New York State Sales Tax Form St 100 Dec 12 Feb 13 2020

What is the New York State Sales Tax Form ST-100 Dec 12 Feb 13

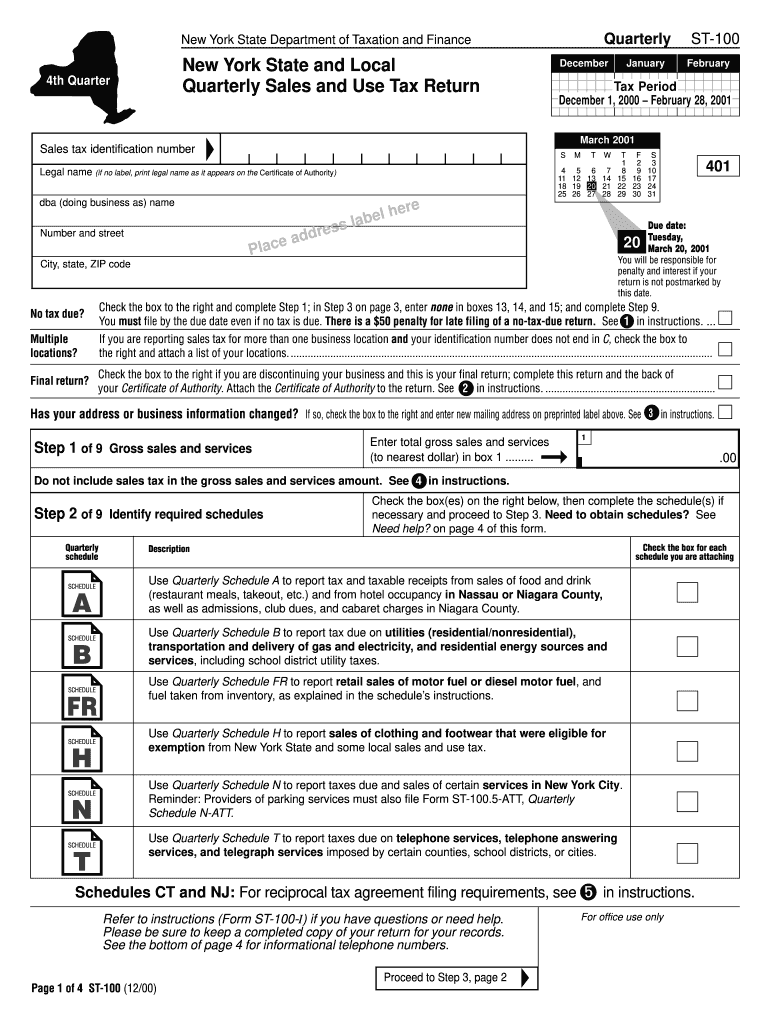

The New York State Sales Tax Form ST-100 Dec 12 Feb 13 is an essential document used by businesses to report and pay sales tax in New York. This form is specifically designed for registered sales tax vendors who need to submit their sales tax returns to the New York State Department of Taxation and Finance. It captures critical information about the vendor's sales, tax collected, and any applicable exemptions. Understanding the purpose and requirements of this form is vital for compliance with state tax laws.

How to use the New York State Sales Tax Form ST-100 Dec 12 Feb 13

Using the New York State Sales Tax Form ST-100 Dec 12 Feb 13 involves several steps. First, ensure you have registered as a sales tax vendor with the state. Next, gather all necessary sales records for the reporting period, including total sales, taxable sales, and any exempt sales. Complete the form by accurately entering this data in the designated sections. Once filled out, the form must be submitted to the New York State Department of Taxation and Finance by the specified deadline to avoid penalties.

Steps to complete the New York State Sales Tax Form ST-100 Dec 12 Feb 13

Completing the New York State Sales Tax Form ST-100 Dec 12 Feb 13 involves the following steps:

- Gather your sales records for the reporting period.

- Enter your total sales, taxable sales, and exempt sales in the appropriate fields.

- Calculate the total sales tax due based on the applicable rate.

- Include any payments made during the period to ensure accurate reporting.

- Review the form for accuracy and completeness before submission.

Key elements of the New York State Sales Tax Form ST-100 Dec 12 Feb 13

The key elements of the New York State Sales Tax Form ST-100 Dec 12 Feb 13 include:

- Vendor Information: This section captures the vendor's name, address, and identification number.

- Sales Data: Detailed reporting of total sales, taxable sales, and exempt sales.

- Tax Calculation: A calculation of the total sales tax due based on reported sales.

- Payment Information: Any payments made during the reporting period should be documented here.

- Signature: The form must be signed by an authorized representative of the business.

Legal use of the New York State Sales Tax Form ST-100 Dec 12 Feb 13

The legal use of the New York State Sales Tax Form ST-100 Dec 12 Feb 13 is governed by state tax laws. To ensure the form is legally binding, it must be completed accurately and submitted by the deadline. Electronic signatures are acceptable if they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant regulations. Maintaining records of the submitted form and any correspondence with the tax department is also crucial for legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the New York State Sales Tax Form ST-100 Dec 12 Feb 13 vary based on the reporting period. Typically, forms are due quarterly, with specific deadlines set by the New York State Department of Taxation and Finance. It is essential to stay informed about these dates to avoid late fees and penalties. Regularly checking the department's website or official communications can help ensure timely submissions.

Quick guide on how to complete new york state sales tax form st 100 dec 12 feb 13 2000

Effortlessly Prepare New York State Sales Tax Form St 100 Dec 12 Feb 13 on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage New York State Sales Tax Form St 100 Dec 12 Feb 13 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Edit and eSign New York State Sales Tax Form St 100 Dec 12 Feb 13 with Ease

- Locate New York State Sales Tax Form St 100 Dec 12 Feb 13 and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Mark important sections of the documents or obscure sensitive information with the tools available through airSlate SignNow specifically designed for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign New York State Sales Tax Form St 100 Dec 12 Feb 13 to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state sales tax form st 100 dec 12 feb 13 2000

Create this form in 5 minutes!

How to create an eSignature for the new york state sales tax form st 100 dec 12 feb 13 2000

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the New York State Sales Tax Form St 100 Dec 12 Feb 13?

The New York State Sales Tax Form St 100 Dec 12 Feb 13 is a tax form used by businesses to report and pay sales tax in New York State. It includes information about taxable sales and the tax due. Utilizing this form correctly is crucial for compliance with state tax regulations.

-

How can airSlate SignNow help with the New York State Sales Tax Form St 100 Dec 12 Feb 13?

airSlate SignNow streamlines the process of completing and eSigning the New York State Sales Tax Form St 100 Dec 12 Feb 13. Our platform simplifies document management, allowing users to easily fill out tax forms and obtain necessary signatures efficiently and securely.

-

Are there any costs associated with using airSlate SignNow for tax forms?

airSlate SignNow offers a variety of pricing plans to cater to different business needs. Whether you need to handle the New York State Sales Tax Form St 100 Dec 12 Feb 13 occasionally or regularly, our plans are cost-effective and provide great value. You can choose a plan that fits your workflow and budget.

-

Can I integrate airSlate SignNow with my accounting software for the New York State Sales Tax Form St 100 Dec 12 Feb 13?

Yes, airSlate SignNow offers integrations with various accounting software solutions, making it easier to manage data related to the New York State Sales Tax Form St 100 Dec 12 Feb 13. This seamless integration allows you to import and export data without manual entry, saving time and reducing the risk of errors.

-

What features does airSlate SignNow provide for completing the New York State Sales Tax Form St 100 Dec 12 Feb 13?

airSlate SignNow provides essential features such as customizable templates, electronic signatures, and document tracking to assist users with the New York State Sales Tax Form St 100 Dec 12 Feb 13. These tools enable efficient form completion and ensure that you always have the necessary documents finalized and secure.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely, airSlate SignNow prioritizes the security of your documents, including the New York State Sales Tax Form St 100 Dec 12 Feb 13. We use advanced encryption and industry-standard security measures to protect your data, ensuring that sensitive tax information remains confidential and secure.

-

Can I access my documents anywhere when using airSlate SignNow?

Yes, one of the signNow benefits of using airSlate SignNow is its cloud-based platform, allowing you to access your documents, including the New York State Sales Tax Form St 100 Dec 12 Feb 13, from any device with an internet connection. This flexibility enables you to manage your tax documents on-the-go.

Get more for New York State Sales Tax Form St 100 Dec 12 Feb 13

Find out other New York State Sales Tax Form St 100 Dec 12 Feb 13

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF