MWBE Quarterly Compliance Report Office of Temporary and Otda Ny 2016-2026

Understanding the MWBE Quarterly Compliance Report

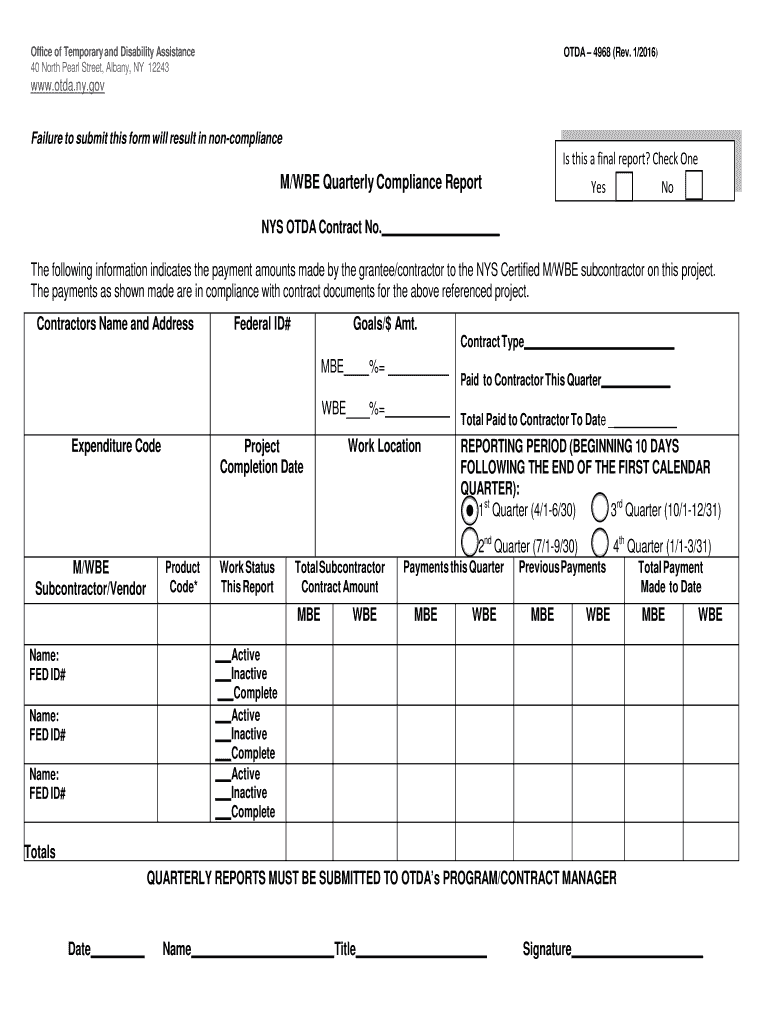

The MWBE Quarterly Compliance Report is a crucial document for businesses seeking to comply with state regulations regarding Minority and Women-Owned Business Enterprises (MWBEs). This report is designed to ensure that businesses meet the necessary criteria set forth by the Office of Temporary and Disability Assistance (OTDA) in New York. It serves as a means for tracking participation in MWBE programs and ensuring that businesses are fulfilling their obligations under state law.

Steps to Complete the MWBE Quarterly Compliance Report

Completing the MWBE Quarterly Compliance Report involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your business's MWBE activities during the reporting period. This may include contracts, invoices, and proof of payments made to MWBE subcontractors. Next, fill out the report form, ensuring that all required fields are completed accurately. Pay special attention to the sections that detail the amount of work performed by MWBEs and the total expenditures. Finally, review the report for completeness and accuracy before submission.

Key Elements of the MWBE Quarterly Compliance Report

The MWBE Quarterly Compliance Report includes several essential components that must be accurately reported. Key elements include the business's name, address, and identification number, as well as detailed information about MWBE subcontractors used during the reporting period. Additionally, the report requires the total dollar amount paid to MWBE firms and a description of the services provided. Ensuring these elements are correctly filled out is vital for compliance and to avoid potential penalties.

Legal Use of the MWBE Quarterly Compliance Report

Understanding the legal implications of the MWBE Quarterly Compliance Report is essential for businesses. The report must adhere to the guidelines established by the OTDA and must be submitted within the designated timeframes. Failure to submit the report or inaccuracies within it can lead to penalties, including fines or loss of certification as an MWBE. It is important for businesses to maintain accurate records and ensure that their reports reflect true and complete information.

Filing Deadlines and Important Dates

Timely submission of the MWBE Quarterly Compliance Report is critical. The report is typically due within a specific timeframe following the end of each quarter. Businesses should be aware of these deadlines to avoid late submissions, which can incur penalties. Keeping a calendar of important dates related to the report can help ensure compliance and maintain good standing with regulatory authorities.

Form Submission Methods

Businesses have several options for submitting the MWBE Quarterly Compliance Report. The form can often be submitted online through the designated portal provided by the OTDA, which offers a streamlined process for electronic filing. Alternatively, businesses may choose to submit the report via mail or in person, depending on their preference and the requirements of the specific reporting period. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure successful filing.

Quick guide on how to complete mwbe quarterly compliance report office of temporary and otda ny

Manage MWBE Quarterly Compliance Report Office Of Temporary And Otda Ny from anywhere, at any time

Your daily business tasks may need extra care when engaging with state-specific business documents. Regain your working hours and lower the costs associated with document-focused processes using airSlate SignNow. airSlate SignNow offers a variety of pre-uploaded business forms, including MWBE Quarterly Compliance Report Office Of Temporary And Otda Ny, which you can utilize and distribute among your business associates. Handle your MWBE Quarterly Compliance Report Office Of Temporary And Otda Ny seamlessly with robust editing and eSignature features and send it straight to your recipients.

Steps to obtain MWBE Quarterly Compliance Report Office Of Temporary And Otda Ny in a few clicks:

- Choose a form applicable to your state.

- Click on Learn More to examine the document and ensure its accuracy.

- Hit Get Form to start working on it.

- MWBE Quarterly Compliance Report Office Of Temporary And Otda Ny will automatically launch within the editor. No further steps are necessary.

- Utilize airSlate SignNow’s advanced editing features to fill it out or modify the form as needed.

- Select the Sign option to create your signature and electronically sign your document.

- When ready, click Done, save your modifications, and access your document.

- Share the form via email or text, or use a link-to-fill option with your partners, or allow them to download the files.

airSlate SignNow greatly saves your time managing MWBE Quarterly Compliance Report Office Of Temporary And Otda Ny and enables you to find necessary documents in a single location. A comprehensive library of forms is organized and tailored to address essential business operations for your organization. The advanced editor reduces the chance of errors, allowing you to easily fix mistakes and review your documents on any device before sending them out. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

-

How do I let a police officer know that my windows are broken and will not roll down if I'm ever pulled over? I don't want to be dragged out of my vehicle and cuffed for non-compliance.

As the officer approaches your vehicle, he/she will ask you to roll down your window. Just explain the window does not roll down.DO NOT OPEN YOUR DOOR UNTIL HE/SHE TELLS YOU TO DO SO!!!Most officers are shot as a suspect gets out of the vehicle. So as soon as a driver tries to exit the vehicle, all officers are trained to respond the same - be prepared for a gun fight!Remain INSIDE your vehicle; hands at 10–2 on the steering wheel, dome light on helps as well.Follow ALL instructions given.If you politely tell the officer your window does not roll down, they will do one of three things:Go the passengers side to make the interactions (or if they already made a passenger side approach and that is the window that does not operate, they will probably go to the driver’s side)Ask you to open the door just enough for you to hand them your license and documentsAsk you to bring your license and documents and to step from the vehicle.Most important thing to remember - DO NOT TRY TO EXIT THE VEHICLE

Create this form in 5 minutes!

How to create an eSignature for the mwbe quarterly compliance report office of temporary and otda ny

How to make an electronic signature for the Mwbe Quarterly Compliance Report Office Of Temporary And Otda Ny online

How to create an electronic signature for the Mwbe Quarterly Compliance Report Office Of Temporary And Otda Ny in Chrome

How to generate an eSignature for putting it on the Mwbe Quarterly Compliance Report Office Of Temporary And Otda Ny in Gmail

How to make an electronic signature for the Mwbe Quarterly Compliance Report Office Of Temporary And Otda Ny right from your smartphone

How to create an electronic signature for the Mwbe Quarterly Compliance Report Office Of Temporary And Otda Ny on iOS

How to create an eSignature for the Mwbe Quarterly Compliance Report Office Of Temporary And Otda Ny on Android

People also ask

-

What are the benefits of using airSlate SignNow for otda and m wbe applications?

Using airSlate SignNow for otda and m wbe applications streamlines document management, making it easy to send, review, and eSign necessary paperwork. It enhances efficiency with a user-friendly interface that caters specifically to the diverse needs of m wbe businesses. Additionally, you can ensure compliance and security, which are crucial in government contracting.

-

How does airSlate SignNow ensure compliance with otda and m wbe requirements?

airSlate SignNow is designed to help businesses meet the compliance requirements for otda and m wbe certifications. With features like secure eSigning, audit trails, and document storage, businesses can maintain an organized and compliant approach to their paperwork. This ensures that all necessary documentation aligns with regulatory standards.

-

What pricing plans are available for businesses seeking otda and m wbe solutions?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes, particularly those looking for otda and m wbe solutions. Each plan includes essential features like eSignature capabilities, document templates, and advanced integrations. Prospective customers can choose a plan that best fits their budget while maximizing efficiency.

-

Can airSlate SignNow integrate with other systems for managing otda and m wbe documents?

Yes, airSlate SignNow offers seamless integrations with major platforms such as Google Workspace, Salesforce, and Microsoft 365, facilitating smoother workflows for managing otda and m wbe documents. This allows businesses to automate processes and sync data across their favorite applications. The integrations help to enhance productivity, especially for teams working on multiple platforms.

-

How does airSlate SignNow enhance collaboration for teams focusing on otda and m wbe projects?

airSlate SignNow enhances collaboration by allowing multiple users to work on documents in real-time, making it easier to gather signatures and feedback on otda and m wbe projects. The platform's commenting and notification features keep all team members informed, ensuring a streamlined review process. This is particularly beneficial for collaborative environments where timely execution is critical.

-

Is airSlate SignNow easy to use for those unfamiliar with otda and m wbe processes?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, ensuring that even those unfamiliar with otda and m wbe processes can navigate the system with ease. The intuitive interface and helpful tutorials make it accessible for users of all experience levels. This empowers businesses to quickly adopt the platform without extensive training.

-

What security measures does airSlate SignNow implement for otda and m wbe document handling?

airSlate SignNow prioritizes security with robust measures for handling otda and m wbe documents, including encryption, secure cloud storage, and multi-factor authentication. These features protect sensitive information and ensure that your documents remain safe throughout the signing process. Compliance with industry standards further assures businesses of data integrity.

Get more for MWBE Quarterly Compliance Report Office Of Temporary And Otda Ny

Find out other MWBE Quarterly Compliance Report Office Of Temporary And Otda Ny

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure