Ein Cancellation Letter Form

What is the EIN Cancellation Letter

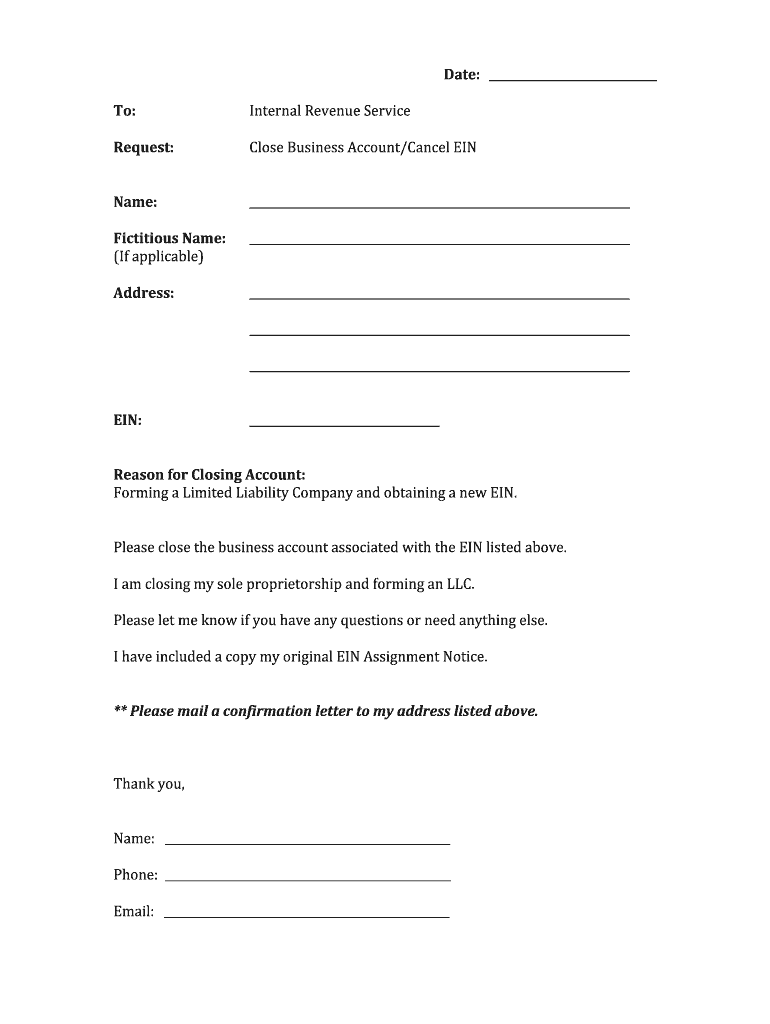

The EIN cancellation letter is a formal document submitted to the Internal Revenue Service (IRS) to request the cancellation of an Employer Identification Number (EIN). This letter is essential for businesses that no longer require their EIN, often due to closure or reorganization. By submitting this letter, a business can ensure that the IRS updates its records, preventing any future tax obligations or liabilities associated with the EIN.

Key Elements of the EIN Cancellation Letter

When drafting an EIN cancellation letter, it is important to include specific key elements to ensure clarity and compliance. These elements typically include:

- Your business name: Clearly state the name under which the EIN was issued.

- Your EIN: Include the full Employer Identification Number that you wish to cancel.

- Business address: Provide the address associated with the EIN.

- Reason for cancellation: Briefly explain why you are requesting the cancellation.

- Signature: Ensure the letter is signed by an authorized representative of the business.

Steps to Complete the EIN Cancellation Letter

Completing the EIN cancellation letter involves several straightforward steps. Follow this process to ensure your cancellation request is properly submitted:

- Gather necessary information, including your business name, EIN, and address.

- Draft the letter, ensuring all key elements are included.

- Review the letter for accuracy and completeness.

- Sign the letter to validate the request.

- Submit the letter to the IRS via mail or electronically, as per the guidelines.

IRS Guidelines

Understanding IRS guidelines is crucial when submitting an EIN cancellation letter. The IRS requires that the letter be clear and concise. It should be sent to the address specified for EIN cancellations, which is typically found on the IRS website or in related publications. Additionally, it is advisable to keep a copy of the letter for your records, along with any confirmation of receipt from the IRS.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting an EIN cancellation letter, it is advisable to do so promptly after deciding to close your business or discontinue the use of the EIN. This helps prevent any potential tax liabilities or complications in the future. Keeping track of important dates related to your business closure will aid in ensuring all necessary steps are completed in a timely manner.

Required Documents

In most cases, the EIN cancellation letter itself is the primary document required for cancellation. However, if there are any additional documents related to the closure of the business, such as dissolution paperwork or final tax returns, it may be beneficial to include copies of these with your cancellation request. This can provide the IRS with a clearer understanding of the context for your cancellation.

Quick guide on how to complete cancel ein letter to irsdocx

Prepare Ein Cancellation Letter effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without interruptions. Manage Ein Cancellation Letter on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and electronically sign Ein Cancellation Letter with ease

- Locate Ein Cancellation Letter and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow.

- Generate your eSignature with the Sign tool, a process that takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to finalize your changes.

- Choose how you would like to send your document, via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your preference. Modify and electronically sign Ein Cancellation Letter and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

Create this form in 5 minutes!

How to create an eSignature for the cancel ein letter to irsdocx

How to generate an eSignature for the Cancel Ein Letter To Irsdocx online

How to create an electronic signature for the Cancel Ein Letter To Irsdocx in Google Chrome

How to create an electronic signature for putting it on the Cancel Ein Letter To Irsdocx in Gmail

How to create an electronic signature for the Cancel Ein Letter To Irsdocx straight from your smartphone

How to make an electronic signature for the Cancel Ein Letter To Irsdocx on iOS

How to generate an electronic signature for the Cancel Ein Letter To Irsdocx on Android OS

People also ask

-

What is a sample letter to IRS to cancel EIN?

A sample letter to IRS to cancel EIN is a document template that businesses can use to officially inform the IRS of their intent to cancel their Employer Identification Number (EIN). This letter typically includes the business's name, EIN, and a request for cancellation. Utilizing a sample letter ensures that all necessary information is included for a smooth cancellation process.

-

How can airSlate SignNow help me with a sample letter to IRS to cancel EIN?

airSlate SignNow enables users to easily create and eSign documents, including a sample letter to IRS to cancel EIN. Our intuitive platform simplifies the document crafting and signing process, making it fast and efficient for businesses. With templates available, you can get started quickly without any hassle.

-

Is there a cost associated with using airSlate SignNow for a sample letter to IRS to cancel EIN?

Yes, there are various pricing plans for airSlate SignNow that cater to different business needs. However, our plans are designed to be cost-effective, allowing you to save on administrative costs while efficiently handling documents like a sample letter to IRS to cancel EIN. Check our pricing page for detailed information.

-

Can I customize a sample letter to IRS to cancel EIN within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize any sample letter to IRS to cancel EIN according to your business needs. You can easily edit, add, or remove sections in our user-friendly editor to ensure that the letter accurately reflects your situation before sending it to the IRS.

-

What features does airSlate SignNow provide for eSigning a sample letter to IRS to cancel EIN?

airSlate SignNow offers several features for eSigning a sample letter to IRS to cancel EIN, including secure electronic signatures, real-time tracking, and the ability to send documents for signature quickly. Our robust security measures ensure that your information is protected throughout the signing process.

-

How long does it take to process a sample letter to IRS to cancel EIN?

The processing time for a sample letter to IRS to cancel EIN can vary depending on the IRS workload and specific circumstances. However, once you've sent the letter using airSlate SignNow, you should receive confirmation from the IRS within a few weeks. It’s always good to follow up if you haven't heard back in a reasonable time.

-

Are there integrations available to assist with sending a sample letter to IRS to cancel EIN?

Yes, airSlate SignNow integrates seamlessly with various third-party applications to assist you in sending a sample letter to IRS to cancel EIN. Whether it’s cloud storage or accounting software, our integrations enhance your workflow and streamline the sending and tracking process.

Get more for Ein Cancellation Letter

Find out other Ein Cancellation Letter

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online