Form 13615 2017

What is the Form 13615

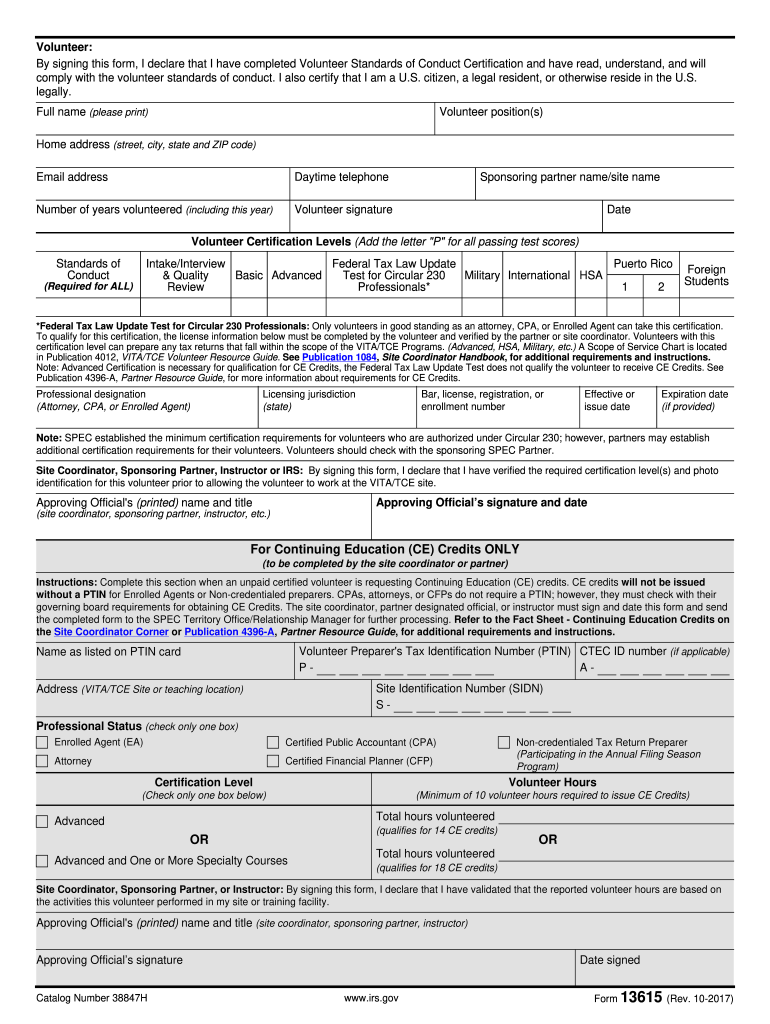

The Form 13615 is an important document used by taxpayers in the United States to certify their eligibility for various tax benefits and programs. This form is primarily utilized by individuals who are seeking assistance with tax preparation and filing, particularly those who qualify for free tax services through the Volunteer Income Tax Assistance (VITA) program. It serves as a declaration of the taxpayer's income level and other relevant financial information, which helps determine eligibility for these services.

How to use the Form 13615

To effectively use the Form 13615, taxpayers should first ensure they meet the eligibility criteria for the VITA program. Once confirmed, individuals can obtain the form from authorized VITA sites or online resources. After filling out the form with accurate personal and financial information, it should be submitted to a certified VITA volunteer who will assist in preparing the tax return. This collaborative process ensures that the taxpayer receives the appropriate support while complying with IRS regulations.

Steps to complete the Form 13615

Completing the Form 13615 involves several straightforward steps:

- Gather necessary documents, including proof of income and identification.

- Clearly fill out personal information, such as name, address, and Social Security number.

- Provide details about your income, including wages, interest, and any other relevant sources.

- Indicate your eligibility for free tax assistance by checking the appropriate boxes.

- Review the completed form for accuracy before submission.

Legal use of the Form 13615

The Form 13615 is legally binding when completed accurately and submitted to authorized tax preparers. It is essential for taxpayers to ensure that all information provided is truthful and verifiable, as any discrepancies could lead to penalties or legal issues with the IRS. By utilizing this form, taxpayers can confidently access free tax preparation services while adhering to legal requirements.

Key elements of the Form 13615

Several key elements are crucial to the Form 13615:

- Personal Information: This includes the taxpayer's name, address, and Social Security number.

- Income Details: Taxpayers must disclose their total income from various sources.

- Eligibility Certification: The form includes sections where taxpayers must certify their eligibility for VITA services.

- Signature: A signature is required to validate the information provided and confirm the taxpayer's understanding of the form's purpose.

Filing Deadlines / Important Dates

It is vital for taxpayers to be aware of the filing deadlines associated with the Form 13615. Generally, the form should be completed and submitted during the tax season, which typically runs from January to April each year. Specific deadlines may vary based on individual circumstances, such as extensions or changes in tax law. Taxpayers should consult the IRS guidelines or their VITA volunteer for precise dates relevant to their situation.

Who Issues the Form

The Form 13615 is issued by the Internal Revenue Service (IRS) and is specifically designed for use within the VITA program. This program is administered by the IRS in partnership with various community organizations and volunteers who provide free tax assistance to eligible individuals. The IRS ensures that the form is updated regularly to reflect any changes in tax laws or eligibility requirements.

Quick guide on how to complete form 13615 2017

Complete Form 13615 effortlessly on any gadget

Online document management has gained popularity among companies and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed papers, as you can obtain the accurate format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage Form 13615 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 13615 with ease

- Locate Form 13615 and click on Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form 13615 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13615 2017

Create this form in 5 minutes!

How to create an eSignature for the form 13615 2017

How to generate an electronic signature for the Form 13615 2017 online

How to make an electronic signature for your Form 13615 2017 in Google Chrome

How to make an eSignature for putting it on the Form 13615 2017 in Gmail

How to make an electronic signature for the Form 13615 2017 right from your smartphone

How to generate an eSignature for the Form 13615 2017 on iOS

How to generate an electronic signature for the Form 13615 2017 on Android devices

People also ask

-

What is Form 13615 and how is it used in airSlate SignNow?

Form 13615 is a document used for eSignature purposes, ensuring that all parties involved in a transaction have agreed to the terms. In airSlate SignNow, this form can be easily uploaded, sent, and signed electronically, streamlining the entire process while maintaining compliance.

-

How does airSlate SignNow ensure the security of Form 13615?

airSlate SignNow employs advanced security protocols to protect documents like Form 13615. With end-to-end encryption and secure cloud storage, users can be confident that their sensitive information remains safe throughout the signing process.

-

Is there a free trial available for using Form 13615 with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to test the platform's features, including the handling of Form 13615. This trial period provides businesses the opportunity to explore the ease of use and functionality before committing to a subscription.

-

What features does airSlate SignNow offer for managing Form 13615?

airSlate SignNow provides a range of features for managing Form 13615, including customizable templates, bulk sending, and automated reminders. These tools enhance efficiency and ensure that documents are signed promptly, facilitating smoother business operations.

-

Can Form 13615 be integrated with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports various integrations with popular software platforms, enabling seamless workflows for managing Form 13615. Users can connect with CRM systems, project management tools, and more for enhanced productivity.

-

What are the pricing options for using airSlate SignNow with Form 13615?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling Form 13615. These plans vary based on features and user count, ensuring that businesses of all sizes can find an affordable solution.

-

How can I track the status of Form 13615 sent through airSlate SignNow?

Tracking the status of Form 13615 is simple with airSlate SignNow. Users can view real-time updates on document statuses, including when it has been sent, viewed, and signed, allowing for better management of eSignature processes.

Get more for Form 13615

Find out other Form 13615

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure