Fire Insurance Format

What is the fire insurance format

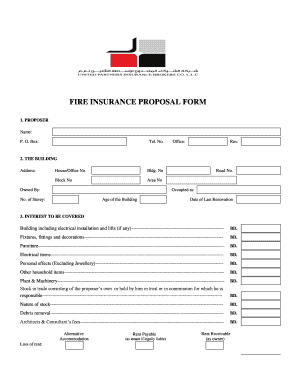

The fire insurance requirement form is a crucial document used to establish the terms and conditions under which fire insurance coverage is provided. This form outlines the obligations of both the insurer and the policyholder, ensuring that all parties understand their rights and responsibilities. It typically includes details such as the property being insured, coverage limits, deductibles, and any specific exclusions. Understanding this form is essential for anyone seeking to protect their property from fire-related risks.

How to use the fire insurance format

Using the fire insurance requirement form involves several steps to ensure that it is completed accurately and efficiently. Begin by gathering all necessary information about the property, including its location, type, and any existing safety measures. Next, fill out the form with this information, ensuring that all sections are completed thoroughly. It is important to review the form for accuracy before submission. Once completed, the form can be submitted to the insurance provider for processing, either digitally or through traditional mail.

Key elements of the fire insurance format

The fire insurance requirement form contains several key elements that are essential for its validity and effectiveness. These elements include:

- Property Description: A detailed account of the property being insured, including its address and type.

- Coverage Amount: The total value of coverage requested, which should reflect the property's replacement cost.

- Deductibles: The amount the policyholder agrees to pay out-of-pocket before insurance coverage kicks in.

- Exclusions: Specific risks or damages that are not covered under the policy.

- Signature Lines: Spaces for both the insurer and the policyholder to sign, indicating agreement to the terms.

Steps to complete the fire insurance format

Completing the fire insurance requirement form involves a systematic approach to ensure all necessary information is provided. Follow these steps:

- Gather relevant property information and documentation.

- Fill in the property description, including address and type.

- Specify the desired coverage amount and deductible.

- Review the exclusions section to understand what is not covered.

- Sign and date the form, ensuring all parties involved do the same.

- Submit the completed form to your insurance provider.

Legal use of the fire insurance format

The fire insurance requirement form must comply with legal standards to be considered valid. In the United States, electronic signatures are legally binding under the ESIGN Act and UETA, provided that certain conditions are met. This means that using an electronic platform to complete and sign the form can be just as legitimate as traditional paper methods. It is important to ensure that the chosen method of submission adheres to state regulations and insurance company policies.

Required documents

When completing the fire insurance requirement form, several documents may be required to support the application. These documents typically include:

- Proof of Ownership: Documents such as a deed or title to verify ownership of the property.

- Previous Insurance Policies: Information on any prior fire insurance coverage.

- Property Appraisal: An assessment of the property's value to determine appropriate coverage amounts.

- Safety Inspection Reports: Documentation of fire safety measures in place, such as smoke detectors and sprinkler systems.

Quick guide on how to complete fire insurance format

Completing Fire Insurance Format seamlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without interruptions. Handle Fire Insurance Format on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Fire Insurance Format effortlessly

- Obtain Fire Insurance Format and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, an invite link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Fire Insurance Format to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fire insurance format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fire insurance form and why is it important?

A fire insurance form is a document that outlines the details and terms of a fire insurance policy. It is crucial for businesses and homeowners as it provides financial protection against fire-related damages. Understanding the specifics of this form can help ensure you have adequate coverage.

-

How can airSlate SignNow facilitate the signing of fire insurance forms?

airSlate SignNow streamlines the process of signing fire insurance forms by allowing users to send and eSign documents electronically. This eliminates the need for physical signatures, making the process faster and more efficient. With our platform, you can manage your insurance documents from anywhere at any time.

-

What features does airSlate SignNow offer for handling fire insurance forms?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and automated workflows that make managing fire insurance forms a breeze. These tools enable you to easily create, send, and track documents while ensuring compliance and security. Its user-friendly interface ensures a smooth experience for all users.

-

Is there a cost associated with using airSlate SignNow for fire insurance forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling fire insurance forms. Our plans are designed to be cost-effective, providing excellent value for the features included. We also offer a free trial, allowing you to explore our services before committing.

-

What are the benefits of using airSlate SignNow for fire insurance forms over traditional methods?

Using airSlate SignNow for fire insurance forms reduces the time and hassle associated with printing, signing, and mailing documents. The electronic signature process is secure and compliant with regulations, minimizing errors and speeding up the processing time. This modern approach saves both time and resources for your business.

-

Can I integrate airSlate SignNow with other tools for managing fire insurance forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party apps, allowing you to synchronize your workflows for managing fire insurance forms. This capability enhances productivity and ensures that your documents are efficiently processed alongside other business tools like CRMs, accounting software, and more.

-

How secure is the electronic signature process for fire insurance forms on airSlate SignNow?

The electronic signature process for fire insurance forms on airSlate SignNow is highly secure, employing advanced encryption standards to protect your documents. Our platform is compliant with legal regulations, ensuring that your signed documents hold up in a court of law. You can have peace of mind knowing that your sensitive information is safely handled.

Get more for Fire Insurance Format

- 540a ftb ca form

- Form 1093 irs 2011

- Blank sales tax form tennessee 2014

- Minicipal business tax return classification 1c tennessee form

- Tngovrevenueformsgeneralr 2012

- 2014 municipal business tax return bus 416 2014 municipal business tax return bus 416 form

- Tennessee estate inheritance tax waiver 2008 form

- Tn fae 170 2008 form

Find out other Fire Insurance Format

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document