CML Disclosure of Incentives BFormb Consultations Rics

What is the CML Disclosure of Incentives Form?

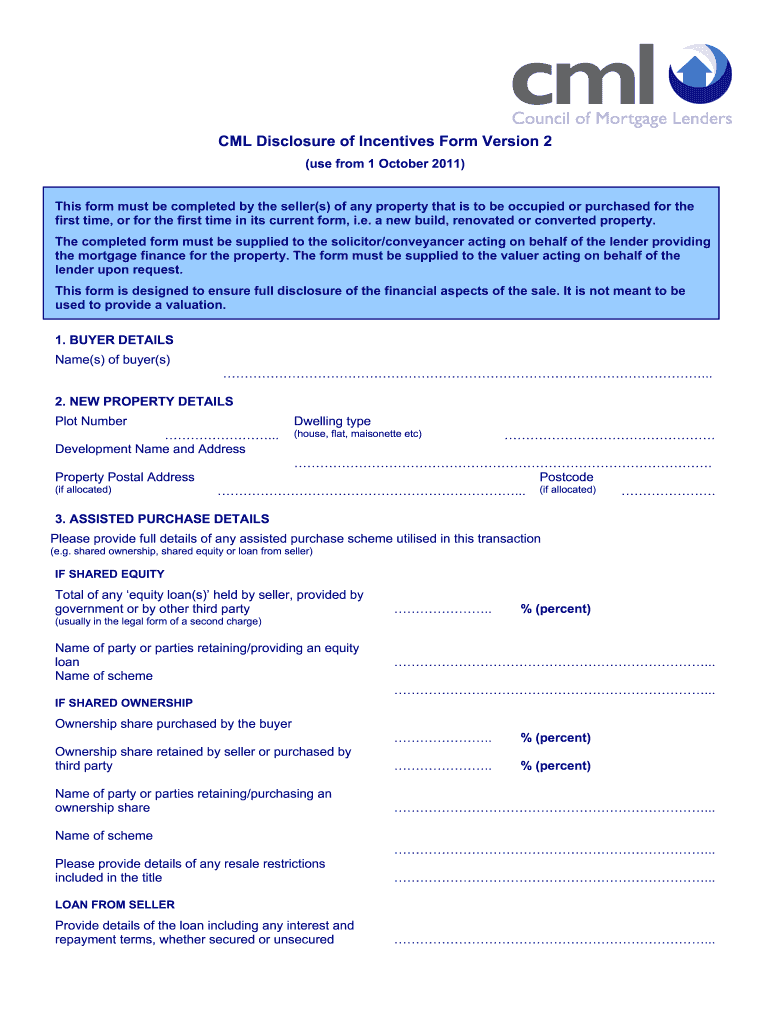

The CML disclosure of incentives form is a crucial document used in the real estate and mortgage sectors. It serves to provide transparency regarding any incentives offered by lenders or brokers to borrowers. This form outlines the financial benefits or incentives that may influence the terms of a mortgage, ensuring that borrowers are fully informed about any potential conflicts of interest.

Typically, the form includes details about the type of incentives, such as discounts, rebates, or other financial arrangements. By requiring this disclosure, regulatory bodies aim to protect consumers and promote fair lending practices.

Steps to Complete the CML Disclosure of Incentives Form

Completing the CML disclosure of incentives form involves several key steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather necessary information: Collect all relevant details about the mortgage, including lender information, loan terms, and any incentives offered.

- Fill out the form: Accurately input the gathered information into the form, ensuring that all fields are completed as required.

- Review the form: Double-check all entries for accuracy and completeness to avoid any errors that could lead to compliance issues.

- Sign and date the form: Ensure that the form is signed by the appropriate parties, indicating agreement and acknowledgment of the disclosed incentives.

- Submit the form: Send the completed form to the relevant parties, such as the lender or mortgage broker, as per the instructions provided.

Legal Use of the CML Disclosure of Incentives Form

The CML disclosure of incentives form is legally binding when completed correctly. It must adhere to specific regulations set forth by federal and state laws, including the Truth in Lending Act and the Real Estate Settlement Procedures Act. These laws mandate that lenders disclose all financial incentives to borrowers, ensuring transparency in the lending process.

Failure to comply with these legal requirements can result in penalties for lenders and brokers, including fines and potential legal action from consumers. Therefore, it is essential to understand the legal implications of this form and ensure it is filled out accurately.

Key Elements of the CML Disclosure of Incentives Form

Understanding the key elements of the CML disclosure of incentives form is vital for both borrowers and lenders. The primary components typically include:

- Borrower Information: Details about the borrower, including name and contact information.

- Lender Information: Information about the lender or broker providing the mortgage.

- Incentives Offered: A clear description of any incentives, including monetary amounts or percentage discounts.

- Terms and Conditions: Any stipulations or conditions associated with the incentives, such as eligibility criteria.

- Signatures: Required signatures from both the borrower and lender to validate the form.

Disclosure Requirements for the CML Disclosure of Incentives Form

Disclosure requirements for the CML disclosure of incentives form are designed to protect consumers and ensure transparency in the lending process. Lenders must disclose all financial incentives that may affect the terms of the mortgage. This includes any bonuses, rebates, or discounts that could influence a borrower's decision.

Additionally, lenders are required to provide clear explanations of these incentives, including any potential conflicts of interest. By adhering to these requirements, lenders can foster trust and maintain compliance with regulatory standards.

Examples of Using the CML Disclosure of Incentives Form

The CML disclosure of incentives form can be utilized in various scenarios within the mortgage process. For instance:

- A borrower may receive a discount on closing costs as an incentive for choosing a specific lender.

- A mortgage broker might offer a rebate to borrowers who complete their loan application online.

- Incentives may also include lower interest rates for borrowers with excellent credit scores.

These examples illustrate how the form can help clarify the financial arrangements between borrowers and lenders, ensuring that all parties are informed and protected.

Quick guide on how to complete cml disclosure of incentives bformb consultations rics

Complete CML Disclosure Of Incentives BFormb Consultations Rics effortlessly on any device

Digital document management has become favored by organizations and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruption. Manage CML Disclosure Of Incentives BFormb Consultations Rics on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric workflow today.

The simplest way to amend and eSign CML Disclosure Of Incentives BFormb Consultations Rics seamlessly

- Find CML Disclosure Of Incentives BFormb Consultations Rics and then click Get Form to begin.

- Use the resources we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign CML Disclosure Of Incentives BFormb Consultations Rics and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cml disclosure of incentives bformb consultations rics

How to create an eSignature for your Cml Disclosure Of Incentives Bformb Consultations Rics in the online mode

How to make an electronic signature for the Cml Disclosure Of Incentives Bformb Consultations Rics in Google Chrome

How to make an electronic signature for putting it on the Cml Disclosure Of Incentives Bformb Consultations Rics in Gmail

How to generate an eSignature for the Cml Disclosure Of Incentives Bformb Consultations Rics straight from your smart phone

How to generate an electronic signature for the Cml Disclosure Of Incentives Bformb Consultations Rics on iOS devices

How to create an electronic signature for the Cml Disclosure Of Incentives Bformb Consultations Rics on Android OS

People also ask

-

What is a cml form and how does it work?

A cml form is a standardized document used in various industries to ensure compliance and streamline processes. With airSlate SignNow, you can easily create, send, and eSign cml forms, enabling quicker approvals and reducing paperwork errors. This tool helps businesses enhance their operational efficiency by digitizing traditional forms.

-

How can I create a cml form using airSlate SignNow?

Creating a cml form with airSlate SignNow is straightforward. Simply log in to your account, select the document type, and customize your cml form as needed. Once created, you can instantly send it for signatures or further edits, making the process user-friendly and efficient.

-

What are the key features of airSlate SignNow for cml forms?

airSlate SignNow offers features such as templates for cml forms, secure eSigning options, workflow automation, and integration with various apps. You can also track document status in real-time and store completed cml forms securely. These features enable seamless management of your documentation needs.

-

Is airSlate SignNow affordable for small businesses looking to manage cml forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With competitive pricing plans, you can access all the essential features needed to manage your cml forms without breaking the bank. Upscale any plan as your business grows, allowing for continued efficiency.

-

Can airSlate SignNow integrate with other software for managing cml forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications such as CRM systems, cloud storage services, and project management tools. These integrations allow you to enhance your workflow and automate the handling of cml forms, saving time and improving productivity.

-

What benefits does using airSlate SignNow for cml forms provide?

Using airSlate SignNow for your cml forms offers numerous benefits, including increased efficiency, reduced processing time, and enhanced compliance. ESigning cml forms is not only faster but also environmentally friendly, contributing to your company's sustainability efforts. Additionally, the platform’s user-friendly interface helps all team members adapt quickly.

-

How secure is the information in my cml forms on airSlate SignNow?

Security is a top priority at airSlate SignNow. All cml forms and associated data are protected with advanced encryption protocols and secure cloud storage. Furthermore, the platform complies with industry standards, ensuring your documents are safe from unauthorized access.

Get more for CML Disclosure Of Incentives BFormb Consultations Rics

Find out other CML Disclosure Of Incentives BFormb Consultations Rics

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form