Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny

What is the Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny

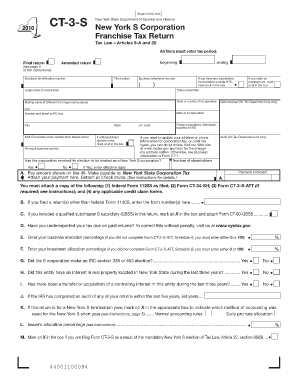

The Form CT 3 S is a critical document for S corporations operating in New York. This franchise tax return is designed to report the corporation's income, deductions, and tax liability to the state. It is essential for compliance with New York tax laws and helps ensure that S corporations meet their tax obligations. The form is structured to capture various financial details, including gross income, tax credits, and specific adjustments that may affect the overall tax calculation.

Steps to complete the Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny

Completing the Form CT 3 S involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by entering your corporation's information, such as name, address, and federal employer identification number (EIN). Then, report your total income, deductions, and any applicable credits. Finally, review the form for completeness and accuracy before submitting it to the New York State Department of Taxation and Finance.

Legal use of the Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny

The legal use of the Form CT 3 S is governed by New York state tax regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Additionally, electronic signatures are permissible under the ESIGN Act, provided that the signing process meets specific legal criteria. This ensures that the form holds up in legal contexts, such as audits or disputes regarding tax obligations.

Filing Deadlines / Important Dates

Timely filing of the Form CT 3 S is crucial to avoid penalties. Generally, the form is due on the fifteenth day of the third month following the close of the corporation's tax year. For corporations operating on a calendar year, this typically means a due date of March 15. It is important to be aware of any extensions or changes to deadlines that may occur, particularly during tax season.

Who Issues the Form

The Form CT 3 S is issued by the New York State Department of Taxation and Finance. This agency oversees the collection of state taxes and ensures compliance with tax laws. The department provides resources and guidance for S corporations to help them understand their filing requirements and responsibilities.

Penalties for Non-Compliance

Failure to file the Form CT 3 S on time can result in significant penalties for S corporations. These penalties may include late filing fees, interest on unpaid taxes, and potential audits. It is essential for corporations to understand these risks and take proactive steps to ensure timely and accurate filing to avoid financial repercussions.

Quick guide on how to complete form ct 3 snew york s corporation franchise tax return tax ny

Complete Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and safely keep it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without delays. Handle Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny on any device using airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

The easiest way to modify and eSign Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny effortlessly

- Obtain Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark relevant sections of the documents or hide sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your amendments.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 snew york s corporation franchise tax return tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 3 S for New York S Corporation Franchise Tax Return Tax NY?

Form CT 3 S is the New York State S Corporation Franchise Tax Return that reports income, deductions, and credits of S corporations. It’s essential for compliance with state tax regulations. Properly completing this form ensures that your corporation meets all necessary tax obligations.

-

How can airSlate SignNow help with the Form CT 3 S filing process?

airSlate SignNow streamlines the filing process for Form CT 3 S New York S Corporation Franchise Tax Return Tax NY by allowing you to electronically sign and submit your documents. Our platform provides an easy-to-use interface, making it simple to gather necessary information and approvals quickly. With airSlate SignNow, you can enhance your efficiency and avoid any last-minute complications.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different business needs. Depending on your requirements, you can choose a monthly or annual subscription that includes features specifically for managing documents like Form CT 3 S New York S Corporation Franchise Tax Return Tax NY. Visit our pricing page for detailed information and to find the perfect plan for your organization.

-

Can I integrate airSlate SignNow with other accounting software for filing Form CT 3 S?

Yes, airSlate SignNow integrates seamlessly with several accounting and tax software programs. This allows you to transfer data easily and ensure accuracy when preparing your Form CT 3 S New York S Corporation Franchise Tax Return Tax NY. Streamlining these processes saves time and minimizes the risk of errors.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the Form CT 3 S New York S Corporation Franchise Tax Return Tax NY has many benefits, including time savings and improved accuracy. Our electronic signature solution is secure and compliant, helping you meet deadlines without stress. Additionally, you can track your document status in real-time for added peace of mind.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect your sensitive information. When dealing with forms like the Form CT 3 S New York S Corporation Franchise Tax Return Tax NY, we utilize encryption and secure access protocols to ensure your documents are safe.

-

How does airSlate SignNow improve the eSignature process for Form CT 3 S?

airSlate SignNow enhances the eSignature process for Form CT 3 S New York S Corporation Franchise Tax Return Tax NY by offering user-friendly features that facilitate quick signing. You can send documents to multiple signers efficiently, track the progress, and even set reminders for pending signatures. This makes it easier to complete your tax returns on time.

Get more for Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny

Find out other Form CT 3 SNew York S Corporation Franchise Tax Return Tax Ny

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template