3k 1 Form 2015

What is the 3k 1 Form

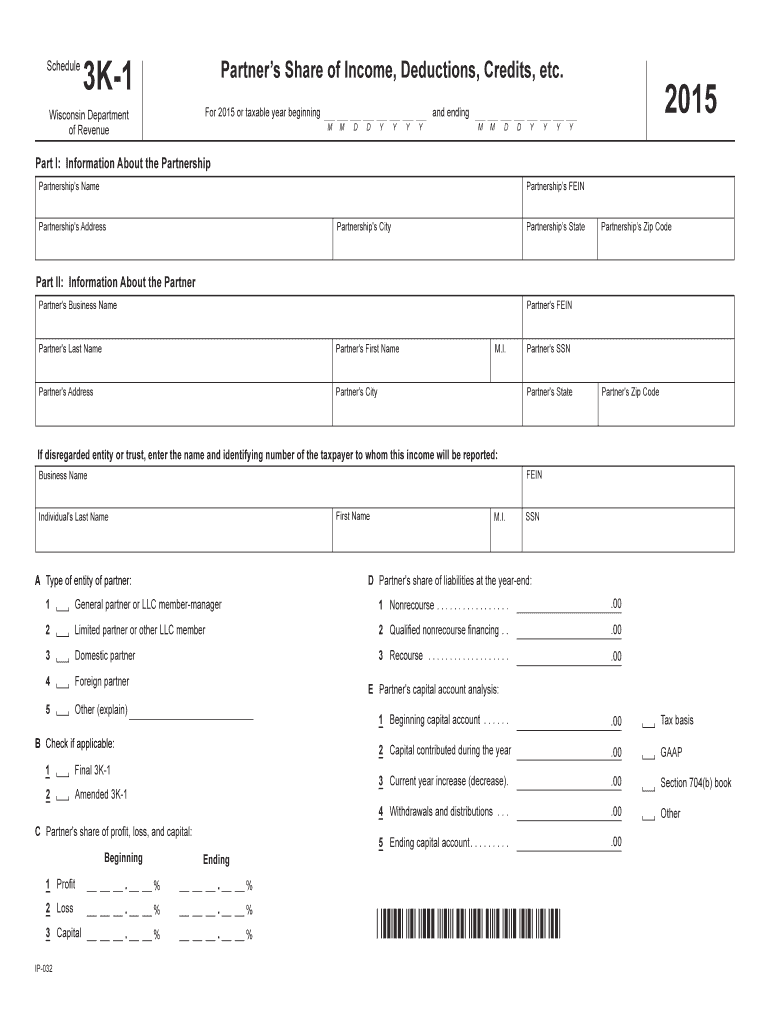

The 3k 1 Form is a tax document used primarily for reporting income, deductions, and credits associated with partnerships and S corporations. This form plays a crucial role in ensuring that all partners or shareholders receive accurate information regarding their share of the entity's income, losses, and other tax-related items. It is essential for both the entity filing the form and the individual partners or shareholders who rely on it for their personal tax filings.

How to use the 3k 1 Form

Using the 3k 1 Form involves several steps to ensure accurate reporting. First, the partnership or S corporation must gather all necessary financial information, including income, expenses, and deductions. Next, this information is entered into the form, detailing each partner's or shareholder's share of the income and deductions. After completing the form, it must be distributed to each partner or shareholder for their records and tax filings. It is important to ensure that the information is accurate and complies with IRS guidelines to avoid potential penalties.

Steps to complete the 3k 1 Form

Completing the 3k 1 Form requires careful attention to detail. Follow these steps:

- Gather financial records, including income statements and expense reports.

- Determine each partner’s or shareholder’s share of the income, deductions, and credits.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Distribute copies to all partners or shareholders for their tax records.

IRS Guidelines

The Internal Revenue Service provides specific guidelines for the completion and submission of the 3k 1 Form. These guidelines include instructions on how to report various types of income and deductions, as well as deadlines for filing. It is essential to adhere to these guidelines to ensure compliance and avoid penalties. The IRS also updates these guidelines periodically, so staying informed about any changes is crucial for accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the 3k 1 Form are critical for compliance with IRS regulations. Typically, the form must be filed by the fifteenth day of the third month following the end of the tax year. For partnerships and S corporations operating on a calendar year, this means the form is due by March fifteenth. It is important to mark this date on your calendar and ensure that all necessary information is compiled and submitted on time to avoid late filing penalties.

Required Documents

When completing the 3k 1 Form, several documents are necessary to ensure accurate reporting. These include:

- Financial statements of the partnership or S corporation.

- Records of income earned and expenses incurred during the tax year.

- Any relevant tax documents that affect the partners’ or shareholders’ tax situations.

Having these documents ready will streamline the completion process and help ensure accuracy.

Quick guide on how to complete 3k 1 2015 form

Your assistance manual on how to prepare your 3k 1 Form

If you’re curious about how to finalize and submit your 3k 1 Form, here are a few concise guidelines to simplify the tax declaration process.

To get started, simply register for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely easy-to-use and robust document solution that enables you to modify, draft, and complete your income tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, returning to modify details whenever necessary. Optimize your tax management with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the steps below to achieve your 3k 1 Form in just a few minutes:

- Create your account and begin working on PDFs within minutes.

- Utilize our catalog to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to open your 3k 1 Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to incorporate your legally-recognized eSignature (if required).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to digitally file your taxes using airSlate SignNow. Keep in mind that paper filing can lead to return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 3k 1 2015 form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the 3k 1 2015 form

How to make an electronic signature for your 3k 1 2015 Form in the online mode

How to create an electronic signature for the 3k 1 2015 Form in Chrome

How to generate an eSignature for signing the 3k 1 2015 Form in Gmail

How to generate an electronic signature for the 3k 1 2015 Form straight from your smart phone

How to create an eSignature for the 3k 1 2015 Form on iOS

How to make an eSignature for the 3k 1 2015 Form on Android devices

People also ask

-

What is the 3k 1 Form in airSlate SignNow?

The 3k 1 Form in airSlate SignNow is a powerful tool designed to streamline document signing and management for businesses. It allows users to send, receive, and eSign important documents quickly and securely, enhancing workflow efficiency. With this feature, you can ensure that your documents are handled with precision and professionalism.

-

How much does the 3k 1 Form feature cost?

Pricing for the 3k 1 Form feature in airSlate SignNow is competitive and designed to fit various business needs. We offer several pricing plans, including a free trial, so you can explore the capabilities of the 3k 1 Form without any commitment. For detailed pricing information, visit our website or contact our sales team.

-

What features are included with the 3k 1 Form?

The 3k 1 Form includes a range of features such as customizable templates, secure eSignature capabilities, and integration with various third-party applications. Additionally, you can track document status in real-time, which enhances accountability in your business processes. These features make the 3k 1 Form a comprehensive solution for document management.

-

How can the 3k 1 Form benefit my business?

Utilizing the 3k 1 Form can signNowly improve your business's efficiency by reducing the time spent on manual document handling. It simplifies the signing process, allowing you to focus on more critical tasks. Moreover, the 3k 1 Form ensures that all documents are legally binding and securely stored.

-

Can I integrate the 3k 1 Form with other software?

Yes, the 3k 1 Form can be easily integrated with various software solutions, including CRM systems, project management tools, and cloud storage services. This compatibility allows for seamless data transfer and enhances your overall workflow. Check our integration options to see how the 3k 1 Form can fit into your existing systems.

-

Is the 3k 1 Form secure for sensitive documents?

Absolutely! The 3k 1 Form is designed with top-notch security features to protect your sensitive documents. We use encryption and secure authentication methods to ensure that your data remains private and secure throughout the signing process. Trust airSlate SignNow for your document signing needs.

-

How do I get started with the 3k 1 Form?

Getting started with the 3k 1 Form is simple! Just sign up for an account on the airSlate SignNow website, and you will gain access to all the features, including the 3k 1 Form. You can then create, send, and manage your documents effortlessly.

Get more for 3k 1 Form

- Form of enrollment

- Affidavit of non possession 255780834 form

- Incident investigation report form

- Nys surrogates court fillable forms

- C4 application and indemnity girl guides south africa form

- Reach riseyouth referral form please send referr

- Service support worker agreement template form

- Service service agreement template form

Find out other 3k 1 Form

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word