Government of the District of Columbia Fill in Fp308b Form

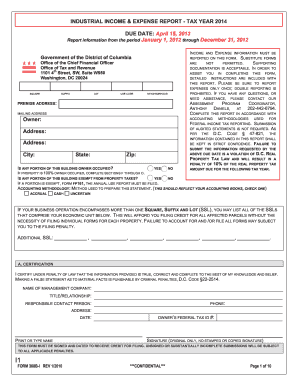

What is the Government Of The District Of Columbia Fill In Fp308b Form

The Government of the District of Columbia Fill In FP308B Form is a specific document used for various administrative purposes within the District. This form may serve different functions, such as providing information for tax assessments, applications for permits, or other governmental processes. Understanding the purpose of this form is crucial for ensuring accurate completion and compliance with local regulations.

Steps to complete the Government Of The District Of Columbia Fill In Fp308b Form

Completing the Government of the District of Columbia Fill In FP308B Form involves several key steps:

- Gather necessary information, including personal details and any relevant identification numbers.

- Access the form through the official government website or authorized distribution channels.

- Fill in the required fields accurately, ensuring all information is current and truthful.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the specified methods, whether online, by mail, or in person.

Legal use of the Government Of The District Of Columbia Fill In Fp308b Form

The legal use of the Government of the District of Columbia Fill In FP308B Form is governed by local laws and regulations. This form must be completed in accordance with the guidelines set forth by the District government to ensure its validity. Proper use includes adhering to submission deadlines, providing accurate information, and maintaining compliance with any applicable legal requirements.

How to obtain the Government Of The District Of Columbia Fill In Fp308b Form

To obtain the Government of the District of Columbia Fill In FP308B Form, individuals can visit the official District government website, where the form is typically available for download. Additionally, the form may be accessible through local government offices or agencies that handle the specific administrative tasks related to the form’s purpose. Ensuring that you have the most current version of the form is essential for compliance.

Key elements of the Government Of The District Of Columbia Fill In Fp308b Form

Key elements of the Government of the District of Columbia Fill In FP308B Form include:

- Identification fields for the individual or entity submitting the form.

- Sections requiring specific information related to the purpose of the form.

- Signature lines for verification and authentication of the submitted information.

- Instructions for proper completion and submission of the form.

Form Submission Methods (Online / Mail / In-Person)

The Government of the District of Columbia Fill In FP308B Form can be submitted through various methods:

- Online: Many forms can be submitted electronically through the District government’s online portal.

- Mail: Completed forms can be sent to the designated government office via postal service.

- In-Person: Individuals can also submit the form directly at relevant government offices during business hours.

Quick guide on how to complete government of the district of columbia fill in fp308b form

Complete Government Of The District Of Columbia Fill In Fp308b Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any hold-ups. Manage Government Of The District Of Columbia Fill In Fp308b Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest method to modify and eSign Government Of The District Of Columbia Fill In Fp308b Form with ease

- Locate Government Of The District Of Columbia Fill In Fp308b Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that task.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a customary wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with a few clicks from your chosen device. Edit and eSign Government Of The District Of Columbia Fill In Fp308b Form and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the government of the district of columbia fill in fp308b form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Government Of The District Of Columbia Fill In Fp308b Form?

The Government Of The District Of Columbia Fill In Fp308b Form is a legal document required for certain administrative processes in D.C. It is essential for businesses and individuals to properly complete this form to comply with local regulations. airSlate SignNow offers features to simplify filling out this form digitally.

-

How can airSlate SignNow help with the Government Of The District Of Columbia Fill In Fp308b Form?

airSlate SignNow streamlines the process of filling out the Government Of The District Of Columbia Fill In Fp308b Form by allowing users to complete and eSign documents seamlessly. Our platform provides templates and intuitive editing tools to ensure accuracy and compliance. This makes the process faster and more efficient.

-

Is there a fee associated with using airSlate SignNow to fill out the Government Of The District Of Columbia Fill In Fp308b Form?

Yes, airSlate SignNow offers various pricing plans tailored to different needs. These plans include access to all the necessary features for completing the Government Of The District Of Columbia Fill In Fp308b Form. You can choose a plan that suits your business requirements and budget.

-

What features does airSlate SignNow offer for filling out forms?

airSlate SignNow provides numerous features for filling out forms, including digital signatures, templates, and real-time collaboration. These tools are particularly useful when dealing with documents like the Government Of The District Of Columbia Fill In Fp308b Form. Users can also track document status, ensuring timely completion.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow with the Government Of The District Of Columbia Fill In Fp308b Form. You can connect it with CRM systems, cloud storage, and other productivity tools. This integration improves efficiency by allowing easy access to your documents.

-

What benefits do I gain from using airSlate SignNow for government forms?

Using airSlate SignNow for government forms like the Government Of The District Of Columbia Fill In Fp308b Form offers several benefits, including increased speed in document processing and reduced errors. The platform’s user-friendly interface allows for efficient completion and eSignature, ensuring you meet compliance requirements easily.

-

Is airSlate SignNow secure for filling out government forms?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for filling out the Government Of The District Of Columbia Fill In Fp308b Form. Our platform uses encrypted connections and follows strict data protection standards, ensuring that your sensitive information is protected.

Get more for Government Of The District Of Columbia Fill In Fp308b Form

Find out other Government Of The District Of Columbia Fill In Fp308b Form

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word