Brazoria County Homestead Exemption Form 2023

What is the Brazoria County Homestead Exemption Form

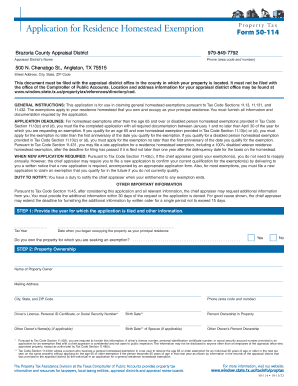

The Brazoria County Homestead Exemption Form is a legal document that allows homeowners in Brazoria County, Texas, to apply for property tax exemptions on their primary residence. This exemption can significantly reduce the amount of property taxes owed, making homeownership more affordable. The form is specifically designed to help eligible homeowners claim their rights to these exemptions, which may include reductions for school taxes, county taxes, and other local taxes.

How to use the Brazoria County Homestead Exemption Form

Using the Brazoria County Homestead Exemption Form involves several straightforward steps. First, ensure that you meet the eligibility criteria, which typically include being a homeowner and occupying the property as your primary residence. Next, fill out the form accurately, providing all required information, such as your name, address, and details about the property. After completing the form, submit it to the appropriate local taxing authority, either in person or by mail, depending on your preference.

Steps to complete the Brazoria County Homestead Exemption Form

Completing the Brazoria County Homestead Exemption Form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including proof of ownership and identification.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the completed form to the local appraisal district office by the deadline.

Eligibility Criteria

To qualify for the Brazoria County Homestead Exemption, applicants must meet specific eligibility criteria. Generally, you must be the owner of the property and use it as your primary residence. Additionally, you should not have claimed a homestead exemption on another property during the same tax year. Some exemptions may also have age or disability requirements, so reviewing these criteria carefully is essential before applying.

Required Documents

When applying for the Brazoria County Homestead Exemption, certain documents are necessary to support your application. Commonly required documents include:

- Proof of ownership, such as a deed or title.

- Identification, like a driver's license or state ID.

- Any additional documentation that may be needed for specific exemptions, such as disability verification.

Form Submission Methods

The Brazoria County Homestead Exemption Form can be submitted through various methods to accommodate different preferences. Homeowners may choose to submit the form:

- Online, if the local appraisal district offers digital submission options.

- By mail, sending the completed form to the designated office address.

- In person, delivering the form directly to the local appraisal district office.

Create this form in 5 minutes or less

Find and fill out the correct brazoria county homestead exemption form

Create this form in 5 minutes!

How to create an eSignature for the brazoria county homestead exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Brazoria County Homestead Exemption Form?

The Brazoria County Homestead Exemption Form is a document that allows homeowners in Brazoria County to apply for property tax exemptions. This form helps reduce the taxable value of your home, potentially lowering your property taxes. Completing this form can lead to signNow savings for eligible homeowners.

-

How can I obtain the Brazoria County Homestead Exemption Form?

You can obtain the Brazoria County Homestead Exemption Form from the official Brazoria County Appraisal District website or by visiting their office. Additionally, airSlate SignNow provides an easy way to access and eSign this form digitally, streamlining the application process for homeowners.

-

What are the benefits of filing the Brazoria County Homestead Exemption Form?

Filing the Brazoria County Homestead Exemption Form can signNowly reduce your property tax burden. It also provides additional benefits such as protection against tax increases and eligibility for other local tax exemptions. By using airSlate SignNow, you can efficiently manage and submit your application.

-

Is there a fee to file the Brazoria County Homestead Exemption Form?

There is no fee to file the Brazoria County Homestead Exemption Form itself. However, you may incur costs if you choose to use a service to assist with the filing. With airSlate SignNow, you can complete the process at a low cost while ensuring your documents are securely signed and submitted.

-

What documents do I need to submit with the Brazoria County Homestead Exemption Form?

When submitting the Brazoria County Homestead Exemption Form, you typically need to provide proof of residency, such as a driver's license or utility bill. Additional documentation may be required depending on your specific situation. airSlate SignNow allows you to easily upload and eSign these documents for a seamless submission.

-

Can I file the Brazoria County Homestead Exemption Form online?

Yes, you can file the Brazoria County Homestead Exemption Form online through the Brazoria County Appraisal District's website. Using airSlate SignNow, you can also eSign the form digitally, making the process faster and more convenient for homeowners.

-

How long does it take to process the Brazoria County Homestead Exemption Form?

The processing time for the Brazoria County Homestead Exemption Form can vary, but it typically takes a few weeks. Once submitted, you will receive a notification regarding the status of your application. Using airSlate SignNow can help ensure your form is submitted correctly and promptly.

Get more for Brazoria County Homestead Exemption Form

- Nigerian passport application form pdf

- Nigeria embassy new york form

- Acte de mariage ambassade du cameroun en tunisie form

- Sample personal invitation letter for china tourist visa form

- Pakistani passport application form

- Libya visa application form

- Eft request form template

- Trust agreement fampampa federal credit union form

Find out other Brazoria County Homestead Exemption Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors