Form 8615 PDF

What is the Form 8615 Pdf

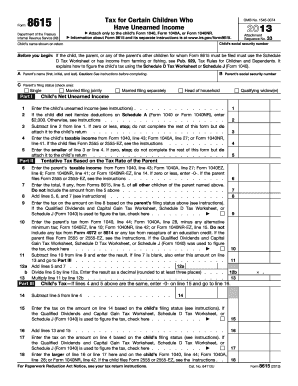

The Form 8615, also known as the Tax for Certain Children Who Have Unearned Income, is a tax form used in the United States. It is specifically designed for children under the age of 18 who have unearned income exceeding a certain threshold. This form helps determine the tax liability for that income, which may be taxed at the parent's tax rate rather than the child's rate. Understanding this form is crucial for families to ensure compliance with IRS regulations and to accurately report income.

How to use the Form 8615 Pdf

Using the Form 8615 involves several steps to ensure accurate completion. First, gather all necessary financial information, including the child's unearned income sources, such as dividends, interest, and capital gains. Next, download the Form 8615 pdf from the IRS website or obtain it through tax preparation software. Fill out the form by entering the required information, ensuring that all calculations are correct. Finally, submit the completed form along with your tax return, either electronically or via mail, depending on your filing method.

Steps to complete the Form 8615 Pdf

Completing the Form 8615 requires careful attention to detail. Follow these steps:

- Gather the child's income documents, including 1099 forms and bank statements.

- Download the Form 8615 pdf and read the instructions carefully.

- Fill in the child's name, Social Security number, and other identifying information.

- Calculate the total unearned income and enter it in the appropriate sections of the form.

- Determine the applicable tax rate based on the parent's tax bracket.

- Review the form for accuracy before submission.

Legal use of the Form 8615 Pdf

The legal use of the Form 8615 is essential for compliance with U.S. tax laws. This form must be filed when a child has unearned income that exceeds the IRS threshold. Failure to file the form or incorrect reporting can lead to penalties and interest on unpaid taxes. It is advisable to consult with a tax professional if there are uncertainties regarding the form's requirements or the child's tax situation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8615 align with the general tax return deadlines. Typically, the form must be submitted by April 15 of the following tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to IRS announcements or legislative changes, especially in light of recent events that may affect tax filing.

Who Issues the Form

The Form 8615 is issued by the Internal Revenue Service (IRS), the U.S. federal agency responsible for tax collection and tax law enforcement. The IRS provides the form along with detailed instructions on how to complete it. It is important for taxpayers to ensure they are using the most current version of the form, as updates may occur that reflect changes in tax law or filing requirements.

Quick guide on how to complete form 8615 pdf

Prepare Form 8615 Pdf effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents promptly without delays. Handle Form 8615 Pdf on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Form 8615 Pdf without any hassle

- Obtain Form 8615 Pdf and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate issues with lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your choice. Modify and eSign Form 8615 Pdf to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8615 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form8615 and why is it important?

Form8615 is a tax form used to calculate the tax liability for certain children with unearned income. Understanding how to fill it out correctly is crucial for compliance with IRS regulations and can impact tax savings, making it essential for parents and guardians.

-

How does airSlate SignNow facilitate the completion of form8615?

airSlate SignNow simplifies the process of completing form8615 by allowing users to easily fill out and sign documents online. With its user-friendly interface, you can ensure that all required fields are filled out correctly, streamlining your filing process.

-

Is airSlate SignNow a cost-effective solution for managing forms like form8615?

Yes, airSlate SignNow offers a cost-effective solution for managing important forms such as form8615. With competitive pricing plans, it allows businesses and individuals to access eSigning capabilities without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing form8615?

Absolutely! airSlate SignNow offers integrations with various popular tools and applications, enhancing the management of form8615 and other documents. This flexibility allows for streamlined workflows tailored to your specific needs.

-

What features does airSlate SignNow offer for form8615 users?

airSlate SignNow provides features such as customizable templates, bulk sending, and tracking capabilities specifically designed to facilitate the efficient handling of form8615. These features help users save time and reduce the chances of errors during the document signing process.

-

How secure is the eSigning process for form8615 on airSlate SignNow?

The eSigning process for form8615 on airSlate SignNow is highly secure, utilizing encryption and advanced security protocols. Users can confidently sign and send documents, knowing their sensitive information is protected throughout the process.

-

Are there templates available for form8615 in airSlate SignNow?

Yes, airSlate SignNow provides templates for form8615, making it easy to prepare and customize your documents. Having access to these templates can signNowly reduce the effort and time needed for proper form completion.

Get more for Form 8615 Pdf

- Front range brain and spine fort collins form

- Usa wrestling claim form

- Medical consultation request form medical consultation form by berkeley lake dentists in norcross ga

- Patient information release form henry ford health system

- Fitness certificate by doctor form

- Yoga intake form

- Obstetric template form

- Aim specialty prior authorization form

Find out other Form 8615 Pdf

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement