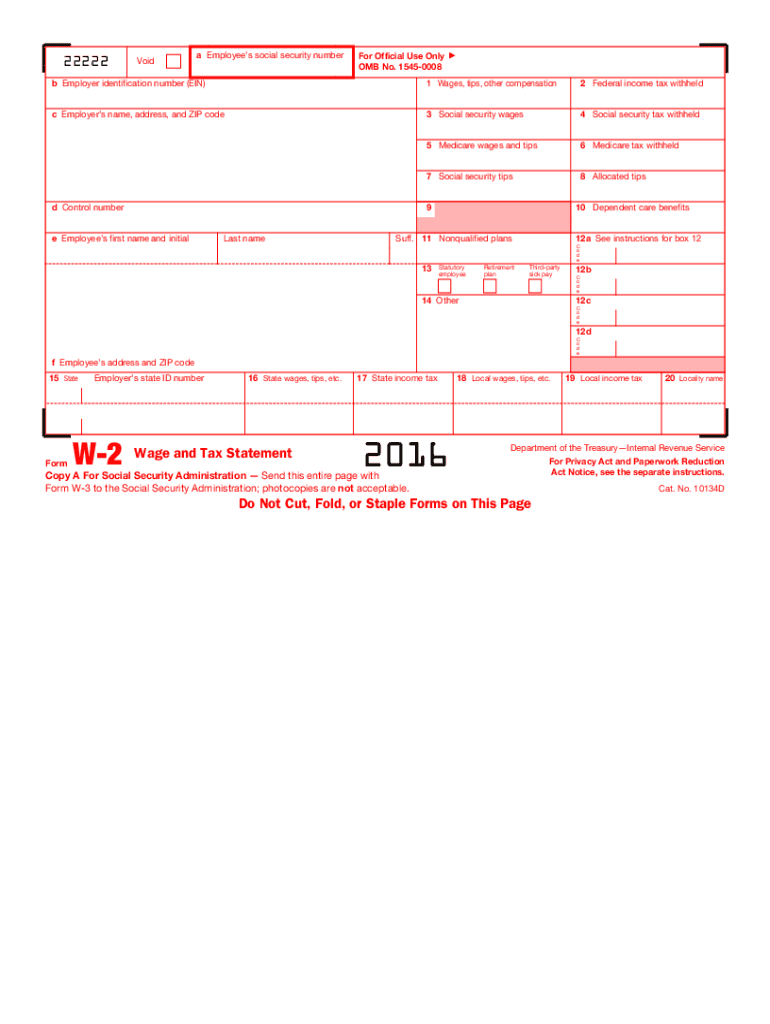

W 2 Form 2016

What makes the 2016 w 2 form legally valid?

Getting documents is not the complicated component in terms of browser document management; making them valid is.

The first step is to examine the current relevance of your form you plan utilizing. Official organizations can't accept out-of-date forms, so it's crucial that you use only templates that are current and up to date.

Next, make sure you insert all the necessary information. Examine required areas, the list of attachments, and supplementary documents carefully. File all of the papers in one bundle to avoid misunderstandings and increase the speed of the procedure of processing your records.

Finally, pay attention to the submitting methods allowed. Find out if you're capable to submit documents using web services, and if you are, think about using safe platforms to complete the 2016 w 2 form, eSign, and deliver.

The best way to protect your 2016 w 2 form when completing it online

If the organization the 2016 w 2 form will be delivered to permits you to do so on the web, stick to secure document management by following the tips below:

- Look for a secure service. Consider implementing airSlate SignNow. We store information encrypted on trustworthy servers.

- Check the platform's compliance. Find more regarding a service's acceptance in other countries. For example, airSlate SignNow electronic signatures are accepted in most countries around the world.

- Pay attention to the hardware and software. Encrypted connections and secure servers mean absolutely nothing when you have viruses on your computer or utilize public Wi-Fi.

- Include more safety levels. Turn on two-step authentications and create passworded folders to protect sensitive details.

- Count on possible hacking from anywhere. Don’t forget that fraudsters can mask behind your loved ones and co-workers, or official institutions. Check files and links you get via electronic mail or in messengers.

Quick guide on how to complete 2016 w 2 form

Explore the easiest method to complete and sign your W 2 Form

Are you still spending time on preparing your official documents on paper instead of doing it online? airSlate SignNow provides a superior approach to complete and sign your W 2 Form and associated forms for public services. Our intelligent electronic signature solution equips you with all the tools necessary to handle paperwork efficiently and in compliance with official standards - comprehensive PDF editing, managing, securing, signing, and sharing features all available within a user-friendly interface.

Only a few steps are needed to fill out and sign your W 2 Form:

- Upload the editable template to the editor using the Get Form button.

- Verify the details you need to include in your W 2 Form.

- Move between the fields using the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to complete the fields with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Select Sign to generate a legally valid electronic signature using your chosen method.

- Include the Date beside your signature and wrap up your task with the Done button.

Store your completed W 2 Form in the Documents folder within your account, download it, or transfer it to your desired cloud storage. Our service also offers convenient form sharing. There’s no need to print out your templates when filing them at the appropriate public office - achieve this via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2016 w 2 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

Do 1099 workers have to pay estimated taxes?

Yes, you are supposed to pay estimated taxes if you expect to owe more than $1,000 in tax. This is a very rough estimate and shouldn’t be taken as fact, but $1K in tax roughly equates to $7,000 in net earnings over the course of a year (excluding any type of W-2 income from a normal job).Estimated taxes are due four times per year; payments are not exactly quarterly though. The IRS’ website has the due dates of each payment. To file, you’ll need to fill out Form 1040-ES: https://www.irs.gov/pub/irs-pdf/.... The form has instructions on how to pay.Another useful resource is this freelancer tax calculator: Freelancer Income Tax Calculator 2016.

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

Can I fill out the SSC CHSL 2017 form while waiting for the 2016 results?

Yes you can.By now you should have started preparing also.We motivate students to crack govt exams while working.Join our YouTube channel SSC PATHSHALA and enjoy learning like never before.Classroom Program for English Mains: Classroom Program for English Mains - YouTube

Create this form in 5 minutes!

How to create an eSignature for the 2016 w 2 form

How to create an electronic signature for the 2016 W 2 Form online

How to create an electronic signature for the 2016 W 2 Form in Chrome

How to generate an eSignature for putting it on the 2016 W 2 Form in Gmail

How to create an eSignature for the 2016 W 2 Form right from your smart phone

How to make an electronic signature for the 2016 W 2 Form on iOS

How to generate an eSignature for the 2016 W 2 Form on Android OS

People also ask

-

What is a W 2 Form and why is it important?

A W 2 Form is a tax document that employers must provide to their employees, detailing annual wages and the taxes withheld. It's important because it helps employees accurately report their income and file their tax returns. Understanding the W 2 Form is crucial for effective tax compliance.

-

How can airSlate SignNow help me manage my W 2 Forms?

airSlate SignNow allows you to easily send, receive, and eSign your W 2 Forms digitally. This streamlines the process, improving efficiency and reducing the risk of errors. With airSlate SignNow, you can ensure secure and compliant handling of your tax documents.

-

Is airSlate SignNow affordable for small businesses needing W 2 Forms?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses that need to manage W 2 Forms. With flexible subscription options, you can choose a plan that fits your budget while accessing essential features. Our solutions help maintain financial efficiency as you manage important documents.

-

What features does airSlate SignNow offer for W 2 Form management?

airSlate SignNow includes features such as customizable templates, easy eSigning, and document tracking specifically for W 2 Forms. You can streamline the workflow, ensuring quick access and turnaround times for tax documents. These features enhance productivity and minimize paperwork hassles.

-

Can I customize my W 2 Form templates with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize W 2 Form templates to fit your branding and specific requirements. This customization ensures your forms are professional and personalized, enhancing your business's image while meeting compliance standards.

-

Does airSlate SignNow integrate with payroll systems for W 2 Forms?

Yes, airSlate SignNow can integrate with various payroll systems, simplifying the management of W 2 Forms. This integration allows for automatic data transfer, minimizing manual entry errors and ensuring that your tax information is accurate and secure. You can streamline your processes effortlessly.

-

Is it secure to sign W 2 Forms using airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to keep your W 2 Forms safe. This ensures that sensitive financial information is protected during the signing process, giving you peace of mind while managing your documents.

Get more for W 2 Form

Find out other W 2 Form

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy