Fannie Mae Form 496 Fillable

What is the Fannie Mae Form 496 Fillable

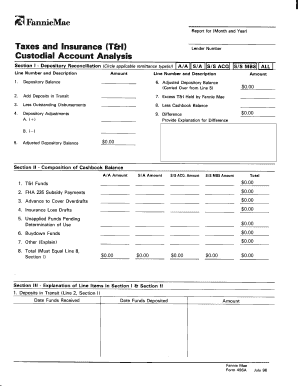

The Fannie Mae Form 496, also known as the FNMA 496, is a document used primarily in the context of mortgage transactions. This form is essential for lenders and borrowers during the underwriting process, as it provides critical information regarding the borrower's financial situation and the property involved. The fillable version of this form allows users to complete it digitally, ensuring a more efficient and organized approach to document management.

How to use the Fannie Mae Form 496 Fillable

To use the Fannie Mae Form 496 fillable, individuals must access the form through a reliable electronic document management system. Users can fill in their information directly into the form fields, which often include personal details, financial data, and property specifics. Once completed, the form can be electronically signed, allowing for a seamless submission process. Utilizing a platform that complies with eSignature laws ensures that the form is legally binding.

Steps to complete the Fannie Mae Form 496 Fillable

Completing the Fannie Mae Form 496 fillable involves several straightforward steps:

- Access the fillable form through a secure platform.

- Enter personal information, including name, address, and contact details.

- Provide financial information, such as income, debts, and assets.

- Include details about the property being financed, including its address and value.

- Review the completed form for accuracy and completeness.

- Sign the form electronically to validate it.

- Submit the form as instructed, either online or through other specified methods.

Legal use of the Fannie Mae Form 496 Fillable

The legal use of the Fannie Mae Form 496 fillable is governed by various regulations surrounding electronic signatures and document submissions. To ensure the form is considered valid, it must comply with the ESIGN Act and UETA, which establish the legality of electronic signatures in the United States. Additionally, using a secure platform that provides an audit trail and encryption enhances the form's legal standing.

Key elements of the Fannie Mae Form 496 Fillable

Key elements of the Fannie Mae Form 496 fillable include:

- Borrower information: Personal details of the borrower, including employment and income.

- Property details: Information about the property being financed, including its location and value.

- Financial disclosures: A comprehensive overview of the borrower's financial status, including debts and assets.

- Signature section: A designated area for the borrower to sign electronically, affirming the accuracy of the provided information.

Form Submission Methods

The Fannie Mae Form 496 can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online submission via a secure electronic document platform.

- Mailing a printed copy of the completed form to the lender.

- In-person delivery at the lender's office, if required.

Quick guide on how to complete fnma form 496a

Accomplish fnma form 496a effortlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the right form and securely archive it online. airSlate SignNow provides you with all the resources necessary to create, adjust, and electronically sign your documents promptly without delays. Handle fannie mae form 496 on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign 496a fnma form without hassle

- Find fannie mae form 496 fillable and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign fnma 496a and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to excel form 496 fnma

Create this form in 5 minutes!

How to create an eSignature for the fannie mae form 496 and 496a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask fnma 496a pdf

-

What is the Fannie Mae Form 496 used for?

The Fannie Mae Form 496 is used to report the details of financing and loan applications. This form is essential for lenders and borrowers as it ensures compliance with Fannie Mae guidelines, facilitating smoother loan processing. By utilizing airSlate SignNow, users can easily complete and eSign the Fannie Mae Form 496 for fast, efficient transactions.

-

How does airSlate SignNow simplify the signing process for the Fannie Mae Form 496?

airSlate SignNow provides an intuitive platform that allows users to eSign the Fannie Mae Form 496 quickly. The software eliminates the need for printing, scanning, or faxing, making the signing process seamless. With a few clicks, you can ensure that your form is filled out correctly and returned promptly.

-

Is airSlate SignNow a cost-effective solution for managing the Fannie Mae Form 496?

Yes, airSlate SignNow offers competitive pricing that makes it an affordable option for businesses that need to manage the Fannie Mae Form 496 regularly. With subscription plans tailored to different needs, users can choose a plan that fits their budget while accessing all necessary features. This cost-effective approach helps save both time and money.

-

Can I integrate airSlate SignNow with other applications to manage the Fannie Mae Form 496?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. These integrations enhance your workflow by allowing easy access and management of the Fannie Mae Form 496 alongside your existing tools, improving overall efficiency.

-

What are the key benefits of using airSlate SignNow for the Fannie Mae Form 496?

Using airSlate SignNow for the Fannie Mae Form 496 provides several key benefits, including enhanced security, accessibility, and improved document tracking. Users can safely store their forms and access them anytime, anywhere. Additionally, real-time notifications keep you updated on the status of your signed documents.

-

How can airSlate SignNow help with compliance for the Fannie Mae Form 496?

airSlate SignNow ensures compliance with regulations pertaining to the Fannie Mae Form 496 by providing legally binding eSignatures. The platform also offers audit trails and secure storage, which help verify that documents are managed according to Fannie Mae standards. This compliance capability minimizes the risk of errors and potential legal issues.

-

What types of businesses benefit most from using airSlate SignNow for the Fannie Mae Form 496?

Businesses in the real estate and lending sectors benefit signNowly from using airSlate SignNow for the Fannie Mae Form 496. Mortgage brokers, lenders, and real estate agents can streamline their document workflows and enhance customer experience by quickly getting forms signed. This efficiency leads to faster closings and improved client satisfaction.

Get more for fannie mae form 496

Find out other 496a fnma form

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form