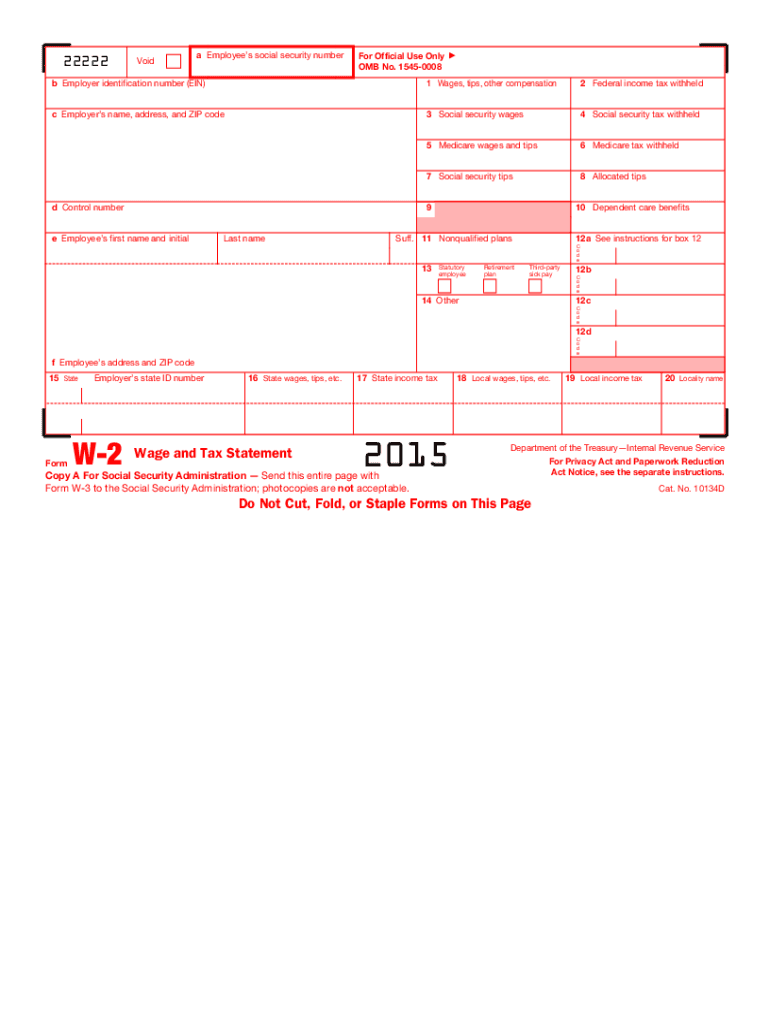

W 2 Form 2015

What makes the 2015 w 2 form legally valid?

Finding samples is not the difficult portion when it comes to web document management; making them binding is.

The first task is to look at the actual relevance of your template you plan utilizing. Official inctitutions have no rights to take obsolete forms, so it's essential to use only forms that are present and up to date.

Secondly, make sure you provide all the necessary information. Check required fields, the list of attachments, and supplementary documents very carefully. File all of the papers in one package in order to avoid misunderstandings and accelerate the procedure of processing your documents.

Finally, observe the submitting approaches required. Find out if you're allowed to send documents online, and if you are, consider using secure platforms to fill the 2015 w 2 form, electronically sign, and send.

The best way to protect your 2015 w 2 form when preparing it online

If the institution the 2015 w 2 form is going to be sent to allows you to do so on the web, stick to safe record management by using the tips below:

- Look for a safe solution. Consider implementing airSlate SignNow. We keep data encrypted on reputable servers.

- Examine the platform's security policies. Discover more about a service's acceptance around the world. For example, airSlate SignNow eSignatures are accepted in most countries.

- Pay attention to the software and hardware. Encoded connections and secure servers mean nothing when you have viruses on your device or utilize public Wi-Fi in public areas.

- Add extra security levels. Activate two-factor authentications and create passworded folders to guard delicate details.

- Count on probable hacking from just about anywhere. Don’t forget that fraudsters can mask behind your loved ones and co-workers, or official institutions. Check documents and links you get via electronic mail or in messengers.

Quick guide on how to complete 2015 w 2 form

Discover the most efficient method to complete and endorse your W 2 Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers an improved approach to complete and endorse your W 2 Form and related forms for public services. Our advanced eSignature platform provides you with all the necessary tools to manage documents swiftly and comply with official criteria - robust PDF editing, managing, securing, signing, and sharing functionalities are all available within a user-friendly interface.

Only a few steps are required to complete to finalize and endorse your W 2 Form:

- Add the editable template to the editor with the Get Form button.

