Mortgage Pre Qualification Form PDF

What is the mortgage pre qualification form pdf

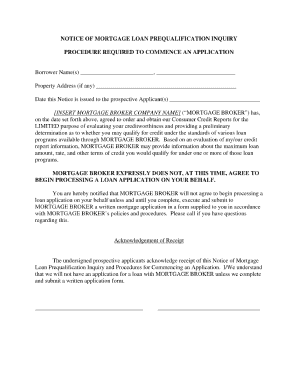

The mortgage pre qualification form pdf is a document used by lenders to assess a borrower's financial situation before they apply for a mortgage. This form collects essential information, such as income, debts, and credit history, to help lenders determine how much money a borrower may qualify for. Completing this form is an important step in the home-buying process, as it provides an initial estimate of the mortgage amount a borrower can expect.

Key elements of the mortgage pre qualification form pdf

Several key elements are typically included in the mortgage pre qualification form pdf. These include:

- Personal Information: Name, address, and contact details.

- Income Details: Monthly income from all sources, including salary, bonuses, and other income streams.

- Debt Information: Monthly obligations such as credit card payments, student loans, and other debts.

- Credit History: Information about the borrower's credit score and history.

- Property Information: Details about the property being considered for purchase, if known.

Steps to complete the mortgage pre qualification form pdf

Completing the mortgage pre qualification form pdf involves several straightforward steps:

- Gather necessary documents, including proof of income and a list of debts.

- Fill out personal information accurately, ensuring all contact details are correct.

- Provide details about your income and debts, being as precise as possible.

- Review the information for accuracy before submission.

- Submit the form electronically or print it out for manual submission, depending on lender requirements.

How to use the mortgage pre qualification form pdf

The mortgage pre qualification form pdf is used primarily to initiate the mortgage application process. Once completed, it can be submitted to lenders who will review the information to provide a prequalification letter. This letter indicates how much the lender is willing to lend, which can help borrowers understand their budget when searching for homes. It is advisable to use this form with multiple lenders to compare offers and find the best mortgage terms.

Legal use of the mortgage pre qualification form pdf

The mortgage pre qualification form pdf can be legally binding when completed and signed using compliant electronic signature tools. To ensure the form is recognized legally, it must adhere to relevant laws such as the ESIGN Act and UETA. These laws establish that electronic signatures and documents hold the same legal weight as their paper counterparts, provided that the signers consent to use electronic means.

How to obtain the mortgage pre qualification form pdf

Obtaining the mortgage pre qualification form pdf is typically straightforward. Many lenders provide this form directly on their websites, allowing potential borrowers to download it easily. Additionally, financial institutions may offer the form in person at their branches. It is important to ensure that the form is the most current version to avoid any issues during the prequalification process.

Quick guide on how to complete mortgage pre qualification form pdf

Complete Mortgage Pre Qualification Form Pdf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Mortgage Pre Qualification Form Pdf on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Mortgage Pre Qualification Form Pdf with minimal effort

- Find Mortgage Pre Qualification Form Pdf and click Get Form to begin.

- Use the tools we provide to complete your form.

- Mark pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Mortgage Pre Qualification Form Pdf and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage pre qualification form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage pre qualification form PDF?

A mortgage pre qualification form PDF is a document that potential homebuyers fill out to provide lenders with their financial information. This form helps lenders assess how much money the buyer may qualify for and streamlines the mortgage process. By using a PDF format, users can easily fill, sign, and submit the form electronically.

-

How can I create a mortgage pre qualification form PDF with airSlate SignNow?

Creating a mortgage pre qualification form PDF with airSlate SignNow is simple. Users can utilize our template library to access pre-designed forms or create their own customized versions. Once designed, the form can be saved as a PDF for easy sharing and signing.

-

What are the benefits of using airSlate SignNow for a mortgage pre qualification form PDF?

Using airSlate SignNow for your mortgage pre qualification form PDF provides several benefits. The platform allows for easy electronic signing, reducing turnaround times. Furthermore, it offers cloud storage, facilitating seamless access and management of your documents.

-

Are there any costs associated with using airSlate SignNow for mortgage pre qualification form PDFs?

AirSlate SignNow offers flexible pricing plans tailored to different business needs when using mortgage pre qualification form PDFs. The pricing includes access to various features such as unlimited document templates, e-signature capabilities, and secure storage options. Prospective customers can choose a plan that fits their budget and requirements.

-

What features does airSlate SignNow offer for mortgage pre qualification form PDFs?

airSlate SignNow provides a range of features for mortgage pre qualification form PDFs, including customizable templates, advanced analytics, and real-time status tracking. Additionally, users can integrate the platform with various CRM systems, enhancing workflow efficiency.

-

How does airSlate SignNow ensure the security of my mortgage pre qualification form PDF?

Security is a top priority for airSlate SignNow. The platform employs bank-grade encryption, secure servers, and compliance with various regulations to protect your mortgage pre qualification form PDFs. This ensures your sensitive information remains confidential and secure.

-

Can I integrate airSlate SignNow with other applications for managing mortgage pre qualification form PDFs?

Yes, airSlate SignNow supports integration with various third-party applications, allowing users to streamline the management of mortgage pre qualification form PDFs. Integrations with popular software like CRM tools can enhance your workflow and improve productivity.

Get more for Mortgage Pre Qualification Form Pdf

Find out other Mortgage Pre Qualification Form Pdf

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form