Alabama Form 2848a Instructions

What is the Alabama Form 2848a Instructions

The Alabama Form 2848a is a document used by taxpayers to authorize an individual to represent them before the Alabama Department of Revenue. This form is crucial for allowing someone else, such as a tax professional or attorney, to act on behalf of the taxpayer regarding tax matters. The instructions for this form guide users through the process of filling it out correctly, ensuring that all necessary information is provided for it to be valid.

Steps to complete the Alabama Form 2848a Instructions

Completing the Alabama Form 2848a involves several essential steps to ensure accuracy and compliance. First, gather all necessary personal information, including your name, address, and Social Security number. Next, provide the representative's details, including their name, address, and phone number. After that, specify the tax matters for which the authorization is granted, including the tax type and periods. Finally, sign and date the form to validate it. Following these steps carefully will help prevent delays in processing.

Legal use of the Alabama Form 2848a Instructions

The legal use of the Alabama Form 2848a is significant as it outlines the authority granted to the representative. This form must be completed in accordance with state regulations to be considered valid. The instructions emphasize the importance of providing accurate information and obtaining the necessary signatures. Failure to comply with these legal requirements may result in the form being rejected, which can delay the resolution of tax matters.

Key elements of the Alabama Form 2848a Instructions

Understanding the key elements of the Alabama Form 2848a instructions is vital for successful completion. Important components include the taxpayer's information, the representative's details, and the specific tax matters being addressed. Additionally, the form requires a clear indication of the tax periods involved. Each of these elements plays a critical role in ensuring that the authorization is recognized by the Alabama Department of Revenue.

Who Issues the Form

The Alabama Form 2848a is issued by the Alabama Department of Revenue. This state agency is responsible for managing tax-related matters and providing the necessary forms for taxpayers. By issuing this form, the department facilitates the process of granting representation to qualified individuals, ensuring that taxpayers have the support they need in navigating their tax obligations.

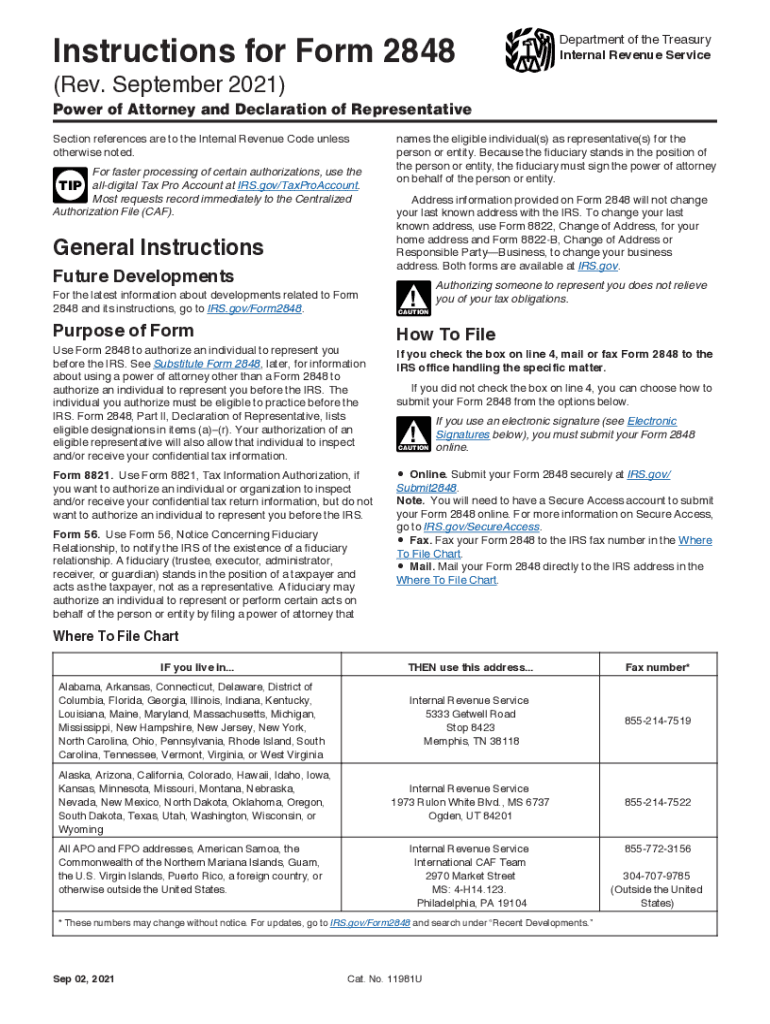

Form Submission Methods (Online / Mail / In-Person)

Submitting the Alabama Form 2848a can be done through various methods, providing flexibility for taxpayers. The form can be submitted online through the Alabama Department of Revenue's e-filing system, ensuring a quick and efficient process. Alternatively, taxpayers may choose to mail the completed form to the appropriate address or deliver it in person at a local office. Each method has its advantages, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete alabama form 2848a instructions

Complete Alabama Form 2848a Instructions effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without issues. Manage Alabama Form 2848a Instructions on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

Effortlessly modify and eSign Alabama Form 2848a Instructions

- Obtain Alabama Form 2848a Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal significance as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Alabama Form 2848a Instructions while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama form 2848a instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Alabama Form 2848A instructions?

The Alabama Form 2848A instructions provide guidance on how to complete the form, which is used for power of attorney in Alabama. This form is essential for individuals allowing others to represent them in tax matters. Understanding the Alabama Form 2848A instructions ensures accurate completion and compliance.

-

Where can I find the Alabama Form 2848A instructions?

You can find the Alabama Form 2848A instructions on the official state website or through the IRS resources. Additionally, airSlate SignNow offers tools to guide you on form completion, enhancing your understanding of the Alabama Form 2848A instructions.

-

How do I complete the Alabama Form 2848A?

To complete the Alabama Form 2848A, you need to provide specific information such as your name, address, and the details of the representative. Following the Alabama Form 2848A instructions carefully is critical for ensuring that all required fields are filled correctly, avoiding submission issues.

-

Is there a fee associated with the Alabama Form 2848A?

Generally, there is no fee for filing the Alabama Form 2848A itself. However, you should check if your representative charges a fee for their services. Understanding any potential costs in alignment with the Alabama Form 2848A instructions can help you plan accordingly.

-

How long does it take to process the Alabama Form 2848A?

Processing times for the Alabama Form 2848A can vary, but it typically takes a few weeks. Following the Alabama Form 2848A instructions accurately can help prevent delays. To ensure quicker processing, consider using tools that streamline electronic submissions.

-

Can I revoke a power of attorney filed with Alabama Form 2848A?

Yes, you can revoke a power of attorney filed using Alabama Form 2848A. You will need to follow specific steps as outlined in the Alabama Form 2848A instructions to ensure proper revocation. Consulting with an expert can clarify the process.

-

What are the benefits of using airSlate SignNow for Alabama Form 2848A?

Using airSlate SignNow to handle the Alabama Form 2848A allows for seamless eSigning and document management. The platform simplifies the process and ensures compliance with Alabama Form 2848A instructions, saving you time and reducing errors. It's a cost-effective solution for businesses managing legal documents.

Get more for Alabama Form 2848a Instructions

Find out other Alabama Form 2848a Instructions

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template