Plans 1 and 2 Withdrawal of Retirement Contributions 2020-2026

What is the Plans 1 And 2 Withdrawal Of Retirement Contributions

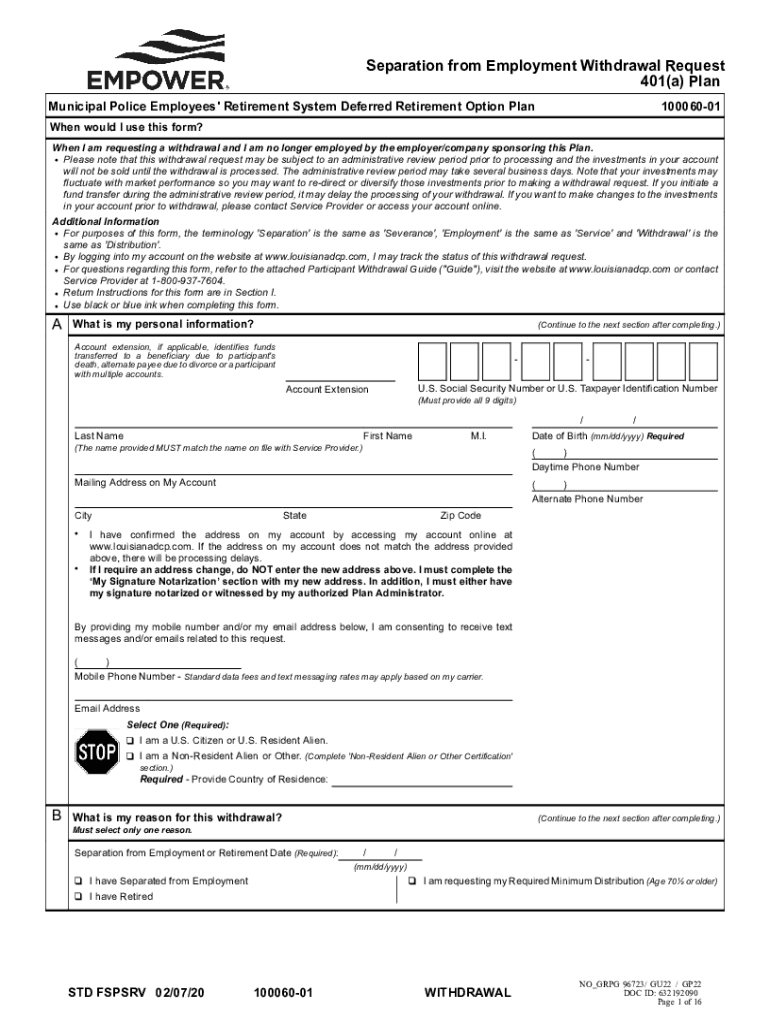

The Plans 1 and 2 Withdrawal of Retirement Contributions allows participants to access their retirement savings under specific circumstances. This withdrawal option is designed to provide financial relief while ensuring that individuals remain compliant with retirement plan regulations. Understanding the eligibility criteria and the implications of withdrawing funds is crucial for making informed decisions regarding your retirement savings.

How to use the Plans 1 And 2 Withdrawal Of Retirement Contributions

To utilize the Plans 1 and 2 Withdrawal of Retirement Contributions, participants must first confirm their eligibility. After verifying eligibility, individuals can initiate the withdrawal process by completing the required forms. It is important to provide accurate information and ensure all necessary documentation is included to avoid delays. Additionally, participants should consider the tax implications and potential penalties associated with early withdrawals.

Steps to complete the Plans 1 And 2 Withdrawal Of Retirement Contributions

Completing the Plans 1 and 2 Withdrawal of Retirement Contributions involves several key steps:

- Review eligibility requirements for withdrawal.

- Gather necessary documentation, including identification and proof of need.

- Complete the withdrawal application form accurately.

- Submit the application through the designated method, whether online, by mail, or in person.

- Monitor the status of your application and follow up if necessary.

Legal use of the Plans 1 And 2 Withdrawal Of Retirement Contributions

The legal use of the Plans 1 and 2 Withdrawal of Retirement Contributions is governed by specific regulations that ensure compliance with federal and state laws. Participants must adhere to the guidelines set forth by the plan administrators to ensure that their withdrawals are considered valid. Understanding these legal frameworks helps protect participants from potential penalties and ensures that their retirement savings remain secure.

Eligibility Criteria

Eligibility for the Plans 1 and 2 Withdrawal of Retirement Contributions typically includes factors such as age, employment status, and the reason for withdrawal. Common qualifying reasons may include financial hardship, medical expenses, or educational costs. It is essential for participants to review the specific criteria outlined by their retirement plan to determine their eligibility before proceeding with the withdrawal process.

Required Documents

When applying for the Plans 1 and 2 Withdrawal of Retirement Contributions, participants must provide several key documents. These may include:

- A completed withdrawal application form.

- Proof of identity, such as a government-issued ID.

- Documentation supporting the reason for withdrawal, such as medical bills or educational invoices.

Ensuring that all required documents are submitted accurately will facilitate a smoother withdrawal process.

Form Submission Methods (Online / Mail / In-Person)

Participants can submit their Plans 1 and 2 Withdrawal of Retirement Contributions application through various methods. Common submission options include:

- Online submission via the designated retirement plan portal.

- Mailing the completed form to the appropriate address provided by the plan administrator.

- Delivering the application in person at a specified location, if available.

Choosing the most convenient submission method can help expedite the processing of the withdrawal request.

Quick guide on how to complete plans 1 and 2 withdrawal of retirement contributions

Effortlessly prepare Plans 1 And 2 Withdrawal Of Retirement Contributions on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly without delays. Manage Plans 1 And 2 Withdrawal Of Retirement Contributions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Plans 1 And 2 Withdrawal Of Retirement Contributions with ease

- Locate Plans 1 And 2 Withdrawal Of Retirement Contributions and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, painstaking form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Plans 1 And 2 Withdrawal Of Retirement Contributions and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct plans 1 and 2 withdrawal of retirement contributions

Create this form in 5 minutes!

How to create an eSignature for the plans 1 and 2 withdrawal of retirement contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is empowermyretirement com and how does it work?

Empowermyretirement com is a digital platform that simplifies document management by allowing businesses to send and eSign documents efficiently. It helps users easily manage their retirement-related documents while ensuring security and compliance. This solution enhances productivity and streamlines processes for both employees and employers.

-

What are the key features of empowermyretirement com?

Empowermyretirement com offers several key features, including easy document eSigning, real-time tracking of document status, and customizable templates. Additionally, it provides secure storage for signed documents and integration options with various business tools. These features work together to make document management seamless and efficient.

-

How does empowermyretirement com benefit businesses?

By using empowermyretirement com, businesses can reduce paperwork and administrative tasks, resulting in signNow time savings. The platform enhances workflow efficiency and helps ensure compliance with legal standards for document management. It also allows for quicker turnaround times in document processing, which can lead to improved customer satisfaction.

-

What pricing plans are available for empowermyretirement com?

Empowermyretirement com offers flexible pricing plans tailored to meet the needs of various businesses. Users can choose from monthly subscriptions or annual plans, which provide cost savings for long-term use. It's essential to contact the sales team or visit the website for detailed pricing and any available promotional offers.

-

Can empowermyretirement com integrate with other software?

Yes, empowermyretirement com supports integration with various third-party software, including CRM systems, document management tools, and cloud storage services. This makes it easier for businesses to incorporate the eSigning solution into their existing workflows. Integration enhances the overall efficiency of document processing in the workplace.

-

Is my data secure with empowermyretirement com?

Data security is a priority at empowermyretirement com. The platform employs advanced encryption methods and secure servers to protect sensitive information during transmission and storage. Regular security audits and compliance with industry standards also ensure that your documents are safe and secure.

-

What type of customer support does empowermyretirement com offer?

Empowermyretirement com provides comprehensive customer support, including live chat, email assistance, and phone support during business hours. Users can access a detailed knowledge base with tutorials and FAQs to help them navigate the platform. This commitment to customer service ensures that users get the help they need promptly.

Get more for Plans 1 And 2 Withdrawal Of Retirement Contributions

Find out other Plans 1 And 2 Withdrawal Of Retirement Contributions

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now