Form 3k 1 2018

What is the Form 3K-1?

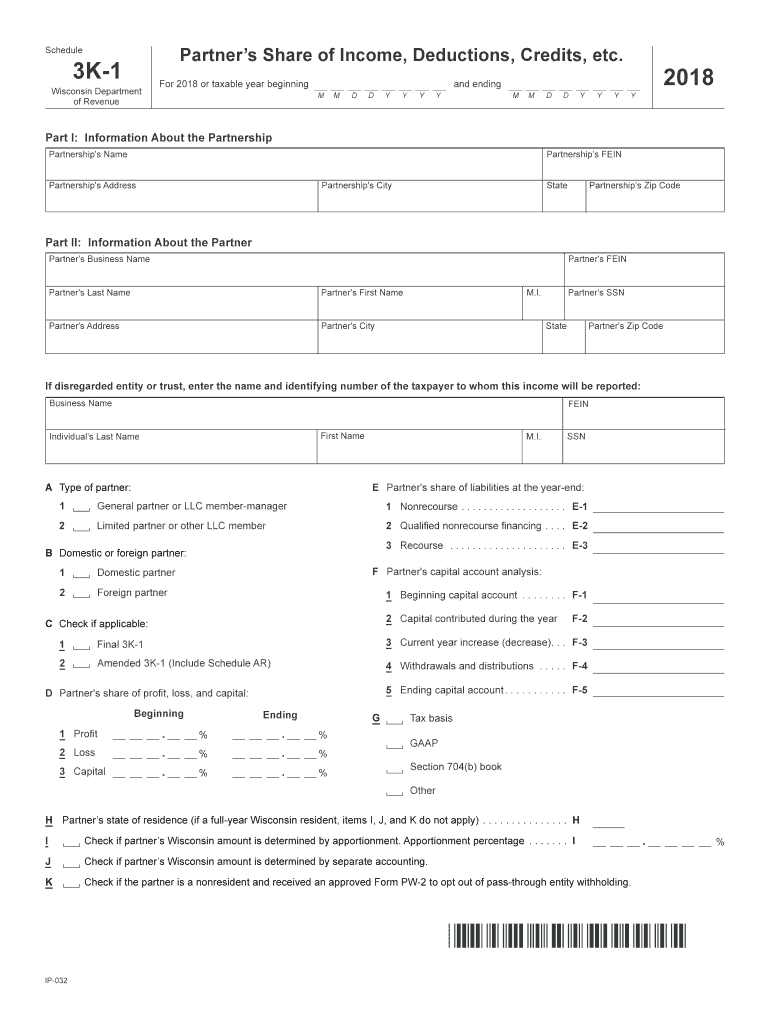

The Form 3K-1 is a Wisconsin tax document used primarily for reporting income from partnerships, S corporations, and limited liability companies (LLCs). This form is essential for individuals who receive income from these entities, as it provides detailed information about their share of the entity's income, deductions, and credits. Each partner or shareholder receives a copy of the Form 3K-1, which they must then report on their personal income tax returns. Understanding this form is crucial for accurate tax reporting and compliance with state regulations.

Steps to Complete the Form 3K-1

Completing the Form 3K-1 involves several key steps to ensure accuracy and compliance:

- Gather Information: Collect all necessary financial documents related to the partnership or S corporation, including income statements and prior year tax returns.

- Fill Out Entity Information: Enter the name, address, and federal identification number of the partnership or S corporation at the top of the form.

- Report Income and Deductions: Input your share of income, deductions, and credits as provided by the entity. This information is typically included in the annual K-1 statement you receive.

- Review and Verify: Double-check all entries for accuracy, ensuring that all figures match your records and the entity's statements.

- Submit the Form: Once completed, include the Form 3K-1 with your personal income tax return when filing.

Legal Use of the Form 3K-1

The Form 3K-1 is legally recognized by the Wisconsin Department of Revenue as a valid means of reporting income from pass-through entities. It is essential for taxpayers to use this form accurately to avoid penalties and ensure compliance with state tax laws. The information reported on the Form 3K-1 must align with the entity's tax filings, and discrepancies can lead to audits or additional taxes owed. Therefore, understanding the legal implications of this form is crucial for all taxpayers involved.

Filing Deadlines / Important Dates

Timely filing of the Form 3K-1 is critical to avoid penalties. The deadlines for submitting this form typically align with the due dates for the entity's tax returns:

- Partnerships and LLCs: Generally due on the 15th day of the third month following the end of the tax year.

