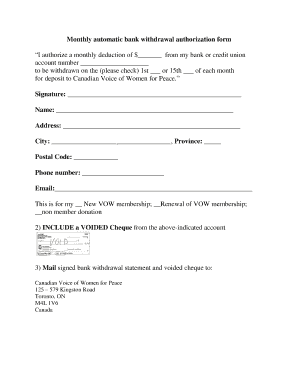

Monthly Automatic Bank Withdrawal Authorization Form

What is the automatic withdrawal form?

The automatic withdrawal form, also known as the withdrawal authorization form, is a document that allows individuals to authorize a financial institution or service provider to withdraw funds directly from their bank account on a recurring basis. This form is commonly used for monthly payments, such as subscriptions, loans, or utility bills. By completing this form, the account holder grants permission for automatic withdrawals, ensuring that payments are made on time without the need for manual intervention.

Key elements of the automatic withdrawal form

Several key elements must be included in the automatic withdrawal form to ensure its validity and effectiveness. These elements typically include:

- Account Holder Information: Full name, address, and contact details of the individual authorizing the withdrawal.

- Bank Account Details: The bank name, account number, and routing number where the funds will be withdrawn.

- Payment Amount: The specific amount to be withdrawn on a regular basis.

- Withdrawal Frequency: The schedule for withdrawals, such as weekly, monthly, or annually.

- Authorization Signature: The signature of the account holder, which confirms their consent for the automatic withdrawals.

Steps to complete the automatic withdrawal form

Completing the automatic withdrawal form involves a straightforward process. Follow these steps to ensure accuracy:

- Obtain the form from your financial institution or service provider.

- Fill in your personal information, including your name, address, and contact details.

- Provide your bank account information, ensuring that the account number and routing number are correct.

- Specify the amount to be withdrawn and the frequency of the withdrawals.

- Review the information for accuracy before signing the form.

- Submit the completed form to the designated recipient, whether online, by mail, or in person.

Legal use of the automatic withdrawal form

The automatic withdrawal form is legally binding once it is completed and signed by the account holder. It is essential to ensure that the form complies with relevant laws and regulations governing electronic signatures and financial transactions. In the United States, the ESIGN Act and UETA provide a legal framework for electronic signatures, ensuring that digital forms are recognized as valid. To enhance legal protection, using a trusted electronic signature solution can provide additional compliance and security measures.

How to use the automatic withdrawal form

Using the automatic withdrawal form effectively involves understanding its purpose and ensuring that it is filled out correctly. Once the form is completed and submitted, the financial institution or service provider will initiate the automatic withdrawals as specified. It is important to monitor your bank account to ensure that the withdrawals occur as planned. If any changes are needed, such as altering the withdrawal amount or frequency, a new form may need to be submitted to update the authorization.

Form submission methods

The automatic withdrawal form can typically be submitted through various methods, depending on the policies of the financial institution or service provider. Common submission methods include:

- Online: Many institutions allow for electronic submission through their websites or mobile apps.

- Mail: A physical copy of the form can be printed and mailed to the appropriate address.

- In-Person: The form can be submitted directly at a branch location for immediate processing.

Quick guide on how to complete monthly automatic bank withdrawal authorization form

Effortlessly Complete Monthly Automatic Bank Withdrawal Authorization Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed materials, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly and without delays. Manage Monthly Automatic Bank Withdrawal Authorization Form across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and eSign Monthly Automatic Bank Withdrawal Authorization Form Without Strain

- Locate Monthly Automatic Bank Withdrawal Authorization Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Monthly Automatic Bank Withdrawal Authorization Form while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly automatic bank withdrawal authorization form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a direct withdrawal form and how does it work?

A direct withdrawal form is a document that allows businesses to authorize funds to be withdrawn directly from a bank account. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining the process for automatic payments and reducing errors. This ensures that transactions are processed swiftly and securely.

-

How can I create a direct withdrawal form using airSlate SignNow?

Creating a direct withdrawal form with airSlate SignNow is simple. You can use our intuitive template editor to customize the form according to your requirements and then send it out for eSigning. Our platform offers step-by-step guidance, making the creation process efficient and user-friendly.

-

Is there a cost associated with using airSlate SignNow for direct withdrawal forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our pricing is designed to be cost-effective, ensuring you get value for your investment, particularly when using features like direct withdrawal forms. You can choose a plan that fits your budget while benefiting from our comprehensive document signing solutions.

-

What features does airSlate SignNow offer for managing direct withdrawal forms?

airSlate SignNow provides a range of features for managing direct withdrawal forms, including customizable templates, real-time tracking, and automated reminders. Additionally, our secure eSignature functionality ensures that all transactions are legally binding and compliant. These features enhance efficiency and streamline your document management process.

-

Can I integrate airSlate SignNow with other software for direct withdrawal forms?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing you to link your direct withdrawal forms with your existing systems. This integration capability enables seamless workflows, maintaining consistency in your data and improving the overall effectiveness of your document management strategies.

-

What are the benefits of using a direct withdrawal form for my business?

Using a direct withdrawal form streamlines payment processes, reduces manual errors, and saves time for both businesses and their clients. With airSlate SignNow, you can ensure that these forms are securely eSigned and easily stored for future reference. This efficiency helps in maintaining positive cash flow and strengthens customer relations.

-

Are direct withdrawal forms secure with airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. Our platform employs advanced encryption and authentication measures to keep your direct withdrawal forms safe from unauthorized access. You can confidently manage sensitive financial information, knowing that our technology protects your data.

Get more for Monthly Automatic Bank Withdrawal Authorization Form

- Onlineacuedu 401043236 form

- Energexform1641

- Brightspace holmesglen form

- Sublimation order form blackchrome sportswear

- Australia post domestic lodgement form

- Australia enagic product order form

- Rescript feb 2010pub pharmaceutical society of western pswa org form

- Volleyball score sheet sacssgsa cesa catholic edu form

Find out other Monthly Automatic Bank Withdrawal Authorization Form

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors