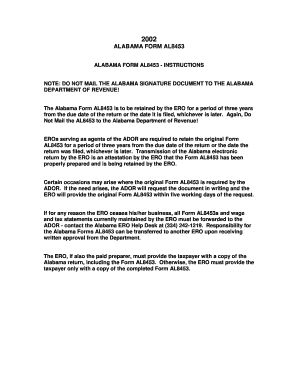

Al8453 Printable Form

What is the AL8453 Printable Form

The AL8453 form is a crucial document used in Alabama for tax purposes. It serves as a declaration of the taxpayer's identity and is often required when filing various tax returns. This form ensures that the information provided is accurate and that the taxpayer is compliant with state regulations. Understanding the purpose of the AL8453 is essential for anyone navigating the tax filing process in Alabama.

How to use the AL8453 Printable Form

Using the AL8453 form involves several steps to ensure proper completion and submission. First, download the printable version of the form from a reliable source. Next, fill in the required fields, including personal identification information and tax details. It is important to double-check all entries for accuracy. Once completed, the form can be submitted according to the specific instructions provided for your tax situation, whether online or via mail.

Steps to complete the AL8453 Printable Form

Completing the AL8453 form requires careful attention to detail. Follow these steps for successful completion:

- Download the latest version of the AL8453 form.

- Fill in your full name, address, and Social Security number.

- Provide any additional information requested, such as income details or tax credits.

- Review the form for any errors or omissions before signing.

- Submit the form according to the instructions for your specific tax return.

Legal use of the AL8453 Printable Form

The AL8453 form is legally binding when filled out correctly and submitted according to Alabama tax laws. It serves as a formal declaration to the state regarding your tax obligations. Compliance with the legal requirements surrounding this form is essential to avoid penalties or issues with your tax filings. Always ensure that the information provided is truthful and complete to uphold the legal integrity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the AL8453 form align with Alabama's tax return submission dates. Typically, individual income tax returns are due by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines to ensure timely submission and avoid potential penalties.

Who Issues the Form

The AL8453 form is issued by the Alabama Department of Revenue. This governmental body is responsible for managing tax collection and ensuring compliance with state tax laws. For any inquiries regarding the form or its requirements, taxpayers should refer to the official Alabama Department of Revenue website or contact their office directly for assistance.

Quick guide on how to complete al8453 printable form

Complete Al8453 Printable Form easily on any device

Online document management has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Al8453 Printable Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Al8453 Printable Form effortlessly

- Find Al8453 Printable Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing out new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign Al8453 Printable Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the al8453 printable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is al8453 in relation to airSlate SignNow?

Al8453 refers to a unique feature set within airSlate SignNow that enhances the document signing process. It includes various tools designed to streamline workflows and improve user experience. By leveraging al8453, businesses can signNowly reduce time spent on document management.

-

How does pricing work for the al8453 features on airSlate SignNow?

The pricing for airSlate SignNow, including the al8453 features, is competitive and varies based on the chosen plan. Each plan offers a range of functionalities to cater to different business needs. For a detailed breakdown of prices and features associated with al8453, you can visit our pricing page.

-

What benefits does al8453 offer for document eSigning?

Al8453 provides numerous benefits such as enhanced security, faster turnaround times, and an intuitive interface for users. This allows businesses to handle their document eSigning processes more efficiently. With al8453, users can also track document progress and manage signatures with ease.

-

Are there integrations available for al8453 within airSlate SignNow?

Yes, al8453 integrates seamlessly with various third-party applications including CRMs and project management tools. This integration enhances operational efficiency by allowing users to manage documents from multiple platforms. Users can customize al8453 to fit their organizational needs.

-

Can I use al8453 for multiple types of documents?

Absolutely! Al8453 is versatile and can be used for a wide range of document types including contracts, invoices, and agreements. This flexibility ensures that businesses can utilize airSlate SignNow for all their eSigning needs. The al8453 feature set is designed to accommodate different document formats.

-

Is al8453 suitable for small businesses?

Yes, al8453 is particularly suitable for small businesses looking for a cost-effective solution to manage their document signing processes. The user-friendly design of airSlate SignNow with the al8453 features makes it accessible even for those with limited technical expertise. Small businesses can greatly benefit from the streamlined workflows.

-

What security measures are included with al8453 in airSlate SignNow?

When using al8453, airSlate SignNow implements robust security measures such as encryption and secure authentication protocols. These measures ensure that all document transactions are safe and compliant with industry standards. Users can have peace of mind knowing that their sensitive information is well protected.

Get more for Al8453 Printable Form

- Apartment rules and regulations north carolina form

- Nc cancellation form

- Amendment of residential lease north carolina form

- Agreement payment form

- Commercial lease assignment from tenant to new tenant north carolina form

- Tenant consent to background and reference check north carolina form

- Residential lease or rental agreement for month to month north carolina form

- Residential rental lease agreement north carolina form

Find out other Al8453 Printable Form

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe