Pt 311 a Mv Form

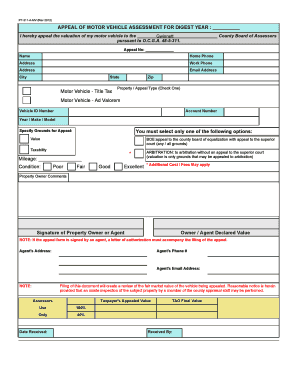

What is the Pt 311 A Mv Form

The Pt 311 A Mv form is a document used primarily for vehicle registration and titling in the United States. This form is essential for individuals and businesses looking to register a vehicle with their state’s Department of Motor Vehicles (DMV). It serves as a formal request for the issuance of a title or registration, providing necessary information about the vehicle and its owner. Understanding the purpose of the Pt 311 A Mv form is crucial for ensuring compliance with state regulations and facilitating a smooth registration process.

How to use the Pt 311 A Mv Form

Using the Pt 311 A Mv form involves several straightforward steps. First, gather all required information, including the vehicle identification number (VIN), make, model, and year of the vehicle. Next, fill out the form accurately, ensuring that all sections are completed to avoid delays. Once the form is filled, it can be submitted to the appropriate state agency, either online, by mail, or in person, depending on the state’s guidelines. It is important to keep a copy of the completed form for personal records.

Steps to complete the Pt 311 A Mv Form

Completing the Pt 311 A Mv form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Pt 311 A Mv form from your state’s DMV website.

- Fill in personal information, including your name, address, and contact details.

- Provide vehicle details such as the VIN, make, model, and year.

- Include any relevant information regarding previous registrations or titles.

- Review the completed form for accuracy before submission.

Legal use of the Pt 311 A Mv Form

The legal use of the Pt 311 A Mv form is governed by state laws regarding vehicle registration and titling. This form must be completed accurately and submitted within the specified time frame to ensure compliance. Failure to properly use the form can result in penalties, including fines or delays in obtaining vehicle registration. It is essential to understand the legal implications of submitting this form to maintain proper ownership and registration of your vehicle.

Who Issues the Form

The Pt 311 A Mv form is typically issued by the state’s Department of Motor Vehicles (DMV) or equivalent agency responsible for vehicle registrations. Each state may have its own version of the form, tailored to meet specific regulatory requirements. It is important to access the correct form from your state’s official DMV website to ensure compliance with local laws.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Pt 311 A Mv form can be done through various methods, depending on state regulations. Common submission methods include:

- Online: Many states offer online submission through their DMV websites, allowing for quick processing.

- Mail: The completed form can be mailed to the appropriate DMV office, ensuring that it is sent via a secure method.

- In-Person: Individuals may also choose to submit the form in person at their local DMV office for immediate processing.

Quick guide on how to complete pt 311 a mv form

Complete Pt 311 A Mv Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Pt 311 A Mv Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Pt 311 A Mv Form with ease

- Obtain Pt 311 A Mv Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages your document administration needs in just a few clicks from any device you choose. Edit and eSign Pt 311 A Mv Form and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 311 a mv form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pt 311 a document in airSlate SignNow?

The pt 311 a document in airSlate SignNow is a standardized form used for various administrative purposes. This document helps streamline processes within organizations, allowing users to efficiently manage and electronically sign essential paperwork. By utilizing airSlate SignNow's features, businesses can simplify and expedite the handling of the pt 311 a document.

-

How does airSlate SignNow improve the signing process for pt 311 a?

airSlate SignNow enhances the signing process for the pt 311 a document by providing a user-friendly interface that allows for quick and efficient eSignature solutions. Users can easily send, sign, and track the status of their pt 311 a documents in real-time. This eliminates paperwork delays and ensures compliance with legal standards.

-

What are the pricing options for using airSlate SignNow for pt 311 a?

AirSlate SignNow offers competitive pricing plans tailored to fit various business needs when managing pt 311 a documents. Each plan provides access to essential features, eSigning capabilities, and integrations that enhance productivity. To find the best fit for your organization, check out our pricing page for specifics.

-

Can I integrate airSlate SignNow with other applications for pt 311 a?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enabling businesses to manage the pt 311 a document more effectively. Popular integrations include CRM systems, cloud storage services, and project management tools. These integrations facilitate a smarter workflow and improve overall efficiency.

-

What are the main benefits of using airSlate SignNow for pt 311 a?

Using airSlate SignNow for the pt 311 a document offers numerous benefits, including reduced turnaround time and enhanced security for sensitive information. The platform's intuitive features also promote collaboration among team members. Additionally, airSlate SignNow's compliance with legal regulations ensures that your signed documents are valid and enforceable.

-

Is airSlate SignNow secure for handling pt 311 a documents?

Absolutely! AirSlate SignNow employs robust security measures to protect your pt 311 a documents, such as encryption and secure authentication. This ensures that sensitive information remains confidential while allowing users to confidently manage and sign documents digitally.

-

How can I track the status of my pt 311 a documents in airSlate SignNow?

AirSlate SignNow provides a streamlined tracking system for your pt 311 a documents. Users can access real-time updates on who has signed, who is pending, and receive notifications upon completion. This feature keeps everyone in the loop and helps maintain an organized document workflow.

Get more for Pt 311 A Mv Form

- Physical examannual and pre employment physicals for work form

- Vendor request form harvard university press

- Sds disability verification form final version sds disability verification form

- Degree or enrollment verification the university of memphis form

- Cummings sheriff form

- Form pdf karyawan cabras marine

- Section 125 plans employers form

- Avi food systems inc aply form

Find out other Pt 311 A Mv Form

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free