Statement in Lieu of Actual Receipts Form

What is the statement in lieu of actual receipts?

The statement in lieu of actual receipts is a document that allows individuals or businesses to claim expenses without providing physical receipts. This form is particularly useful in situations where receipts are lost or unavailable. It serves as a formal declaration of the expenses incurred, ensuring that the claim is still valid for reimbursement or tax purposes. By detailing the nature and amount of the expenses, this statement helps maintain transparency and accountability.

How to use the statement in lieu of actual receipts

Using the statement in lieu of actual receipts involves a few straightforward steps. First, gather all relevant information regarding the expenses you wish to claim. This includes dates, amounts, and descriptions of each expense. Next, complete the statement form by accurately filling in these details. Ensure that you sign and date the document to validate it. Once completed, submit the statement to the appropriate party, such as an employer or tax authority, along with any required supporting documentation.

Steps to complete the statement in lieu of actual receipts

Completing the statement in lieu of actual receipts requires careful attention to detail. Follow these steps:

- Identify the expenses you are claiming.

- Gather necessary details, including dates, amounts, and descriptions.

- Fill out the statement form accurately, ensuring all fields are completed.

- Review the information for accuracy and completeness.

- Sign and date the form to authenticate your claim.

- Submit the completed statement to the relevant authority.

Legal use of the statement in lieu of actual receipts

The legal validity of the statement in lieu of actual receipts is recognized in various contexts, particularly for tax purposes and expense reimbursements. To ensure that the statement is legally acceptable, it must comply with relevant regulations and guidelines. This includes providing accurate and truthful information, as well as adhering to any specific requirements set forth by the IRS or other governing bodies. Failure to comply can result in penalties or denial of claims.

Key elements of the statement in lieu of actual receipts

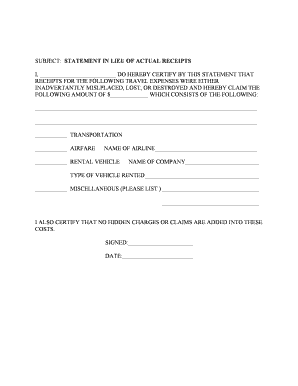

Several key elements must be included in the statement in lieu of actual receipts to ensure its effectiveness:

- Date: The date when the expense was incurred.

- Amount: The total amount of the expense.

- Description: A brief explanation of the nature of the expense.

- Signature: A signed declaration affirming the accuracy of the information provided.

- Submission details: Information on where or to whom the statement should be submitted.

IRS guidelines for the statement in lieu of actual receipts

The IRS has specific guidelines regarding the use of the statement in lieu of actual receipts, particularly for tax deductions and reimbursements. It is essential to ensure that the statement accurately reflects the expenses claimed and complies with IRS requirements. The IRS may require additional documentation or proof of expenses in certain cases, so it is advisable to keep thorough records and be prepared to provide further information if requested.

Quick guide on how to complete statement in lieu of actual receipts

Complete Statement In Lieu Of Actual Receipts effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Statement In Lieu Of Actual Receipts on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to alter and eSign Statement In Lieu Of Actual Receipts with ease

- Locate Statement In Lieu Of Actual Receipts and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Statement In Lieu Of Actual Receipts to guarantee seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the statement in lieu of actual receipts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a statement in lieu of actual receipts?

A statement in lieu of actual receipts is a document that summarizes expenses incurred without the need for physical receipts. It serves as an official record for reimbursement and tax purposes, making it easier for businesses to manage their expense claims. Using airSlate SignNow, you can create, send, and eSign such statements conveniently.

-

How does airSlate SignNow facilitate the use of statements in lieu of actual receipts?

airSlate SignNow streamlines the creation and signing of statements in lieu of actual receipts by providing an intuitive online platform. Users can easily input expenses, generate the statement, and send it for electronic signatures. This simplifies the process and saves valuable time for businesses.

-

What are the benefits of using a statement in lieu of actual receipts with airSlate SignNow?

Using a statement in lieu of actual receipts with airSlate SignNow allows businesses to maintain accurate expense records while minimizing paperwork. It enhances productivity by allowing for quick approval processes and reduces the risk of losing physical receipts. This digital solution is an efficient way to handle expenses.

-

Is airSlate SignNow cost-effective for managing statements in lieu of actual receipts?

Yes, airSlate SignNow offers a cost-effective solution that can help businesses save on operational costs related to managing statements in lieu of actual receipts. With competitive pricing and various plans, businesses can choose the option that best fits their needs without compromising on functionality.

-

Can I integrate airSlate SignNow with other accounting tools for expense management?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and expense management tools, allowing you to efficiently handle statements in lieu of actual receipts. This integration ensures that all your expenses are tracked and recorded in real-time, enabling better financial management.

-

What features does airSlate SignNow offer for document signing related to statements in lieu of actual receipts?

airSlate SignNow includes features like customizable templates, real-time tracking of signatures, and secure storage for all documents, including statements in lieu of actual receipts. These features make it easy to manage the signing process and ensure that all necessary parties have access to important documents.

-

How secure is the process of sending statements in lieu of actual receipts through airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. When sending statements in lieu of actual receipts, your data is encrypted, ensuring that sensitive information remains confidential. Additionally, the platform complies with industry standards for data protection, providing peace of mind for users.

Get more for Statement In Lieu Of Actual Receipts

- Illinois license request 83863374 form

- Request to suppress personal information illinois secretary of state

- Illinois sb form

- Customer feedback illinois secretary of state 6966569 form

- Illinois waiver request form

- Rules of the road review course illinois secretary of state form

- Formal hearing request illinois secretary of state

- Form st 9q massachusetts

Find out other Statement In Lieu Of Actual Receipts

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online