Aspen Rett Exemption Application Form

What is the Aspen Rett Exemption Application

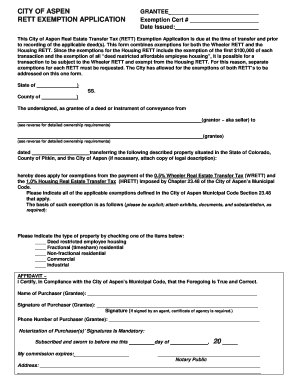

The Aspen Rett Exemption Application is a formal request used by residents of Aspen, Colorado, to apply for a property tax exemption. This application is specifically designed for properties that meet certain criteria set by the city, allowing eligible homeowners to reduce their property tax burden. Understanding the purpose of this application is crucial for property owners seeking financial relief and ensuring compliance with local tax regulations.

Steps to complete the Aspen Rett Exemption Application

Completing the Aspen Rett Exemption Application involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about your property, including its address, current assessed value, and ownership details. Next, fill out the application form accurately, providing all required information and documentation. After completing the form, review it carefully to ensure no errors are present. Finally, submit the application by the designated deadline to the appropriate city office, either online or by mail.

Eligibility Criteria

To qualify for the Aspen Rett Exemption Application, applicants must meet specific eligibility criteria established by the city. Typically, this includes being a resident of Aspen, owning the property for which the exemption is sought, and using the property as a primary residence. Additional requirements may include income limits or specific property characteristics. It is essential to review these criteria thoroughly to ensure that your application is valid and stands a good chance of approval.

Required Documents

When submitting the Aspen Rett Exemption Application, several documents are typically required to support your request. These may include proof of residency, such as a utility bill or lease agreement, the property deed, and any other documentation that verifies your eligibility. Gathering these documents in advance can streamline the application process and help avoid delays in approval.

Form Submission Methods

Applicants have multiple options for submitting the Aspen Rett Exemption Application. The form can often be submitted online through the city’s official website, which may provide a convenient and efficient way to ensure timely processing. Alternatively, applicants may choose to send the completed form via mail or deliver it in person to the appropriate city office. Understanding these submission methods can help ensure that your application is received and processed without complications.

Legal use of the Aspen Rett Exemption Application

The legal use of the Aspen Rett Exemption Application is governed by local tax laws and regulations. It is essential for applicants to understand that providing false information or failing to meet eligibility requirements can result in penalties, including denial of the exemption or legal action. Ensuring compliance with all legal stipulations is crucial for maintaining the integrity of the application process and protecting your rights as a property owner.

Quick guide on how to complete aspen rett exemption application

Effortlessly Prepare Aspen Rett Exemption Application on Any Device

Online document management has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to quickly create, modify, and eSign your documents without any delays. Manage Aspen Rett Exemption Application on any platform with airSlate SignNow's Android or iOS apps and streamline any document-related task today.

Easily Modify and eSign Aspen Rett Exemption Application with No Hassle

- Locate Aspen Rett Exemption Application and click on Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive data with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information carefully and click on the Completed button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require you to print new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Aspen Rett Exemption Application and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aspen rett exemption application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow platform used for?

The airSlate SignNow platform is designed to empower businesses to send and eSign documents seamlessly. Specifically, for the aspen rett exemption application, it provides an efficient interface that simplifies the document signing process.

-

How do I start the aspen rett exemption application process with airSlate SignNow?

To begin the aspen rett exemption application process on airSlate SignNow, create an account and navigate to the document creation feature. You can easily upload your existing form or create a new one, and then send it for signatures.

-

Is there a cost associated with using airSlate SignNow for the aspen rett exemption application?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans include features specifically designed to facilitate tasks like the aspen rett exemption application, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for managing documents like the aspen rett exemption application?

AirSlate SignNow includes features such as template creation, secure cloud storage, and real-time tracking of the aspen rett exemption application. These tools enhance efficiency and ensure all your documents are easily accessible.

-

Can I integrate airSlate SignNow with other applications for my aspen rett exemption application?

Absolutely! AirSlate SignNow supports multiple integrations with popular applications, allowing you to streamline the aspen rett exemption application process. This connectivity enhances your workflow and keeps all your tools interconnected.

-

What advantages does airSlate SignNow provide for the aspen rett exemption application?

Using airSlate SignNow for the aspen rett exemption application offers benefits such as speed, security, and ease of use. With its intuitive interface, you can complete the application quickly, ensuring that you meet your deadlines.

-

Is airSlate SignNow secure for submitting sensitive documents like the aspen rett exemption application?

Yes, airSlate SignNow prioritizes security with advanced encryption protocols and compliance. Your aspen rett exemption application and any sensitive documents are protected, ensuring your information remains confidential.

Get more for Aspen Rett Exemption Application

Find out other Aspen Rett Exemption Application

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online