PT 401 I South Carolina Department of Revenue SC Gov 2018

What is the PT 401 I South Carolina Department Of Revenue SC gov

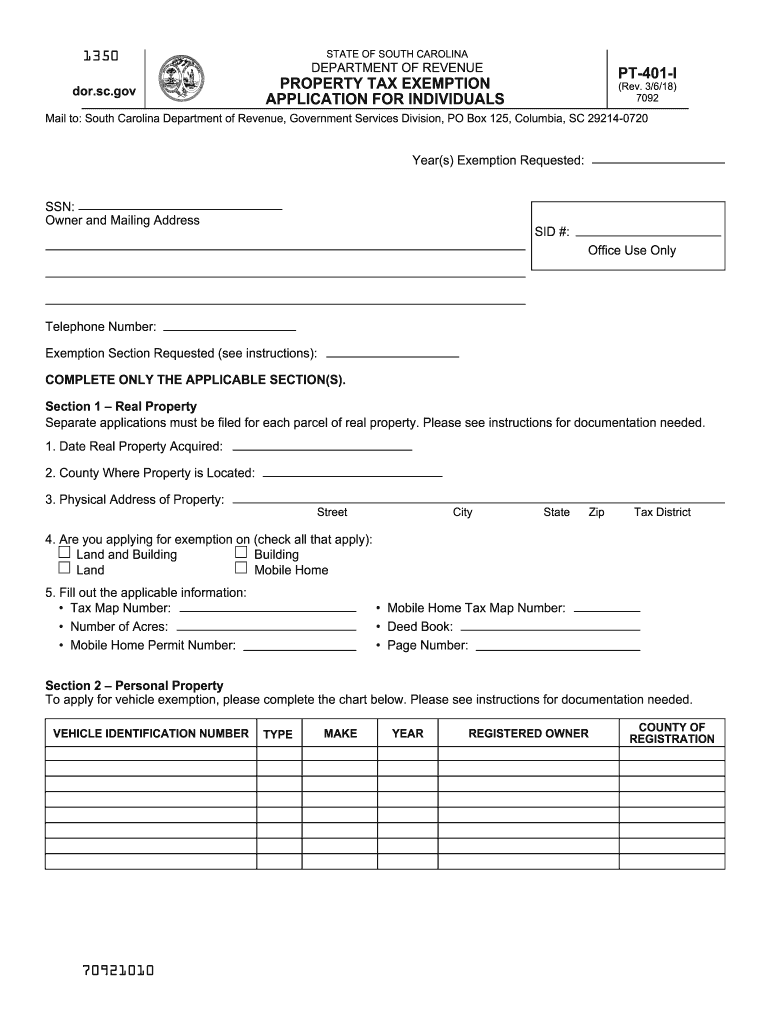

The PT 401 I form, issued by the South Carolina Department of Revenue, is a tax document primarily used for reporting property taxes. This form is essential for individuals and businesses in South Carolina to accurately declare their property holdings and ensure compliance with state tax regulations. Proper completion of the PT 401 I is crucial for determining the correct property tax liability, which supports local government services and infrastructure.

How to use the PT 401 I South Carolina Department Of Revenue SC gov

Using the PT 401 I form involves several key steps. First, gather all necessary information regarding your property, including its location, value, and any exemptions you may qualify for. Next, download the form from the South Carolina Department of Revenue's official website or complete it online using a secure eSignature platform. After filling out the form with accurate information, review it carefully to ensure all details are correct. Finally, submit the completed form according to the instructions provided, either electronically or via mail.

Steps to complete the PT 401 I South Carolina Department Of Revenue SC gov

Completing the PT 401 I form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant property documentation, including deeds and tax assessments.

- Access the PT 401 I form through the South Carolina Department of Revenue website.

- Fill out the form, providing details about the property, such as its address and assessed value.

- Indicate any applicable exemptions, such as those for veterans or seniors.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, ensuring it is sent to the correct address.

Legal use of the PT 401 I South Carolina Department Of Revenue SC gov

The PT 401 I form is legally binding when completed and submitted according to South Carolina tax laws. It is essential that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal repercussions. The form must be filed by the designated deadline to avoid late fees. Utilizing an eSignature platform can enhance the legal validity of the form, ensuring compliance with electronic filing regulations.

Filing Deadlines / Important Dates

Filing deadlines for the PT 401 I form are crucial for compliance. Typically, property tax returns must be filed by a specific date each year, often falling in early January. It is important to check the South Carolina Department of Revenue’s website for the exact deadline, as it may vary annually. Failing to meet this deadline can result in penalties, so timely submission is essential.

Form Submission Methods (Online / Mail / In-Person)

The PT 401 I form can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online via the South Carolina Department of Revenue’s e-filing system, which offers a quick and secure way to submit the form. Alternatively, the form can be printed and mailed to the appropriate department address. In some cases, in-person submissions may also be accepted at local tax offices, providing flexibility for those who prefer direct interaction.

Quick guide on how to complete pt 401 i south carolina department of revenue scgov

Your assistance manual on how to prepare your PT 401 I South Carolina Department Of Revenue SC gov

If you’re curious about how to generate and transmit your PT 401 I South Carolina Department Of Revenue SC gov, here are a few concise instructions on simplifying the tax declaration process.

To begin, you simply need to set up your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is a highly intuitive and powerful document solution enabling you to alter, create, and finalize your income tax files with ease. With its editor, you can toggle between text, check boxes, and electronic signatures, allowing you to revisit and modify answers as necessary. Optimize your tax handling with advanced PDF editing, electronic signing, and seamless sharing.

Complete the following steps to finalize your PT 401 I South Carolina Department Of Revenue SC gov in no time:

- Register your account and start working on PDFs within minutes.

- Browse our directory to find any IRS tax form; explore various versions and schedules.

- Select Get form to access your PT 401 I South Carolina Department Of Revenue SC gov in our editor.

- Input the necessary information in the fillable fields (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding electronic signature (if necessary).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to the recipient, and download it to your device.

Utilize this manual to electronically submit your taxes with airSlate SignNow. Keep in mind that filing on paper may increase the chances of return errors and delay refunds. Moreover, before submitting your taxes electronically, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct pt 401 i south carolina department of revenue scgov

Create this form in 5 minutes!

How to create an eSignature for the pt 401 i south carolina department of revenue scgov

How to generate an eSignature for the Pt 401 I South Carolina Department Of Revenue Scgov in the online mode

How to create an electronic signature for the Pt 401 I South Carolina Department Of Revenue Scgov in Google Chrome

How to generate an eSignature for putting it on the Pt 401 I South Carolina Department Of Revenue Scgov in Gmail

How to make an electronic signature for the Pt 401 I South Carolina Department Of Revenue Scgov from your smart phone

How to create an electronic signature for the Pt 401 I South Carolina Department Of Revenue Scgov on iOS devices

How to create an eSignature for the Pt 401 I South Carolina Department Of Revenue Scgov on Android devices

People also ask

-

What is the PT 401 I South Carolina Department Of Revenue SC gov form?

The PT 401 I South Carolina Department Of Revenue SC gov form is used to report property taxes for businesses in South Carolina. This form is essential for ensuring compliance with state regulations and helps businesses accurately declare their property values.

-

How can airSlate SignNow help me with the PT 401 I South Carolina Department Of Revenue SC gov form?

airSlate SignNow allows businesses to easily send and eSign the PT 401 I South Carolina Department Of Revenue SC gov form. With its user-friendly interface, you can streamline your form submissions and ensure that all signatures are collected efficiently.

-

Is there a cost associated with using airSlate SignNow for the PT 401 I South Carolina Department Of Revenue SC gov form?

Yes, while airSlate SignNow offers various pricing plans, using their platform for the PT 401 I South Carolina Department Of Revenue SC gov form is cost-effective. You can choose a plan that fits your business needs and budget, making it an affordable solution for document signing.

-

What features does airSlate SignNow offer for the PT 401 I South Carolina Department Of Revenue SC gov form?

AirSlate SignNow provides features like eSignatures, document templates, and audit trails, making it ideal for managing the PT 401 I South Carolina Department Of Revenue SC gov form. These tools enhance the security and efficiency of your document processes.

-

Can I integrate airSlate SignNow with other applications for processing the PT 401 I South Carolina Department Of Revenue SC gov?

Yes, airSlate SignNow can be integrated with various applications such as CRM systems and cloud storage services, facilitating seamless processing of the PT 401 I South Carolina Department Of Revenue SC gov form. This integration ensures better workflow and data management.

-

What are the benefits of using airSlate SignNow for the PT 401 I South Carolina Department Of Revenue SC gov form?

The benefits of using airSlate SignNow include faster turnaround times, improved accuracy in document completion, and enhanced compliance with state requirements like the PT 401 I South Carolina Department Of Revenue SC gov form. This helps businesses save time and reduces the risk of errors.

-

How secure is airSlate SignNow when handling the PT 401 I South Carolina Department Of Revenue SC gov form?

AirSlate SignNow prioritizes security, using advanced encryption methods to protect documents, including the PT 401 I South Carolina Department Of Revenue SC gov form. This ensures that your sensitive information remains confidential and secure.

Get more for PT 401 I South Carolina Department Of Revenue SC gov

Find out other PT 401 I South Carolina Department Of Revenue SC gov

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple