How to Fill the Form De 4 Employees Withholding Allowance Certificate If You Are Single

What is the How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single

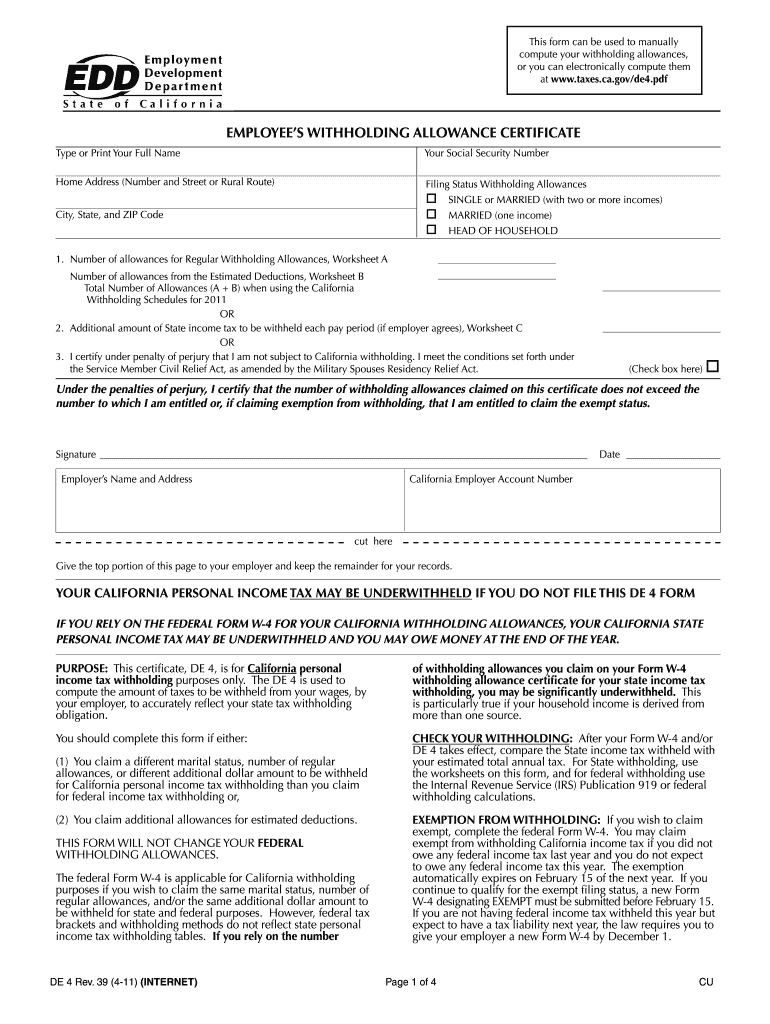

The Form DE-4 is the Employees Withholding Allowance Certificate used in the state of North Carolina. This form allows employees to declare their withholding allowances, which determine the amount of state income tax withheld from their paychecks. If you are single, filling out this form accurately is essential to ensure the correct amount of tax is withheld based on your personal situation. The form takes into account your filing status, number of allowances, and any additional withholding you may wish to request.

Steps to complete the How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single

Completing the Form DE-4 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status as single in the designated section.

- Determine the number of allowances you are claiming. Typically, as a single individual, you may claim one allowance.

- If you wish to have additional amounts withheld, specify that amount in the appropriate section.

- Review the form for accuracy, then sign and date it to validate your submission.

Key elements of the How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single

When filling out the DE-4, several key elements must be considered:

- Personal Information: Ensure all your details are correct, as inaccuracies can lead to issues with tax withholding.

- Filing Status: Clearly state that you are single to reflect your tax situation accurately.

- Allowances: Understand how many allowances you qualify for, as this affects your tax withholding.

- Additional Withholding: Decide if you want to specify an extra amount to be withheld from your paycheck.

IRS Guidelines

The IRS provides guidelines on how to fill out withholding allowance certificates. While the DE-4 is specific to North Carolina, it is important to understand how it aligns with federal guidelines. The IRS allows individuals to claim allowances based on personal and dependent situations. For single filers, the IRS suggests reviewing the IRS Withholding Estimator to determine the appropriate number of allowances to claim, ensuring that the correct amount of federal tax is withheld as well.

Form Submission Methods (Online / Mail / In-Person)

Once you have completed the DE-4, you can submit it through various methods:

- Online: Some employers may offer a digital submission option through their payroll systems.

- Mail: You can send the completed form directly to your employer's payroll department.

- In-Person: Delivering the form in person to your HR or payroll department is also an option, ensuring immediate processing.

Penalties for Non-Compliance

Failing to accurately complete and submit the DE-4 can lead to penalties. If too little tax is withheld, you may owe a significant amount at tax time, potentially incurring interest and penalties for underpayment. Conversely, if too much tax is withheld, you may experience reduced take-home pay. It is crucial to review your withholding regularly, especially after life changes such as marriage or changes in employment status.

Quick guide on how to complete how to fill the form de 4 employees withholding allowance certificate if you are single

Complete How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single effortlessly on any device

Online document oversight has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly without delays. Manage How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

The easiest way to modify and eSign How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single without hassle

- Obtain How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal weight as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and eSign How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single and guarantee outstanding communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill the form de 4 employees withholding allowance certificate if you are single

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form DE 4 Employees Withholding Allowance Certificate?

The Form DE 4 Employees Withholding Allowance Certificate is a tax form used in California for employees to declare their withholding allowances. Understanding How To Fill The Form DE 4 Employees Withholding Allowance Certificate If You Are Single is important for accurate tax withholding. This form helps ensure that you have the appropriate amount deducted from your paycheck for state taxes.

-

How can airSlate SignNow help me fill out the Form DE 4?

airSlate SignNow streamlines the process of filling out the Form DE 4, providing an easy-to-use platform for electronic signatures and document management. You can learn How To Fill The Form DE 4 Employees Withholding Allowance Certificate If You Are Single by using our guided templates. This ensures that you complete the form accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for this process?

airSlate SignNow offers a range of pricing plans to fit different business needs, including features for filling out government forms like the DE 4. Our service is cost-effective, providing you with the tools to learn How To Fill The Form DE 4 Employees Withholding Allowance Certificate If You Are Single, without breaking the bank. Check our website for the most up-to-date pricing information.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features like electronic signatures, document templates, and robust security protocols. These tools help you easily manage important documents such as the Form DE 4. Knowing How To Fill The Form DE 4 Employees Withholding Allowance Certificate If You Are Single is made simpler with our intuitive platform.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers integrations with a variety of software applications, enhancing your workflow efficiency. By leveraging these integrations, you can simplify the process of learning How To Fill The Form DE 4 Employees Withholding Allowance Certificate If You Are Single. Explore our integration options for a seamless experience.

-

What are the benefits of using airSlate SignNow for filling out tax forms?

Using airSlate SignNow for filling out tax forms like the DE 4 comes with numerous benefits, such as enhanced accuracy and compliance. Our platform guides you on How To Fill The Form DE 4 Employees Withholding Allowance Certificate If You Are Single, reducing errors and ensuring you meet deadlines. Plus, electronic signatures save you time and paper.

-

Is eSigning the Form DE 4 legally binding?

Yes, eSignatures created using airSlate SignNow are legally binding and recognized under federal and state law. This means that when you learn How To Fill The Form DE 4 Employees Withholding Allowance Certificate If You Are Single and sign it electronically, your submission is valid. Rest assured that our platform prioritizes security to safeguard your documents.

Get more for How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single

Find out other How To Fill The Form De 4 Employees Withholding Allowance Certificate If You Are Single

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe