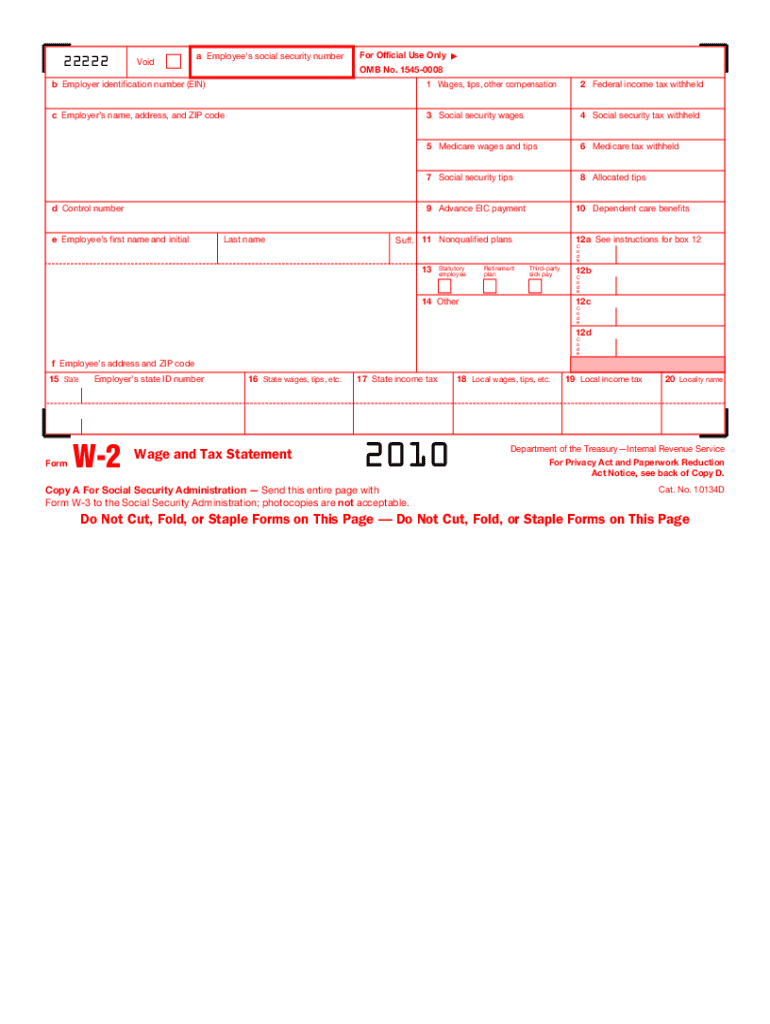

W 2 Form 2010

What makes the 2010 w 2 form legally valid?

Getting documents is not the difficult component in terms of web document management; making them legal is.

The first task is to look at the current relevance of your template you plan utilizing. Official organizations can't accept out-of-date documents, so it's essential to only use forms that are current and up to date.

Next, ensure you include all the required information. Review required fields, the list of attachments, and additional forms carefully. File all the papers in one bundle to protect yourself from misunderstandings and accelerate the procedure of processing your information.

Additionally, observe the submitting ways needed. Check if you're capable to file documents via internet, and if you are, think about using secure services to complete the 2010 w 2 form, electronically sign, and deliver.

How to protect your 2010 w 2 form when completing it online

If the institution the 2010 w 2 form will be brought to allows you to do this online, stick to secure document administration by using the guidelines below:

- Get a safe solution. Consider trying airSlate SignNow. We keep records encrypted on trustworthy servers.

- Look into the platform's conformity. Find more about a service's acceptance around the world. As an example, airSlate SignNow eSignatures are accepted in many countries around the world.

- Pay attention to the software and hardware. Encoded connections and safe servers mean practically nothing in case you have malware on your computer or use public Wi-Fi.

- Include more protection levels. Activate two-factor authentications and create locked folders to guard delicate details.

- Count on probable hacking from just about anywhere. Remember that fraudsters can mask behind your loved ones and colleagues, or companies. Verify files and links you receive via electronic mail or in messengers.

Quick guide on how to complete 2010 w 2 form

Discover the easiest method to complete and sign your W 2 Form

Are you still spending time creating your official documents on paper instead of online? airSlate SignNow offers a superior approach to finish and sign your W 2 Form and associated forms for public services. Our intelligent e-signature platform equips you with all the tools necessary to handle documents swiftly and in line with official standards - robust PDF editing, management, security, signing, and sharing features all conveniently located within a user-friendly interface.

Only a few steps are needed to fill out and sign your W 2 Form:

- Upload the fillable template to the editor using the Get Form button.

- Identify the information you need to include in your W 2 Form.

- Navigate through the fields with the Next button to ensure you don’t overlook anything.

- Utilize Text, Check, and Cross tools to fill the blanks with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly important or Conceal areas that are no longer relevant.

- Select Sign to create a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finished W 2 Form in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our platform also facilitates versatile file sharing. There’s no need to print your forms when you can send them directly to the appropriate public office - do so via email, fax, or by requesting a USPS “snail mail” shipment from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 2010 w 2 form

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

If I have to fill out Form WH-4852, should I also send in my original W-2 and file it?

The purpose of Form 4852 is to substitute for the original W-2 if for some reason you didn't receive one and couldn't get one from an employer. If you have the original W-2, you don't file Form 4852.

Create this form in 5 minutes!

How to create an eSignature for the 2010 w 2 form

How to make an electronic signature for the 2010 W 2 Form online

How to make an eSignature for the 2010 W 2 Form in Google Chrome

How to create an electronic signature for signing the 2010 W 2 Form in Gmail

How to create an eSignature for the 2010 W 2 Form straight from your mobile device

How to make an electronic signature for the 2010 W 2 Form on iOS

How to generate an electronic signature for the 2010 W 2 Form on Android devices

People also ask

-

What is a W 2 Form and why is it important?

A W 2 Form is a tax document issued by employers to report an employee's annual wages and tax withholdings. It is crucial for accurately filing income tax returns, ensuring that employees report their earnings correctly and receive any potential refunds.

-

How can airSlate SignNow help me with my W 2 Form?

AirSlate SignNow enables you to easily send, receive, and eSign your W 2 Form securely. With our platform, you can streamline the document management process, ensuring that all parties involved can access and sign the form without hassle.

-

Is there a specific cost associated with using airSlate SignNow for W 2 Forms?

Yes, airSlate SignNow offers a range of pricing plans tailored to meet different business needs. Each plan provides various features to optimize your handling of W 2 Forms, allowing you to choose an option that fits your budget.

-

What features does airSlate SignNow offer for handling W 2 Forms?

AirSlate SignNow includes features like customizable templates, real-time tracking, and automated reminders, specifically designed for W 2 Forms. These tools enhance efficiency, ensuring that your documents are processed quickly and accurately.

-

Can I integrate airSlate SignNow with other software for my W 2 Form processes?

Absolutely! AirSlate SignNow easily integrates with various applications such as CRM systems and accounting software, allowing you to streamline your W 2 Form workflow. These integrations enhance data sharing and improve overall productivity.

-

Is airSlate SignNow compliant with legal requirements for W 2 Forms?

Yes, airSlate SignNow complies with all legal standards regarding electronic signatures and document handling. This compliance ensures that your W 2 Forms are signed and stored securely, meeting IRS regulations and protecting your data.

-

How does eSigning a W 2 Form work with airSlate SignNow?

With airSlate SignNow, eSigning a W 2 Form is straightforward. You can upload your form, add the required signers, and send it out for signature, all through an intuitive interface, ensuring a quick and efficient signing process.

Get more for W 2 Form

- Request for production of documents california 100054173 form

- Rp 305 1211agricultural assessment program rp305 form

- Triton college general petition form

- Fuse form suny new paltz newpaltz

- Form 83d62 worksafebc worksafebc com

- Dc parade permit registration form

- Oklahoma absentee ballot form 627041196

- Subrecipient agreement template form

Find out other W 2 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors