Wi Schedule 3k 1 Form 2013

What is the Wi Schedule 3k 1 Form

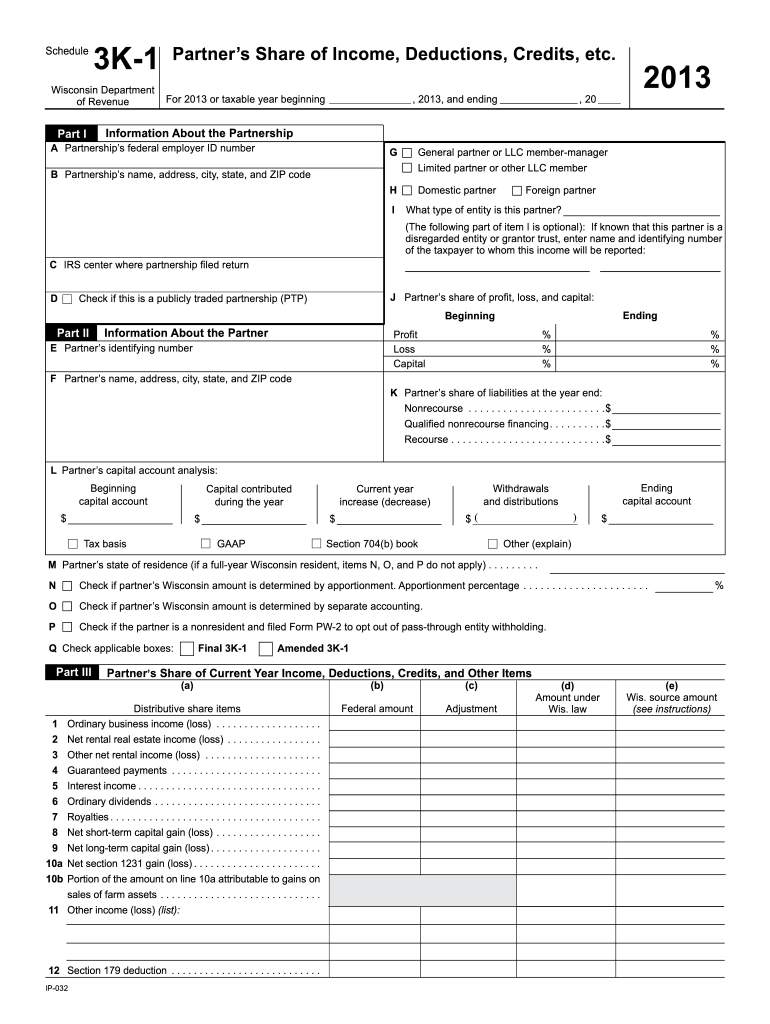

The Wi Schedule 3k 1 Form is a tax document used in the state of Wisconsin, primarily for reporting income, deductions, and credits from partnerships and certain pass-through entities. This form is essential for individuals who receive income from these entities, as it helps to ensure accurate reporting of income on their personal tax returns. The form provides detailed information about the taxpayer's share of income, losses, and other tax-related items that need to be reported to the IRS.

How to use the Wi Schedule 3k 1 Form

Using the Wi Schedule 3k 1 Form involves several steps. First, taxpayers should obtain the form from the Wisconsin Department of Revenue or through authorized tax software. Once the form is in hand, individuals need to fill it out with accurate information regarding their income from partnerships or pass-through entities. After completing the form, it should be attached to the taxpayer's personal income tax return, ensuring all relevant income is reported correctly. It is important to review the form for accuracy before submission to avoid any potential issues with the IRS.

Steps to complete the Wi Schedule 3k 1 Form

Completing the Wi Schedule 3k 1 Form requires attention to detail. Here are the steps to follow:

- Gather necessary documents, including K-1 forms from partnerships or S corporations.

- Enter your personal information, including name, address, and Social Security number.

- Report your share of income, deductions, and credits as indicated on your K-1 forms.

- Double-check all entries for accuracy and completeness.

- Sign and date the form once all information is verified.

- Attach the completed form to your Wisconsin income tax return.

Legal use of the Wi Schedule 3k 1 Form

The legal use of the Wi Schedule 3k 1 Form is crucial for compliance with state tax laws. This form must be accurately completed and submitted to report income from partnerships and pass-through entities. Failure to use this form correctly can result in penalties or audits from the Wisconsin Department of Revenue. It is important for taxpayers to understand the legal implications of their submissions and ensure that all information is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Wi Schedule 3k 1 Form typically align with the annual income tax return deadlines. Taxpayers should be aware of the following important dates:

- April 15: Deadline for filing individual income tax returns, including the Wi Schedule 3k 1 Form.

- Extensions: Taxpayers may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods

The Wi Schedule 3k 1 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Many tax software programs allow for electronic filing, which is often faster and more secure.

- Mail: Taxpayers can print the completed form and send it via postal service to the Wisconsin Department of Revenue.

- In-Person: Forms can also be submitted in person at designated state tax offices.

Quick guide on how to complete wi schedule 3k 1 2013 form

Your assistance manual on how to prepare your Wi Schedule 3k 1 Form

If you’re interested in discovering how to generate and transmit your Wi Schedule 3k 1 Form, here are some succinct guidelines on how to make tax submission signNowly easier.

To start, all you need to do is register for your airSlate SignNow account to revolutionize your approach to handling documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, create, and complete your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend responses when necessary. Optimize your tax administration with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to accomplish your Wi Schedule 3k 1 Form in just a few minutes:

- Register your account and begin working on PDFs in a matter of minutes.

- Utilize our catalog to locate any IRS tax form; sift through versions and schedules.

- Click Get form to launch your Wi Schedule 3k 1 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if required).

- Review your file and rectify any mistakes.

- Save modifications, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to errors in returns and postpone refunds. Certainly, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct wi schedule 3k 1 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I e fill Income tax ITR-1 form in excel and generate xml in excel 2013?

First download the excel file.Then after all the relevant information is filled click on validate.After you click on validate XML file will be generated which is required to be uploaded.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I relist my previous company that is unlisted from MCA for not filling out the e-return form 2013-14?

First of all you have to prepare all financials and get it audited from an Auditor (CA), and then approach National company law tribunal (NCLT) with petition for restoration of your company.It is pertinent to note that NCLT observe may things before making the company active, one of them is that whether company was making some operation during these periods or not, i.e you have to proof with supporting documents like VAT return/Service tax return/Income tax return that company was in operation.Company Registration

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the wi schedule 3k 1 2013 form

How to create an eSignature for your Wi Schedule 3k 1 2013 Form in the online mode

How to generate an eSignature for your Wi Schedule 3k 1 2013 Form in Google Chrome

How to make an eSignature for signing the Wi Schedule 3k 1 2013 Form in Gmail

How to make an eSignature for the Wi Schedule 3k 1 2013 Form straight from your mobile device

How to generate an eSignature for the Wi Schedule 3k 1 2013 Form on iOS

How to generate an electronic signature for the Wi Schedule 3k 1 2013 Form on Android devices

People also ask

-

What is the Wi Schedule 3k 1 Form used for?

The Wi Schedule 3k 1 Form is specifically designed for reporting income from partnerships and S corporations in Wisconsin. It helps individuals accurately report their share of income, deductions, and credits, ensuring compliance with state tax regulations.

-

How can airSlate SignNow assist with the Wi Schedule 3k 1 Form?

airSlate SignNow provides a streamlined solution for creating, sending, and eSigning the Wi Schedule 3k 1 Form. With our easy-to-use platform, you can quickly gather signatures and manage document workflows efficiently, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the Wi Schedule 3k 1 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our pricing is competitive and includes features that simplify the signing process for documents like the Wi Schedule 3k 1 Form, ensuring you get excellent value for your investment.

-

What features does airSlate SignNow offer for the Wi Schedule 3k 1 Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, making it ideal for handling the Wi Schedule 3k 1 Form. These features enhance efficiency and ensure that your documents are managed correctly throughout the signing process.

-

Can I integrate airSlate SignNow with other software for the Wi Schedule 3k 1 Form?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and more. This allows for seamless management of the Wi Schedule 3k 1 Form alongside your other business tools, streamlining your workflow.

-

How secure is the signing process for the Wi Schedule 3k 1 Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. We use industry-leading encryption and authentication protocols to ensure that your Wi Schedule 3k 1 Form and other sensitive documents are protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for the Wi Schedule 3k 1 Form?

Using airSlate SignNow for the Wi Schedule 3k 1 Form offers numerous benefits, including faster turnaround times, improved accuracy, and reduced paperwork. Our platform simplifies the process of getting documents signed, allowing you to focus on your core business operations.

Get more for Wi Schedule 3k 1 Form

- Designation of authorized representative form nj medicaid

- Judiciary benefits center form

- Mccm student vaccination form mc0945 117 mccm student vaccination form student vaccination attestation authorization clinic

- Lic 9150 spanish 393069628 form

- 5 3 practice inequalities in one triangle form

- Mcps form srs 6 montgomery county public schools montgomeryschoolsmd

- Dcm6 domestic installation certificates form

- Service tenancy agreement template form

Find out other Wi Schedule 3k 1 Form

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document