West Virginia Tax Exemption Form

What is the West Virginia Tax Exemption Form

The West Virginia Tax Exemption Form is a document used by individuals and businesses in West Virginia to claim exemptions from certain taxes. This form is essential for those who qualify for tax relief based on specific criteria established by state law. By completing this form, taxpayers can reduce their tax liabilities, ensuring compliance with state regulations while taking advantage of available exemptions.

How to obtain the West Virginia Tax Exemption Form

To obtain the West Virginia Tax Exemption Form, individuals can visit the West Virginia State Tax Department's official website. The form is typically available for download in a PDF format, allowing users to print and fill it out. Additionally, physical copies may be available at local tax offices or government buildings. Ensuring you have the correct version of the form is crucial, as updates may occur periodically.

Steps to complete the West Virginia Tax Exemption Form

Completing the West Virginia Tax Exemption Form involves several key steps:

- Download the form from the official website or obtain a physical copy.

- Read the instructions carefully to understand eligibility requirements and necessary documentation.

- Fill out the required sections, providing accurate personal and financial information.

- Attach any supporting documents that may be needed to substantiate your claim.

- Review the completed form for accuracy before submission.

Legal use of the West Virginia Tax Exemption Form

The legal use of the West Virginia Tax Exemption Form is governed by state tax laws. To ensure the form is legally binding, it must be filled out accurately and submitted within the designated timeframe. Compliance with all relevant regulations is essential to avoid penalties and ensure that the claimed exemptions are honored by the state. Electronic submissions of the form are also recognized as valid under current eSignature laws, provided they meet necessary security standards.

Key elements of the West Virginia Tax Exemption Form

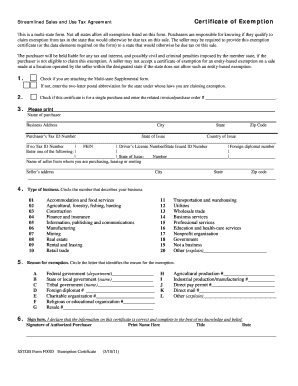

Key elements of the West Virginia Tax Exemption Form include:

- Taxpayer Information: Personal details such as name, address, and Social Security number or Employer Identification Number.

- Type of Exemption: Specific exemptions being claimed, such as property tax exemptions or sales tax exemptions.

- Signature: A signature certifying that the information provided is true and accurate.

- Date: The date of submission, which is crucial for compliance with filing deadlines.

Eligibility Criteria

Eligibility for the West Virginia Tax Exemption Form varies based on the type of exemption being claimed. Common criteria include:

- Residency status in West Virginia.

- Income thresholds that determine qualification for certain exemptions.

- Specific use of property or goods that qualifies for tax relief.

It is important for applicants to review the eligibility requirements carefully to ensure compliance and maximize their benefits.

Quick guide on how to complete west virginia tax exemption form

Effortlessly prepare West Virginia Tax Exemption Form on any device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without issues. Manage West Virginia Tax Exemption Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

Steps to modify and electronically sign West Virginia Tax Exemption Form easily

- Locate West Virginia Tax Exemption Form and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details thoroughly and click on the Done button to save your changes.

- Choose your preferred method to send your form, such as email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign West Virginia Tax Exemption Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the west virginia tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the West Virginia Tax Exemption Form?

The West Virginia Tax Exemption Form is a document that allows eligible individuals or businesses to claim tax exemptions in the state of West Virginia. Completing this form accurately ensures that you can benefit from various exemptions, ranging from property tax to sales tax. Utilizing tools like airSlate SignNow can help streamline the form submission process.

-

How do I fill out the West Virginia Tax Exemption Form?

To fill out the West Virginia Tax Exemption Form, start by gathering all necessary information, such as your identification details and the specific exemptions you are claiming. edl. airSlate SignNow provides templates and tools that can simplify this process, making it easy to complete and submit your form electronically.

-

Is there a fee to use airSlate SignNow for the West Virginia Tax Exemption Form?

airSlate SignNow offers a variety of pricing plans to cater to different needs, including a cost-effective option for businesses looking to handle documents like the West Virginia Tax Exemption Form. Fees vary based on the level of service and features you choose, but the platform is designed to be affordable and worth the investment when managing important tax documents.

-

What features does airSlate SignNow offer for managing the West Virginia Tax Exemption Form?

airSlate SignNow offers features like electronic signatures, document templates, and secure cloud storage, all making it easier to manage your West Virginia Tax Exemption Form. The platform also allows for collaboration, enabling multiple users to access and edit the form as needed. This streamlined process saves time and ensures accuracy.

-

Can I integrate airSlate SignNow with other software when filling out the West Virginia Tax Exemption Form?

Yes, airSlate SignNow offers integration capabilities with various software applications, enabling you to connect tools that you may already be using. This includes integration with customer relationship management (CRM) systems and cloud storage solutions, enhancing the overall efficiency of submitting your West Virginia Tax Exemption Form.

-

What are the benefits of using airSlate SignNow for the West Virginia Tax Exemption Form?

Using airSlate SignNow for the West Virginia Tax Exemption Form provides numerous benefits including ease of use, speed in processing documents, and the ability to access forms from anywhere. The secure eSignatures ensure that your submissions are legally binding, while the platform’s user-friendly interface simplifies the entire process.

-

How secure is airSlate SignNow for submitting my West Virginia Tax Exemption Form?

airSlate SignNow employs robust security measures, including encryption and secure authentication protocols, to protect your documents, including the West Virginia Tax Exemption Form. This commitment to security ensures that your sensitive information is safeguarded throughout the submission process. Trust in a platform that values your privacy and data integrity.

Get more for West Virginia Tax Exemption Form

Find out other West Virginia Tax Exemption Form

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy