Profit and Loss Template Form

What is the profit and loss template?

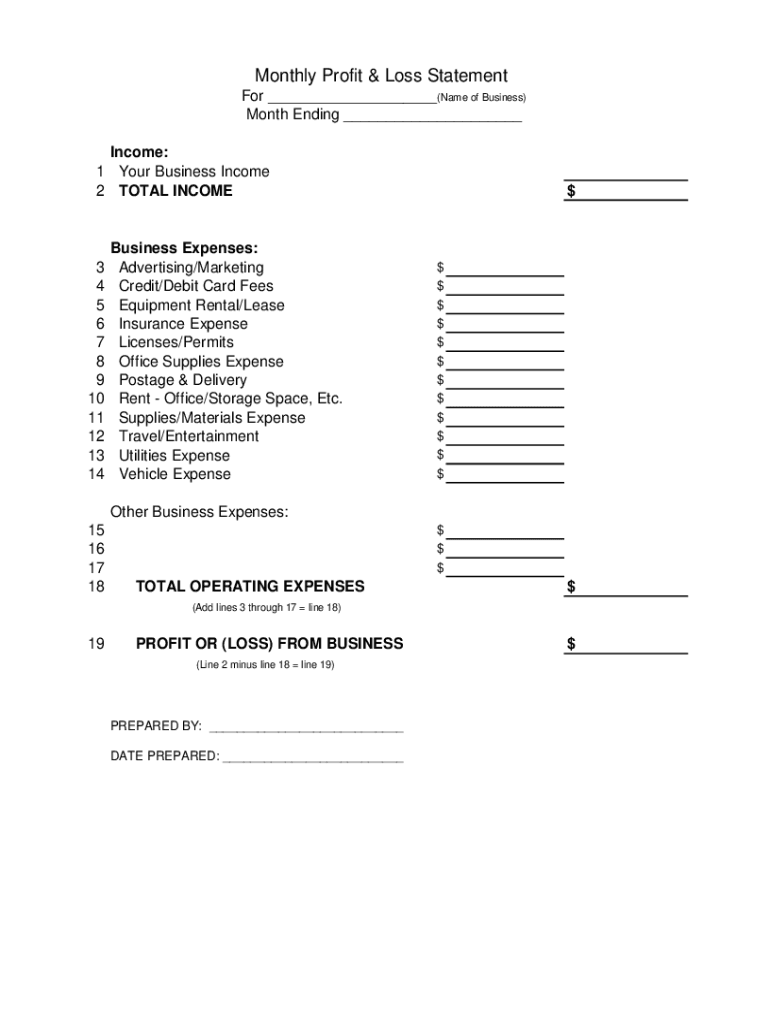

The profit and loss template is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period, typically a month, quarter, or year. This template is essential for businesses to assess their financial performance, allowing them to determine whether they are operating at a profit or a loss. It provides a clear view of income sources and expenditure categories, helping organizations make informed financial decisions. The profit and loss statement is often used alongside other financial documents, such as balance sheets and cash flow statements, to give a comprehensive overview of a company's financial health.

Key elements of the profit and loss template

A well-structured profit and loss template includes several critical components:

- Revenue: This section lists all income generated from sales and services.

- Cost of Goods Sold (COGS): This includes direct costs attributable to the production of goods sold by the business.

- Gross Profit: Calculated by subtracting COGS from total revenue, this figure indicates the profitability of core business activities.

- Operating Expenses: These are indirect costs such as rent, utilities, and salaries that are necessary for running the business.

- Net Profit or Loss: This final figure is derived by subtracting total expenses from gross profit, showing the overall financial performance.

How to use the profit and loss template

Using the profit and loss template involves several straightforward steps:

- Gather all financial data, including sales figures, expenses, and any other relevant information.

- Input the revenue figures into the designated sections of the template.

- Calculate the cost of goods sold and enter this information.

- Deduct COGS from total revenue to find the gross profit.

- List all operating expenses and total them up.

- Finally, subtract total expenses from gross profit to determine net profit or loss.

Steps to complete the profit and loss template

Completing the profit and loss template requires attention to detail and accuracy. Follow these steps:

- Start with a clear title, indicating the business name and the reporting period.

- List all sources of income, ensuring to categorize them appropriately.

- Document all costs associated with producing goods or services.

- Include all operating expenses, breaking them down into categories for clarity.

- Ensure that all calculations are accurate, double-checking figures to avoid discrepancies.

- Review the completed template for completeness and accuracy before finalizing it.

IRS guidelines for the profit and loss template

The Internal Revenue Service (IRS) provides specific guidelines for preparing a profit and loss statement. Businesses must ensure that:

- All income and expenses are reported accurately and in accordance with IRS regulations.

- Documentation supporting all figures is maintained for audit purposes.

- The template aligns with the accounting method used by the business, whether cash or accrual.

- Any discrepancies or unusual entries are explained in accompanying notes.

Examples of using the profit and loss template

Practical examples illustrate how the profit and loss template can be utilized:

- A small retail business can use the template to track monthly sales and expenses to identify trends in profitability.

- A restaurant may employ the template to analyze food costs versus sales, helping to optimize menu pricing.

- Freelancers can utilize the template to monitor income from various clients against their operational costs, ensuring sustainable income.

Quick guide on how to complete profit and loss template form

Learn how to effortlessly navigate the Profit And Loss Template process with this simple guide

Submitting and filling out forms online is becoming more and more widespread and is the preferred option for many users. It offers numerous advantages over traditional printed paperwork, such as convenience, time savings, enhanced accuracy, and security.

With tools like airSlate SignNow, you can find, modify, signNow, enhance, and send your Profit And Loss Template without the hassle of constant printing and scanning. Follow this brief guide to begin and complete your document.

Employ these steps to obtain and complete Profit And Loss Template

- Begin by clicking on the Get Form button to access your form in our editor.

- Observe the green label on the left indicating required fields so you don't miss any.

- Utilize our advanced features to annotate, modify, sign, secure, and enrich your form.

- Protect your document or transform it into a fillable form using the tools on the right panel.

- Review the form and inspect it for mistakes or inconsistencies.

- Select DONE to complete the editing process.

- Rename your document or choose to keep it as is.

- Select the storage option you wish to utilize to save your form, send it via USPS, or click the Download Now button to save your file.

If Profit And Loss Template is not what you were seeking, feel free to explore our vast assortment of pre-uploaded forms that you can complete with ease. Test our platform today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out ITR 2, for capital profit/loss?

You can do Income Tax Return Filing in ITR-2 if you are an Individual or HUF having:Income from items in ITR 1 which is more than Rs. 50 lakhIncome from capital gainsForeign IncomeAgricultural Income more than Rs. 5,000Income from Business or Profession under a Partnership firmLegalraasta provides all the legal business services online. You can apply for ITR filing by going to their site.Hope it will help.Thanks

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How do I treat unrealized losses in equity for ITR? Which form should I fill out?

There is no procedure for set of unrealized losses in equity from other profit. The actual losses can be set of against the profit of other equities. For the purpose of profit or losses in the transaction of equity, the form no.3 should be filed.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

As a business owner, what online/offline templates would you benefit from having (e.g. a template to fill out and send invoices, business plan templates, etc.)?

One awesome highlight of ZipBooks’ invoice templates is that you can save default settings like your notes and payment terms for your invoices once you nail down the details of what exactly should be on your invoice. Using ZipBooks for your invoice means never sending off an invoice without your own company information on it (oops!). They actually score your invoice based on what information you include and so you'll be able to leverage the data we've collected from tens of thousands of invoices on what things are important to get you paid faster.Here are a couple tips on things that you will get you paid faster and should definitely be included on your invoice:Company logo: This is part of the invoice template that we provide for you. You'll save a company logo under company settings and you'll never have to think about whether your invoice template header looks good again.Notes: Thanking a customer for their business will always make you stand out in a crowd and leverages the psychological principle of reciprocity so that you get paid faster. Lots of studies show that including a thank you note gets you paid faster. I think that would especially be true when someone is getting a big bill for legal services.Invoice payment terms: Another great free feature of ZipBooks invoice templates for legal services (and anyone else who used our invoice templates for that matter) is that when you put terms into an invoice, we automatically detected it and set a due date for you. If you don't set terms, we assume that the invoice will be due in 14 days. This is the due date that we use to drive the late payment reminder and to display the number of days that a invoice has been outstanding in the AR aging report. If you don't want to set the invoice payment terms every time, you can set it up once under Account Preferences in the ZipBooks app. Pretty neat, right?Customer information: This one might seem pretty straightforward but it should always be on the list of "must haves" when thinking about what you should put on your invoice.Detailed description of bill: ZipBooks' invoice template lends itself to the ability to show a detailed account of everything that you have charged since you last sent an invoice. You can do that by manually entering the invoice details or you can use the time tracker to automatically pull in billable activity once you are ready to send the next invoice for your legal services.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the profit and loss template form

How to make an electronic signature for your Profit And Loss Template Form in the online mode

How to generate an eSignature for your Profit And Loss Template Form in Chrome

How to create an electronic signature for putting it on the Profit And Loss Template Form in Gmail

How to make an electronic signature for the Profit And Loss Template Form right from your mobile device

How to create an eSignature for the Profit And Loss Template Form on iOS devices

How to generate an eSignature for the Profit And Loss Template Form on Android

People also ask

-

What is a Profit And Loss Template?

A Profit And Loss Template is a financial tool that helps businesses track their income and expenses over a specific period. By using this template, you can easily understand your financial performance and make informed decisions. It is essential for budgeting and forecasting.

-

How can airSlate SignNow help with my Profit And Loss Template?

airSlate SignNow allows you to create, send, and eSign your Profit And Loss Template seamlessly. With our easy-to-use platform, you can collaborate with team members and stakeholders in real-time, ensuring that your financial documents are accurate and up-to-date.

-

What features does the Profit And Loss Template in airSlate SignNow offer?

Our Profit And Loss Template includes customizable fields, automated calculations, and an intuitive interface. You can easily input data, and the template will generate summaries and insights, making it easier to analyze your business performance.

-

Is there a cost to use the Profit And Loss Template with airSlate SignNow?

While airSlate SignNow offers various pricing plans, you can access the Profit And Loss Template as part of our standard features. We provide competitive pricing to ensure that businesses of all sizes can benefit from our cost-effective solutions.

-

Can I integrate airSlate SignNow with other accounting software for my Profit And Loss Template?

Yes, airSlate SignNow supports integration with various accounting software. This allows you to effortlessly import and export data related to your Profit And Loss Template, streamlining your financial processes and enhancing productivity.

-

What are the benefits of using a Profit And Loss Template?

Using a Profit And Loss Template helps you maintain clear visibility of your financial health, aiding in strategic planning. It simplifies the process of tracking income and expenses, enabling better decision-making and financial management.

-

How do I get started with the Profit And Loss Template on airSlate SignNow?

Getting started is easy! Simply sign up for an airSlate SignNow account, navigate to our template library, and select the Profit And Loss Template. From there, you can customize it to fit your needs and start managing your finances effectively.

Get more for Profit And Loss Template

Find out other Profit And Loss Template

- Help Me With Sign California Letter of Intent

- Can I Sign California Letter of Intent

- Sign Kentucky Hold Harmless (Indemnity) Agreement Simple

- Sign Maryland Hold Harmless (Indemnity) Agreement Now

- Sign Minnesota Hold Harmless (Indemnity) Agreement Safe

- Sign Mississippi Hold Harmless (Indemnity) Agreement Now

- Sign Nevada Hold Harmless (Indemnity) Agreement Easy

- Sign South Carolina Letter of Intent Later

- Sign Texas Hold Harmless (Indemnity) Agreement Computer

- Sign Connecticut Quitclaim Deed Free

- Help Me With Sign Delaware Quitclaim Deed

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed