Radnor Township Bpt 2016-2026

What is the Radnor Township BPT?

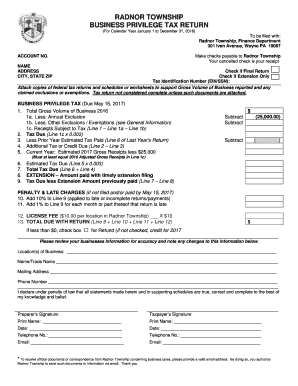

The Radnor Township Business Privilege Tax (BPT) is a tax imposed on businesses operating within Radnor Township. This tax is calculated based on the gross receipts of the business, and it applies to various types of business entities, including corporations, partnerships, and sole proprietorships. The BPT is essential for funding local services and infrastructure, making it a crucial aspect of business operations in the area.

Steps to Complete the Radnor Township BPT

Completing the Radnor Township business privilege tax return involves several key steps. First, gather all necessary financial documents, including income statements and receipts. Next, accurately calculate your gross receipts for the tax year. Once you have the required information, you can fill out the BPT form, ensuring all figures are correct. Finally, submit the completed form by the designated deadline, either online or via mail.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Radnor Township business privilege tax return. Typically, the return is due on April 15 of each year for the previous tax year. However, extensions may be available under certain circumstances. Keeping track of these important dates helps ensure compliance and avoids potential penalties.

Required Documents

When preparing to file the Radnor Township BPT, certain documents are required. These include:

- Financial statements detailing gross receipts

- Previous tax returns, if applicable

- Any relevant business licenses or permits

- Documentation of deductions or exemptions claimed

Having these documents ready will facilitate a smoother filing process.

Penalties for Non-Compliance

Failing to file the Radnor Township business privilege tax return or submitting it late can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand these consequences and ensure timely compliance with all tax obligations.

Digital vs. Paper Version

Businesses have the option to file the Radnor Township BPT either digitally or through a paper form. The digital version offers several advantages, including faster processing times and the ability to easily track submissions. Conversely, the paper version may be preferred by those who are less comfortable with technology. Both methods require adherence to the same regulations and deadlines.

Quick guide on how to complete radnor township bpt

Effortlessly Prepare Radnor Township Bpt on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Manage Radnor Township Bpt on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Alter and Electronically Sign Radnor Township Bpt with Ease

- Obtain Radnor Township Bpt and click on Get Form to commence.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Radnor Township Bpt and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the radnor township bpt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is radnor bpt and how does it benefit my business?

Radnor bpt is a robust feature within airSlate SignNow that streamlines the process of sending and signing documents electronically. By leveraging radnor bpt, businesses can increase efficiency, reduce turnaround times, and enhance customer satisfaction. It’s an ideal solution for organizations looking to modernize their workflow.

-

How much does airSlate SignNow with radnor bpt cost?

The pricing for airSlate SignNow varies based on the subscription plan chosen. However, all plans that include radnor bpt are cost-effective and designed to provide maximum value. You can explore various pricing tiers on our website to find the option that best fits your business needs.

-

What features does the radnor bpt offer?

Radnor bpt offers a range of features including customizable templates, advanced security options, and real-time status tracking. These features signNowly enhance document management and facilitate seamless collaboration among users. With radnor bpt, you can ensure that your documents are handled with care and efficiency.

-

Can radnor bpt integrate with other software applications?

Yes, radnor bpt within airSlate SignNow integrates seamlessly with numerous software applications including CRM systems, cloud storage, and productivity tools. This integration capability allows for a more unified workflow and helps businesses consolidate their operations. By using radnor bpt, you can streamline your processes even further.

-

Is radnor bpt secure for sensitive documents?

Absolutely! Radnor bpt prioritizes security by implementing advanced encryption protocols and compliance with industry standards. Your sensitive documents are protected throughout the signing process, ensuring that your business's confidential information remains secure. Choosing radnor bpt allows you to handle documents with peace of mind.

-

How user-friendly is radnor bpt for new users?

Radnor bpt is designed to be extremely user-friendly, even for those who are not tech-savvy. The intuitive interface guides users through the document sending and signing processes effortlessly. With a little practice, new users can fully leverage radnor bpt to optimize their document workflows.

-

What types of businesses can benefit from radnor bpt?

Radnor bpt is beneficial for a wide range of businesses, from small startups to large enterprises. Any organization that requires regular document management and signing can enhance its efficiency through radnor bpt. It is particularly advantageous for industries like legal, real estate, and finance.

Get more for Radnor Township Bpt

- Complaint form on state commission on judicial conduct

- Name change bell county form

- Eviction nueces form blank

- Non employee background questionnaire texas department of tdcj state tx form

- Texas non employee form

- Tdcj pers 263 form

- Texas non prosecution form

- Marriage license clarke county alabama form

Find out other Radnor Township Bpt

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online