- Review the information you need to enter in your W 2 Form.

- Move between the sections using the Next option to ensure nothing is overlooked.

- Utilize Text, Checkbox, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the top menu.

- Emphasize what is essential or Conceal sections that are no longer relevant.

- Press Sign to generate a legally recognized eSignature using your preferred method.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed W 2 Form in the Documents folder within your account, download it, or send it to your preferred cloud storage service. Our solution also provides versatile file sharing. There’s no need to print your forms when you need to submit them to the relevant public office - do it via email, fax, or request a USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct 2015 w 2 form

FAQs

-

In 2015, I made $1,700. At the time, I was told that I did not need not to file taxes but the school I'm trying to enroll in says I do. Do I need to file my own taxes even though my mom claimed me as her dependent? If not how do I prove it?

A2A.I assume that when you say you made $1700 it was from a job. If that is the case, then the advice you were given was correct. As a dependent, you do not have to file a return when your earned income is less than the maximum standard deduction for a dependent.If your income was from something other than a job - for example, if your parents invested in a stock fund in your name that generated the $1700 (or if you bought and sold Bitcoin or something like thst) - then you were required to file a return. In 2015 the maximum you could have in unearned income without filing was $1050.Assuming that you earned the income from a job, for the purposes of college financial aid, a student who was not required to file enters the information from the W-2 or 1099 form received (since you earned $1700 you should have received one or the other) instead of the return information. If you are filling out the FAFSA form, the instructions for the form tell you what to do. The college should accept the W-2 in lieu of the tax return.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

What is the link for filling out the CAT 2015 form?

CAT 2014

Create this form in 5 minutes!

How to create an eSignature for the 2015 w 2 form

How to make an electronic signature for your 2015 W 2 Form in the online mode

How to make an eSignature for your 2015 W 2 Form in Google Chrome

How to create an electronic signature for putting it on the 2015 W 2 Form in Gmail

How to make an electronic signature for the 2015 W 2 Form from your smart phone

How to create an eSignature for the 2015 W 2 Form on iOS devices

How to create an electronic signature for the 2015 W 2 Form on Android devices

People also ask

-

What is a W 2 Form and why is it important?

A W 2 Form is a tax document that employers must provide to their employees, detailing annual wages and the taxes withheld. It is crucial for employees as it is used to report income when filing their federal and state tax returns. Understanding the W 2 Form helps ensure accurate tax reporting and compliance with the IRS.

-

How can airSlate SignNow help with W 2 Form management?

airSlate SignNow streamlines the process of sending and signing W 2 Forms electronically, making it easier for businesses to manage their employee tax documents. With features like eSignature and document tracking, you can ensure timely delivery and compliance. This efficient management reduces paperwork and enhances the overall workflow.

-

Is airSlate SignNow cost-effective for managing W 2 Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing W 2 Forms, providing various pricing plans that cater to different business needs. By reducing the costs associated with paper forms and manual processing, businesses can save money while ensuring compliance. Plus, the digital process minimizes errors and speeds up document handling.

-

What features does airSlate SignNow offer for W 2 Form eSigning?

airSlate SignNow provides robust features for W 2 Form eSigning, including secure electronic signatures, customizable templates, and real-time tracking. These features enhance the efficiency of document handling, allowing businesses to send W 2 Forms quickly and receive signed copies in a fraction of the time. Additionally, the platform ensures that all signatures are legally binding.

-

Can I integrate airSlate SignNow with other tools for W 2 Form processing?

Yes, airSlate SignNow seamlessly integrates with popular tools like Google Drive, Salesforce, and Microsoft Office, enhancing your W 2 Form processing capabilities. These integrations allow you to access documents easily and streamline workflows across different platforms. This connectivity ensures that managing W 2 Forms fits smoothly into your existing processes.

-

How secure is airSlate SignNow for handling W 2 Forms?

airSlate SignNow prioritizes security, employing bank-level encryption and compliance with industry standards to protect sensitive W 2 Form data. The platform includes features like two-factor authentication and secure cloud storage to safeguard all documents. Your employee information remains confidential and secure throughout the signing process.

-

What benefits does airSlate SignNow provide for small businesses with W 2 Forms?

For small businesses, airSlate SignNow offers signNow benefits in managing W 2 Forms, including cost savings, efficiency, and ease of use. The platform simplifies the signing process, reducing the time spent on paperwork and allowing business owners to focus on growth. Additionally, the user-friendly interface ensures that even those with limited tech skills can navigate the platform effectively.

Get more for W 2 Form

Find out other W 2 Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy