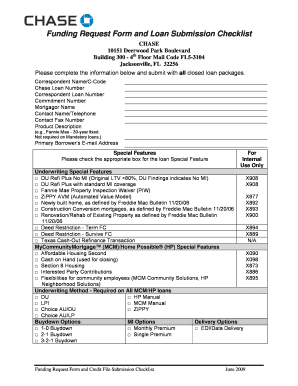

Funding Request Form and Loan Submission Checklist Chase B2B

Understanding the Dealer Funding Request Form

The dealer funding request form is a crucial document used by businesses to apply for financing or funding from financial institutions. This form typically outlines the details of the funding being requested, including the amount, purpose, and any relevant financial information. It serves as a formal request that initiates the funding process and helps lenders assess the viability of the application.

Key Elements of the Dealer Funding Request Form

When completing the dealer funding request form, several key elements must be included to ensure a comprehensive submission. These elements typically include:

- Applicant Information: Name, address, and contact details of the dealer applying for funding.

- Funding Amount: The specific amount of funding being requested.

- Purpose of Funding: A clear explanation of how the funds will be used, such as inventory purchases or operational expenses.

- Financial Statements: Relevant financial documents that demonstrate the dealer's financial health.

- Business Plan: An outline of the business model and how the funding will contribute to growth.

Steps to Complete the Dealer Funding Request Form

Completing the dealer funding request form involves several steps to ensure accuracy and completeness. Follow these steps for a successful submission:

- Gather necessary documentation, including financial statements and a business plan.

- Fill out the form with accurate and up-to-date information.

- Clearly state the amount of funding requested and the purpose behind it.

- Review the completed form for any errors or omissions.

- Submit the form through the designated channel, whether online or via mail.

Legal Use of the Dealer Funding Request Form

The dealer funding request form must comply with relevant legal standards to be considered valid. This includes adherence to eSignature laws, ensuring that electronic signatures are legally binding. Compliance with regulations such as the ESIGN Act and UETA is essential for the form to be recognized by financial institutions. Additionally, maintaining confidentiality and data protection is critical when handling sensitive information.

Form Submission Methods

There are various methods for submitting the dealer funding request form, allowing flexibility based on the dealer's preferences. Common submission methods include:

- Online Submission: Many lenders offer an online platform for submitting forms, which can expedite the process.

- Mail Submission: Dealers can choose to print the form and send it via postal service, ensuring all documents are included.

- In-Person Submission: Some dealers may prefer to deliver the form directly to the lender's office for immediate processing.

Eligibility Criteria for Funding

Eligibility for funding through the dealer funding request form varies by lender but generally includes criteria such as:

- Business Type: The dealer must be a registered business entity, such as an LLC or corporation.

- Creditworthiness: Lenders will assess the dealer's credit history and financial stability.

- Operational History: A track record of business operations may be required to demonstrate reliability.

- Purpose of Funding: The intended use of funds must align with the lender's guidelines for financing.

Quick guide on how to complete funding request form and loan submission checklist chase b2b

Complete Funding Request Form And Loan Submission Checklist Chase B2B effortlessly on any device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Funding Request Form And Loan Submission Checklist Chase B2B on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to modify and eSign Funding Request Form And Loan Submission Checklist Chase B2B with ease

- Locate Funding Request Form And Loan Submission Checklist Chase B2B and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to finalize your changes.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate the printing of new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Funding Request Form And Loan Submission Checklist Chase B2B and ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the funding request form and loan submission checklist chase b2b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a dealer funding request?

A dealer funding request is a formal application used by dealerships to secure funding from financial institutions. It typically includes details about the vehicle transaction and helps streamline the approval process for financing. With airSlate SignNow, you can easily create and eSign dealer funding requests to expedite your funding.

-

How does airSlate SignNow simplify the dealer funding request process?

airSlate SignNow provides an intuitive platform to create, send, and electronically sign dealer funding requests. This not only reduces paperwork but also accelerates the funding approval timeline, allowing you to focus on closing sales faster. By leveraging digital signatures, you can enhance the efficiency of your funding processes.

-

Are there any costs associated with using airSlate SignNow for dealer funding requests?

Yes, airSlate SignNow offers several pricing plans tailored to meet the needs of different businesses. Each plan includes features specifically designed for managing dealer funding requests efficiently. Investing in our solution can save time and resources in your funding operations.

-

What features does airSlate SignNow offer for dealer funding requests?

Certain features of airSlate SignNow, such as customizable templates for dealer funding requests and real-time tracking, ensure a seamless experience. Additionally, our platform supports multi-user collaboration, which means your team can work together efficiently. These features collectively enhance the management of your funding requests.

-

Can I integrate airSlate SignNow with other software for dealer funding requests?

Absolutely! airSlate SignNow integrates with various CRM and ERP systems, allowing you to automate and streamline your dealer funding request process. This integration ensures your financial data and documents are synced, eliminating manual entry errors and saving time.

-

What are the benefits of using airSlate SignNow for dealer funding requests?

Using airSlate SignNow for dealer funding requests offers numerous benefits, including reduced turnaround time and enhanced accuracy. By transitioning to a digital platform, you can eliminate paper-based processes and foster better communication among your team. Overall, it leads to a more efficient financing workflow.

-

How secure is the airSlate SignNow platform for dealer funding requests?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance with industry standards to protect your dealer funding requests and sensitive data. You can trust that your information remains confidential and secure throughout the signing process.

Get more for Funding Request Form And Loan Submission Checklist Chase B2B

Find out other Funding Request Form And Loan Submission Checklist Chase B2B

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF