Incometaxreturnverificationform

What is the return verification form?

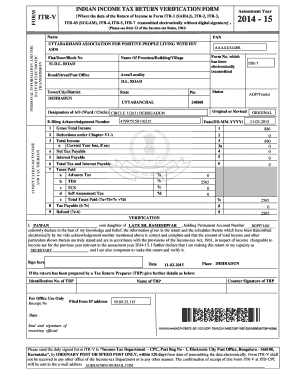

The return verification form is a crucial document used primarily in the context of tax filings. It serves to verify the accuracy and authenticity of tax returns submitted to the Internal Revenue Service (IRS). This form is often required by financial institutions or other entities that need to confirm the details of a taxpayer's return, ensuring compliance with federal tax regulations.

How to use the return verification form

Using the return verification form involves several key steps. First, ensure you have the correct version of the form, which can typically be obtained from the IRS or authorized tax professionals. Next, fill out the necessary information, including your personal details and tax return specifics. After completing the form, it should be submitted to the requesting institution or agency, either electronically or via mail, depending on their requirements.

Steps to complete the return verification form

Completing the return verification form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including your tax return and any supporting documentation.

- Fill in your personal information, such as name, address, and Social Security number.

- Provide details from your tax return, including income, deductions, and any credits claimed.

- Review the form for accuracy and completeness before submission.

- Submit the form as directed by the requesting institution, ensuring you keep a copy for your records.

Legal use of the return verification form

The return verification form holds legal significance as it is used to affirm the contents of a tax return. It must be filled out accurately to ensure it meets IRS standards and is accepted by financial institutions. Legal compliance is essential, as any discrepancies can lead to penalties or delays in processing your tax-related requests.

Required documents

When preparing to complete the return verification form, several documents are typically required:

- Your most recent tax return.

- W-2 forms or 1099 forms that report income.

- Any supporting schedules or documentation that substantiate deductions or credits.

- Identification documents, such as a driver's license or Social Security card.

Form submission methods

The return verification form can be submitted through various methods, depending on the requirements of the requesting institution. Common submission methods include:

- Online submission via secure portals provided by financial institutions.

- Mailing a hard copy to the designated address.

- In-person delivery at local offices, if applicable.

Quick guide on how to complete incometaxreturnverificationform

Effortlessly prepare Incometaxreturnverificationform on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a fantastic environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Incometaxreturnverificationform on any device using the airSlate SignNow Android or iOS applications, and enhance any document-driven process today.

Efficiently modify and eSign Incometaxreturnverificationform with ease

- Obtain Incometaxreturnverificationform and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize crucial sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device you prefer. Edit and eSign Incometaxreturnverificationform to ensure outstanding communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the incometaxreturnverificationform

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a return verification form?

A return verification form is a document used to confirm that items have been returned or received by a business or individual. It helps in tracking returns efficiently and ensures that both parties have a record of the transaction.

-

How can airSlate SignNow help with the return verification form?

airSlate SignNow simplifies the process of creating and sending a return verification form electronically. With our intuitive eSignature features, businesses can manage returns seamlessly while maintaining a clear trail of documentation.

-

What features does airSlate SignNow offer for handling return verification forms?

Our platform provides features like customizable templates for the return verification form, real-time tracking, and automated reminders. This ensures your team can authorize returns efficiently and reduces manual error.

-

Is there a cost associated with using airSlate SignNow for return verification forms?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. Our cost-effective solution allows you to efficiently manage return verification forms without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing return verification forms?

Absolutely! airSlate SignNow easily integrates with multiple platforms and tools, allowing you to streamline your entire return process. This means you can handle return verification forms alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for return verification forms?

Using airSlate SignNow enhances efficiency by reducing paperwork, speeding up approvals, and ensuring secure document handling. It allows businesses to focus on core operations while we take care of the return verification forms.

-

Is it easy to send a return verification form with airSlate SignNow?

Yes, sending a return verification form with airSlate SignNow is incredibly user-friendly. With just a few clicks, you can prepare and send your document for eSignature, eliminating the hassles of traditional paperwork.

Get more for Incometaxreturnverificationform

- Youth apprenticeship lakeshore technical college form

- Govbenefits by employer to learn more about choices available to you view an elearning and see instructions form

- Employee enrollment application wisconsin form

- Kansas medicare redetermination request form

- Ui claim form

- Laramie location form

- Alaskas unemployment insurance ui claim assistance form

- Request for certification home health services form bcbsal

Find out other Incometaxreturnverificationform

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA