority website or obtaining a physical copy. Fill in your personal information, including your name, address, and tax identification number. Clearly state the reason for the refund request and provide any supporting documentation. Double-check all entries for accuracy before signing and dating the form. Finally, submit the completed claim to the appropriate agency, adhering to any specific submission guidelines they may have.

Legal use of the Tn Claim For Refund

The legal use of the Tn Claim For Refund is governed by tax laws and regulations. To ensure that your claim is valid, it must be filed within the designated time frame set by the tax authority. Additionally, the information provided must be truthful and supported by documentation. Misrepresentation or fraudulent claims can lead to penalties, including fines or legal action. Therefore, understanding the legal framework surrounding this form is essential for a successful refund process.

Required Documents

When filing the Tn Claim For Refund, certain documents are typically required to support your request. These may include:

- Copies of previous tax returns

- Proof of payment, such as receipts or bank statements

- Any correspondence with the tax authority related to your claim

- Documentation supporting the reason for the refund, such as amended returns

Having these documents ready can expedite the review process and increase the likelihood of a favorable outcome.

Filing Deadlines / Important Dates

Filing deadlines for the Tn Claim For Refund are critical to ensure your request is accepted. Generally, claims must be submitted within three years from the original due date of the tax return or within two years from the date the tax was paid, whichever is later. It is essential to be aware of these deadlines to avoid missing the opportunity to recover overpaid taxes. Marking these dates on your calendar can help you stay organized and compliant.

Quick guide on how to complete tn claim for refund

Effortlessly Prepare Tn Claim For Refund on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Handle Tn Claim For Refund on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Edit and Electronically Sign Tn Claim For Refund with Ease

- Find Tn Claim For Refund and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important portions of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tn Claim For Refund and ensure seamless communication at any step of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tn claim for refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are NetSuite eRefunds and how do they work?

NetSuite eRefunds are a streamlined solution designed to manage customer refunds effectively within the NetSuite platform. They allow businesses to issue refunds electronically, reducing processing time and improving customer satisfaction. By utilizing NetSuite eRefunds, companies can automate transactions, ensuring accuracy and efficiency in their financial operations.

-

How does airSlate SignNow integrate with NetSuite eRefunds?

airSlate SignNow integrates seamlessly with NetSuite eRefunds, allowing users to eSign refund documents directly within the NetSuite environment. This integration simplifies the signing process, ensuring that refund requests are processed quickly and accurately. By using airSlate SignNow with NetSuite eRefunds, businesses can enhance their operational efficiency.

-

What are the pricing options for using airSlate SignNow with NetSuite eRefunds?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to utilize NetSuite eRefunds. The pricing is structured based on the number of users and features required, making it cost-effective for your refund processing needs. For complete details on pricing, please visit the airSlate SignNow website.

-

What benefits does airSlate SignNow provide for NetSuite eRefunds?

By using airSlate SignNow for NetSuite eRefunds, users benefit from a user-friendly interface, quick document turnaround, and enhanced security features for sensitive refund data. The platform also provides tracking and management tools that ensure all refund processes are transparent and organized. This leads to improved workflows and a better customer experience.

-

Can I customize refund templates for NetSuite eRefunds using airSlate SignNow?

Yes, airSlate SignNow allows you to customize refund templates specifically for NetSuite eRefunds. You can create and modify templates that meet your business needs, ensuring consistency and compliance with your branding. Customization options help streamline the refund process, making it tailored for your customers.

-

Is airSlate SignNow secure for processing NetSuite eRefunds?

Absolutely, airSlate SignNow is designed with top-notch security measures to protect sensitive information involved in NetSuite eRefunds. With encryption and secure data storage, businesses can trust that their refund documents and customer information are handled safely. Compliance with industry standards further enhances the security of the eSigning process.

-

How can airSlate SignNow improve my overall refund processing times?

By integrating airSlate SignNow with NetSuite eRefunds, you can signNowly reduce your refund processing times. The platform automates the eSigning process, eliminating the delays associated with traditional methods. As a result, many businesses experience faster turnaround times for their refunds, enhancing customer satisfaction.

Get more for Tn Claim For Refund

Find out other Tn Claim For Refund

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast