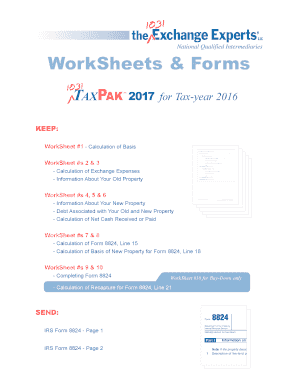

Taxpak Form

What is the Taxpak

The Taxpak is a comprehensive form utilized in the context of 1031 exchanges, which allows real estate investors to defer capital gains taxes on the sale of investment properties. This form is essential for those looking to reinvest their proceeds into like-kind properties, ensuring compliance with IRS regulations. The Taxpak includes various components that facilitate the documentation process, making it easier for investors to navigate the complexities of tax deferral.

How to use the Taxpak

Using the Taxpak involves several key steps. First, gather all necessary documentation related to your property transaction. This includes details about the properties involved, the sale price, and any associated costs. Next, fill out the Taxpak carefully, ensuring that all information is accurate and complete. Once completed, the form must be submitted to the appropriate parties, which may include your qualified intermediary and the IRS. Utilizing digital tools can streamline this process, allowing for efficient eSigning and submission.

Steps to complete the Taxpak

Completing the Taxpak requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Collect all relevant documents, including property deeds and sales agreements.

- Carefully fill out each section of the Taxpak, paying close attention to detail.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your qualified intermediary and retain copies for your records.

Legal use of the Taxpak

The legal use of the Taxpak hinges on adherence to IRS guidelines governing 1031 exchanges. It is crucial to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or disqualification from tax deferral. The Taxpak must be executed in accordance with the timelines set forth by the IRS, which includes strict deadlines for identifying and acquiring replacement properties. Understanding these legal parameters is essential for successful compliance.

Required Documents

To complete the Taxpak effectively, several documents are required. These typically include:

- Sales contract for the relinquished property.

- Purchase agreement for the replacement property.

- Closing statements for both transactions.

- Identification of the qualified intermediary.

Having these documents readily available will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Taxpak is critical. Investors must identify replacement properties within forty-five days of selling their original property. Additionally, the entire exchange must be completed within one hundred eighty days. Missing these deadlines can result in the loss of tax deferral benefits, making it essential to stay organized and adhere to the timeline.

Quick guide on how to complete taxpak

Complete Taxpak seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to prepare, modify, and eSign your documents quickly without delays. Manage Taxpak on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Taxpak effortlessly

- Find Taxpak and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow manages all your document needs in just a few clicks from any device of your choice. Modify and eSign Taxpak and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpak

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of working with 1031 exchange experts?

Working with 1031 exchange experts can simplify the complex process of real estate transactions. They have a thorough understanding of tax implications and can help you maximize your investment return. Additionally, their expertise can prevent costly mistakes and ensure compliance with IRS regulations.

-

How does airSlate SignNow support 1031 exchange experts?

airSlate SignNow provides 1031 exchange experts with a streamlined platform to manage documents efficiently. Our eSigning features allow for quicker approvals, reducing delays in transactions. With customizable workflows, experts can ensure they meet client needs seamlessly.

-

What is the pricing structure for services involving 1031 exchange experts?

Pricing for services involving 1031 exchange experts can vary depending on the level of assistance required. airSlate SignNow offers competitive rates that allow experts to provide cost-effective solutions to clients. You can explore our pricing plans on our website to find the best fit for your budget.

-

What features make airSlate SignNow the ideal choice for 1031 exchange experts?

AirSlate SignNow offers features such as in-app collaboration, customizable templates, and advanced security measures that are ideal for 1031 exchange experts. These tools help streamline the documentation process, allowing experts to focus on delivering value to their clients. Our user-friendly interface further enhances productivity.

-

Can airSlate SignNow integrate with other tools used by 1031 exchange experts?

Yes, airSlate SignNow provides robust integration capabilities with popular CRM and real estate management tools. This seamless integration allows 1031 exchange experts to sync data and manage documentation without switching between multiple platforms. Our goal is to enhance the efficiency of your workflows.

-

What types of documents can 1031 exchange experts manage with airSlate SignNow?

1031 exchange experts can manage a variety of documents with airSlate SignNow, including contracts, agreements, and compliance forms. Our platform supports the creation, sending, and eSigning of these documents, ensuring all necessary paperwork is handled professionally and securely. This flexibility enhances the overall client experience.

-

How does airSlate SignNow ensure compliance for 1031 exchange experts?

AirSlate SignNow is committed to maintaining compliance with industry regulations, which is crucial for 1031 exchange experts. We utilize robust security protocols and provide audit trails for all signed documents. This ensures that experts can confidently manage transactions while minimizing compliance risks.

Get more for Taxpak

Find out other Taxpak

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document