- S Corporations: Also due on the 15th day of the third month following the end of the tax year.

- Individual Tax Returns: Taxpayers must report the information from the Form 3K-1 on their personal returns by April 15th of the following year.

Who Issues the Form 3K-1?

The Form 3K-1 is issued by partnerships, S corporations, and LLCs operating in Wisconsin. Each entity is responsible for preparing and distributing the form to its partners or shareholders. The entity must ensure that the information provided is accurate and complete, as this directly affects the individual taxpayer's filings. It is important for recipients to keep these forms for their records and to use them when preparing their personal tax returns.

Examples of Using the Form 3K-1

Understanding how to use the Form 3K-1 can be illustrated through various taxpayer scenarios:

- Partnership Income: A partner in a Wisconsin partnership receives a Form 3K-1 detailing their share of profits, which they must report on their personal tax return.

- S Corporation Distributions: Shareholders of an S corporation receive a Form 3K-1 that outlines their share of the corporation's income and credits, impacting their overall tax liability.

- LLC Member Reporting: An LLC member uses the information from their Form 3K-1 to report income on their tax return, ensuring compliance with state tax regulations.

Quick guide on how to complete wisconsin 3k 1 2018 2019 form

Your instructional manual on how to prepare your Form 3k 1

If you’re curious about how to generate and submit your Form 3k 1, here are some straightforward instructions on how to simplify tax submission.

To begin, all you need is to set up your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that allows you to edit, create, and complete your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and return to modify details as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Form 3k 1 in moments:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to open your Form 3k 1 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized electronic signature (if required).

- Review your document and rectify any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this guide to electronically file your taxes with airSlate SignNow. Please be aware that submitting on paper can increase filing mistakes and delay reimbursements. Before e-filing your taxes, check the IRS website for filing guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin 3k 1 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the wisconsin 3k 1 2018 2019 form

How to generate an eSignature for your Wisconsin 3k 1 2018 2019 Form online

How to create an eSignature for the Wisconsin 3k 1 2018 2019 Form in Chrome

How to make an electronic signature for signing the Wisconsin 3k 1 2018 2019 Form in Gmail

How to generate an eSignature for the Wisconsin 3k 1 2018 2019 Form from your smart phone

How to generate an electronic signature for the Wisconsin 3k 1 2018 2019 Form on iOS devices

How to make an eSignature for the Wisconsin 3k 1 2018 2019 Form on Android

People also ask

-

What is the purpose of the schedule 3k 1 wisconsin 2017 form?

The schedule 3k 1 wisconsin 2017 form is used for reporting income, deductions, and credits from partnerships, S corporations, and multi-member LLCs in Wisconsin. Completing this form ensures compliance with state tax regulations and helps you accurately report your income.

-

How can airSlate SignNow help with the schedule 3k 1 wisconsin 2017 form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents like the schedule 3k 1 wisconsin 2017 form. Our solution simplifies the entire process, making it convenient to gather signatures and store important tax documents.

-

What are the key features of airSlate SignNow for managing tax forms like schedule 3k 1 wisconsin 2017?

airSlate SignNow offers features such as templates for tax forms, real-time tracking of document status, and secure cloud storage. These features ensure that your schedule 3k 1 wisconsin 2017 forms are managed efficiently and securely.

-

Is airSlate SignNow a cost-effective solution for handling schedule 3k 1 wisconsin 2017 documents?

Yes, airSlate SignNow is designed to provide a cost-effective solution for businesses of all sizes. Our pricing plans are tailored to fit various budgets, making it affordable to manage your schedule 3k 1 wisconsin 2017 and other important tax documents.

-

Can I integrate airSlate SignNow with other software for my schedule 3k 1 wisconsin 2017 needs?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tools such as CRMs and accounting software, enhancing your workflow for managing schedule 3k 1 wisconsin 2017 forms. This versatility allows you to streamline document processes across your tech stack.

-

Are there any benefits to using airSlate SignNow for my business's schedule 3k 1 wisconsin 2017 submissions?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper waste, and improved document security for your schedule 3k 1 wisconsin 2017 submissions. Our platform helps you save time and resources while ensuring compliance with state regulations.

-

How does the signing process work for the schedule 3k 1 wisconsin 2017 with airSlate SignNow?

The signing process with airSlate SignNow for your schedule 3k 1 wisconsin 2017 is quick and straightforward. Simply upload your document, add signers, and send it out for eSignature; you can track its progress in real-time.

Get more for Form 3k 1

Find out other Form 3k 1

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement