Form Ct3 Instructions 2020

What is the Form Ct3 Instructions

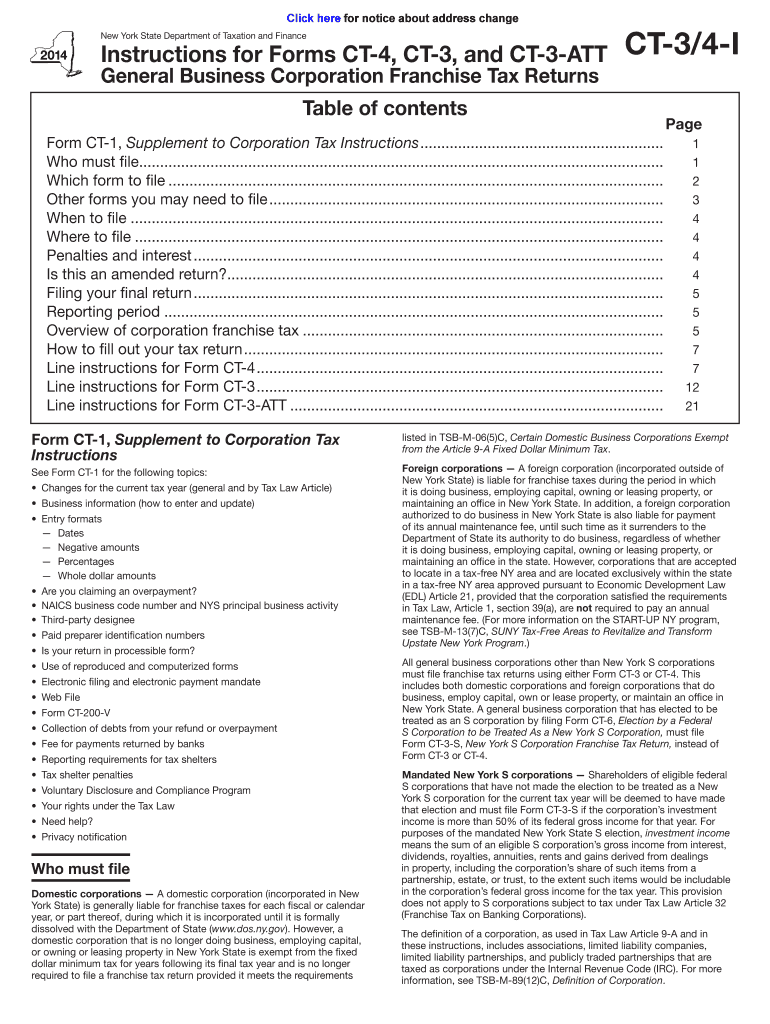

The Form Ct3 Instructions provide detailed guidance on how to complete the CT-3 form, which is used by corporations in New York State to report their income and calculate their tax liability. This form is essential for corporate tax compliance and includes specific requirements that must be met for accurate reporting. Understanding the instructions is crucial for ensuring that all necessary information is included and that the form is filed correctly.

Steps to complete the Form Ct3 Instructions

Completing the Form Ct3 requires a systematic approach. Here are the key steps to follow:

- Gather all necessary financial documents, including income statements and expense reports.

- Review the specific sections of the Form Ct3 that apply to your corporation.

- Fill out the form accurately, ensuring that all calculations are correct.

- Double-check the form for any missing information or errors before submission.

- Submit the completed form by the designated deadline to avoid penalties.

How to obtain the Form Ct3 Instructions

The Form Ct3 Instructions can be obtained through the New York State Department of Taxation and Finance website. They are available for download in PDF format, ensuring that you have access to the most current version. Additionally, physical copies may be requested from local tax offices if needed.

Legal use of the Form Ct3 Instructions

Using the Form Ct3 Instructions legally involves adhering to the guidelines set forth by the New York State Department of Taxation and Finance. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or audits. Proper use of the form supports compliance with state tax laws and helps maintain the integrity of corporate financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct3 are critical to avoid late fees and penalties. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the corporation's fiscal year. It is advisable to keep track of these dates and plan accordingly to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form Ct3 can be submitted through various methods, providing flexibility for corporations. Options include:

- Online submission through the New York State Department of Taxation and Finance portal.

- Mailing a physical copy of the form to the designated address.

- In-person submission at local tax offices, if preferred.

Key elements of the Form Ct3 Instructions

The Form Ct3 Instructions include several key elements that must be understood for successful completion. These elements cover:

- Identification of the corporation, including name and Employer Identification Number (EIN).

- Income reporting sections, detailing revenue sources.

- Deductions and credits available to the corporation.

- Calculation of total tax liability based on reported income.

Quick guide on how to complete form ct3 instructions 2014

Complete Form Ct3 Instructions effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form Ct3 Instructions on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form Ct3 Instructions with ease

- Obtain Form Ct3 Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or hide sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form Ct3 Instructions and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct3 instructions 2014

Create this form in 5 minutes!

How to create an eSignature for the form ct3 instructions 2014

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What are Form Ct3 Instructions and why are they important?

Form Ct3 Instructions provide detailed guidance on how to complete the New York City Corporate Tax Return, ensuring compliance with local tax regulations. Understanding these instructions is crucial for accurate filing and avoiding penalties.

-

How does airSlate SignNow help with Form Ct3 Instructions?

airSlate SignNow enables businesses to prepare and sign documents, including tax forms like the Form Ct3, electronically. This streamlines the process by allowing multiple stakeholders to review and sign documents efficiently, ensuring adherence to the Form Ct3 Instructions.

-

Are there any costs associated with using airSlate SignNow for Form Ct3 Instructions?

airSlate SignNow offers competitive pricing plans that cater to different business needs. While the details on cost can vary, investing in airSlate SignNow provides businesses with a cost-effective solution to manage their Form Ct3 Instructions and other document processes.

-

Can I store my completed Form Ct3 Instructions in airSlate SignNow?

Yes, airSlate SignNow allows you to securely store your completed documents, including Form Ct3 Instructions, in the cloud. This ensures easy access and retrieval when needed, enhancing your document management capabilities.

-

What features does airSlate SignNow provide for handling Form Ct3 Instructions?

airSlate SignNow offers features like electronic signatures, template creation, and document tracking, all designed to streamline the process of completing Form Ct3 Instructions. These features help businesses improve efficiency and maintain organized records.

-

Does airSlate SignNow integrate with other tools to assist with Form Ct3 Instructions?

Yes, airSlate SignNow integrates seamlessly with various business applications, enabling users to import data and manage Form Ct3 Instructions alongside their other financial tools. This integration simplifies workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for Form Ct3 Instructions?

Using airSlate SignNow for Form Ct3 Instructions offers benefits such as improved accuracy, reduced processing time, and enhanced collaboration among team members. These advantages lead to a smoother filing experience and decreased risk of errors.

Get more for Form Ct3 Instructions

Find out other Form Ct3 Instructions

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT