Form 5884 D

What is the Form 5884 D

The Form 5884 D is a tax form used by businesses to claim the Employee Retention Credit (ERC). This credit was established to encourage employers to retain their employees during the economic downturn caused by the COVID-19 pandemic. The form allows eligible businesses to report their qualified wages and the number of employees retained, which can result in significant tax savings. Understanding the purpose and details of this form is essential for businesses looking to maximize their benefits under the ERC program.

How to use the Form 5884 D

Using the Form 5884 D involves several steps to ensure accurate completion and submission. First, businesses must determine their eligibility based on the criteria set by the IRS. Once eligibility is confirmed, businesses can fill out the form by providing necessary information such as the number of employees, qualified wages paid, and any applicable credits claimed. It is important to follow the IRS guidelines carefully to avoid errors that could delay processing or lead to penalties.

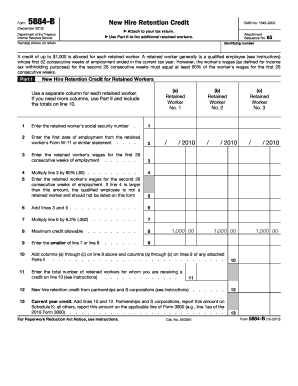

Steps to complete the Form 5884 D

Completing the Form 5884 D requires careful attention to detail. Here are the key steps:

- Gather necessary documentation, including payroll records and tax identification numbers.

- Determine the eligibility period for the Employee Retention Credit.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any mistakes or omissions before submission.

- Submit the form to the appropriate IRS address, either electronically or by mail, based on your filing preference.

Legal use of the Form 5884 D

The legal use of the Form 5884 D is governed by IRS regulations. To ensure compliance, businesses must adhere to the eligibility requirements and accurately report their qualified wages. The form must be signed and dated by an authorized representative of the business. Failure to comply with IRS guidelines can result in penalties or disqualification from receiving the credit. It is advisable to consult with a tax professional to navigate the legal aspects of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5884 D are crucial for businesses seeking to claim the Employee Retention Credit. The form must be submitted by the due date of the employer’s payroll tax return for the quarter in which the qualified wages were paid. For example, if wages were paid in the second quarter, the form should be filed by the deadline for that quarter's payroll tax return. Keeping track of these deadlines helps ensure timely processing and maximizes potential credits.

Eligibility Criteria

Eligibility for the Form 5884 D is based on specific criteria set forth by the IRS. Businesses must demonstrate a decline in gross receipts or meet certain operational restrictions due to governmental orders related to COVID-19. Additionally, the number of employees and the amount of qualified wages paid during the eligibility period are key factors. It is essential for businesses to review these criteria thoroughly to determine their qualification for the Employee Retention Credit.

Quick guide on how to complete form 5884 d

Make Form 5884 D effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 5884 D on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and electronically sign Form 5884 D with ease

- Obtain Form 5884 D and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a standard handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 5884 D and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5884 d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5884 d and how can airSlate SignNow help?

Form 5884 D is a tax credit form used to claim the Employee Retention Credit. airSlate SignNow simplifies the process by allowing you to prepare and eSign this important document quickly, ensuring compliance and accuracy while maximizing your tax benefits.

-

How much does airSlate SignNow cost for using form 5884 d?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Our plans are affordable, making it easy to eSign documents like form 5884 D without breaking your budget. Check our website for current pricing options.

-

What features does airSlate SignNow provide for managing form 5884 d?

With airSlate SignNow, you can create, send, and eSign form 5884 D directly from your device. Our platform offers templates, customizable workflows, and real-time tracking, making the management of your documents efficient and secure.

-

Can I integrate airSlate SignNow with other software for form 5884 d?

Yes, airSlate SignNow seamlessly integrates with popular business applications such as Salesforce, Google Workspace, and Microsoft Office. This makes it easy to incorporate eSigning capabilities for document management, including form 5884 D, into your existing workflow.

-

What are the benefits of using airSlate SignNow for form 5884 d?

Using airSlate SignNow for form 5884 D allows for faster processing times and enhanced security for your documents. Additionally, our platform provides a user-friendly experience, making it accessible for all team members, saving you both time and resources.

-

Is airSlate SignNow legally compliant for signing documents like form 5884 d?

Absolutely! airSlate SignNow meets all legal requirements for electronically signing documents, including form 5884 D. Our solution complies with the ESIGN Act and UETA, ensuring your eSigned documents are legally binding and enforceable.

-

How can I get started with airSlate SignNow for form 5884 d?

Getting started is easy! Simply visit our website and sign up for an account. Once you’re onboarded, you can begin creating and eSigning form 5884 D right away with our intuitive interface and helpful resources.

Get more for Form 5884 D

Find out other Form 5884 D

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile