Continental Title Form

What is the Continental Title

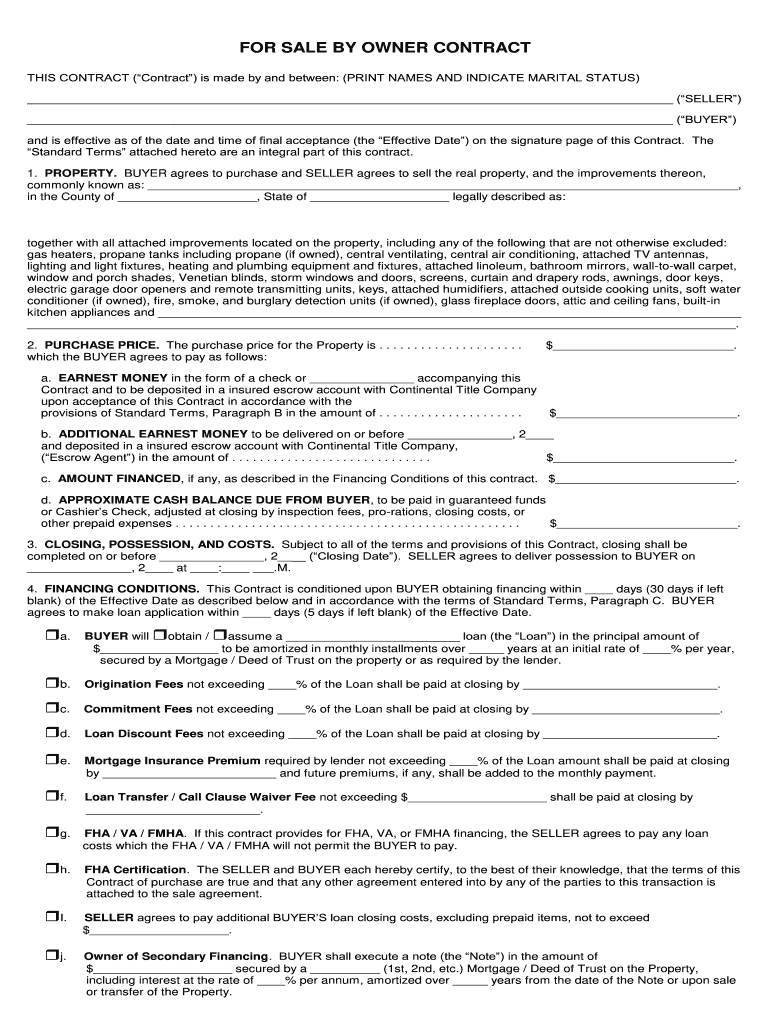

The Continental Title is a legal document that outlines the ownership of a property during a real estate transaction. It serves as proof of ownership and is essential for ensuring that the seller has the right to sell the property. This document is particularly important for transactions involving properties sold directly by the owner, known as "for sale by owner" (FSBO) transactions. The Continental Title provides clarity on the property's history, including any liens or encumbrances that may affect the sale.

How to use the Continental Title

To use the Continental Title effectively, it is important to first ensure that all relevant information is accurately documented. This includes details about the property, the seller, and any outstanding obligations. When completing a for sale by owner contract, the Continental Title should be referenced to confirm that the seller has clear ownership rights. Additionally, potential buyers should review the title to ensure there are no legal issues that could complicate the transaction.

Steps to complete the Continental Title

Completing the Continental Title involves several key steps:

- Gather necessary documents, including previous title deeds and any relevant legal paperwork.

- Verify the ownership details and ensure there are no outstanding liens or claims against the property.

- Complete the Continental Title form, ensuring all fields are filled out accurately.

- Have the document notarized if required, to validate the transaction.

- Provide copies of the completed title to all parties involved in the transaction.

Legal use of the Continental Title

The legal use of the Continental Title is crucial in real estate transactions. It must comply with state laws and regulations to be considered valid. This document acts as a safeguard against potential disputes over ownership and ensures that the sale is conducted legally. It is advisable for sellers to consult with a legal professional to ensure that the Continental Title is correctly executed and complies with all applicable laws.

Key elements of the Continental Title

Several key elements must be included in the Continental Title to ensure its validity:

- Property Description: A detailed description of the property, including its physical address and legal description.

- Owner Information: The full name and contact information of the current owner(s).

- Title History: A record of previous ownership and any liens or encumbrances.

- Signatures: Signatures of the seller and any witnesses, if required.

- Notarization: A notary public's seal to validate the document.

State-specific rules for the Continental Title

Each state in the U.S. may have specific rules governing the use and execution of the Continental Title. It is essential for sellers and buyers to familiarize themselves with their state's requirements, as these can affect the validity of the title and the overall transaction process. Consulting with a local real estate attorney or title company can provide guidance on state-specific regulations and ensure compliance.

Quick guide on how to complete for sale by owner contract continental title company

The optimal method to locate and endorse Continental Title

Across your entire organization, unproductive procedures concerning document approval can consume a signNow amount of work time. Signing documents such as Continental Title is an inherent aspect of operations in any firm, which is why the efficiency of each agreement's lifecycle signNowly impacts the overall productivity of the organization. With airSlate SignNow, endorsing your Continental Title can be as straightforward and quick as possible. This platform provides you with the latest version of nearly any document. Even better, you can sign it instantly without the necessity of downloading external software on your device or printing physical copies.

Steps to obtain and endorse your Continental Title

- Browse our library by category or use the search bar to locate the form you require.

- View the form preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any required details using the toolbar.

- Upon completion, click the Sign tool to endorse your Continental Title.

- Choose the signing method that suits you best: Draw, Generate initials, or upload an image of your signature.

- Click Done to finalize editing and move on to any document-sharing options if needed.

With airSlate SignNow, you possess everything necessary to manage your documents efficiently. You can find, complete, modify, and even send your Continental Title in a single tab with ease. Enhance your workflows by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Can an individual form a company on the MCA service? Is it mandatory to fill out MCA forms for a company formed by a CA only?

Yes an individual can form a company on the MCA service by filling mca form 18, it is not mandatory that only a chartered accountant can fill out MCA forms for a company but is mostly prefered by many companies to do so.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

What are some reasons that a health insurance company would ask for a pre-authorization form to be filled out by a Dr. before filling a prescription?

One common reason would be that there is a cheaper, therapeutically equivalent drug that they would like you to try first before they approve a claim for the prescribed drug. Another reason is that they want to make sure the prescribed drug is medically necessary.Remember that nothing is stopping you from filling the prescribed drug. It just won't be covered by insurance until the pre-authorization process is complete.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

Create this form in 5 minutes!

How to create an eSignature for the for sale by owner contract continental title company

How to generate an electronic signature for the For Sale By Owner Contract Continental Title Company in the online mode

How to make an eSignature for the For Sale By Owner Contract Continental Title Company in Chrome

How to generate an eSignature for signing the For Sale By Owner Contract Continental Title Company in Gmail

How to make an electronic signature for the For Sale By Owner Contract Continental Title Company right from your smart phone

How to generate an electronic signature for the For Sale By Owner Contract Continental Title Company on iOS

How to generate an eSignature for the For Sale By Owner Contract Continental Title Company on Android devices

People also ask

-

What is a for sale by owner contract?

A for sale by owner contract is a legal document that outlines the terms of a property sale when the owner sells it directly to the buyer without an agent. This contract typically includes details such as price, contingencies, and responsibilities of both parties. Utilizing a for sale by owner contract can streamline the process and ensure that all parties are clear on the transaction details.

-

How can airSlate SignNow assist with my for sale by owner contract?

airSlate SignNow simplifies the process of creating and signing your for sale by owner contract. Our platform allows you to easily customize the contract templates and send them for electronic signatures. This enables a smooth transaction while ensuring that all legal requirements are met efficiently.

-

What are the benefits of using a for sale by owner contract?

Using a for sale by owner contract can save you money on real estate agent commissions while giving you full control over the sale process. Additionally, this type of contract helps clarify the terms of the sale, reducing the risk of disputes. By utilizing airSlate SignNow, you can expedite signing and enhance the overall experience.

-

Is there a cost associated with using airSlate SignNow for my for sale by owner contract?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs, including options for individuals and businesses. The cost is generally lower than hiring a real estate agent, making it a cost-effective choice for managing your for sale by owner contract. Visit our pricing page for more details on specific plans and features.

-

What features does airSlate SignNow offer for managing my for sale by owner contract?

airSlate SignNow includes features such as easy document creation and editing, secure electronic signing, and tracking of document status. These features ensure that your for sale by owner contract is handled smoothly from creation to finalization. Additionally, the platform integrates with other tools for seamless workflow management.

-

Can I integrate airSlate SignNow with other platforms for my for sale by owner contract?

Yes, airSlate SignNow offers numerous integrations with popular platforms to enhance your experience. This allows you to link your for sale by owner contract process with tools you already use, streamlining your workflow and improving efficiency. Check our integrations page for a complete list of compatible applications.

-

What should I include in my for sale by owner contract?

A comprehensive for sale by owner contract should include critical details such as property description, sale price, payment terms, and any contingencies for inspections or financing. It’s also essential to outline the responsibilities of both the seller and buyer. Using airSlate SignNow helps you ensure that all necessary components are included in your contract.

Get more for Continental Title

Find out other Continental Title

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF