Maine Seller's Property Disclosure Form

What is the Maine Seller's Property Disclosure Form

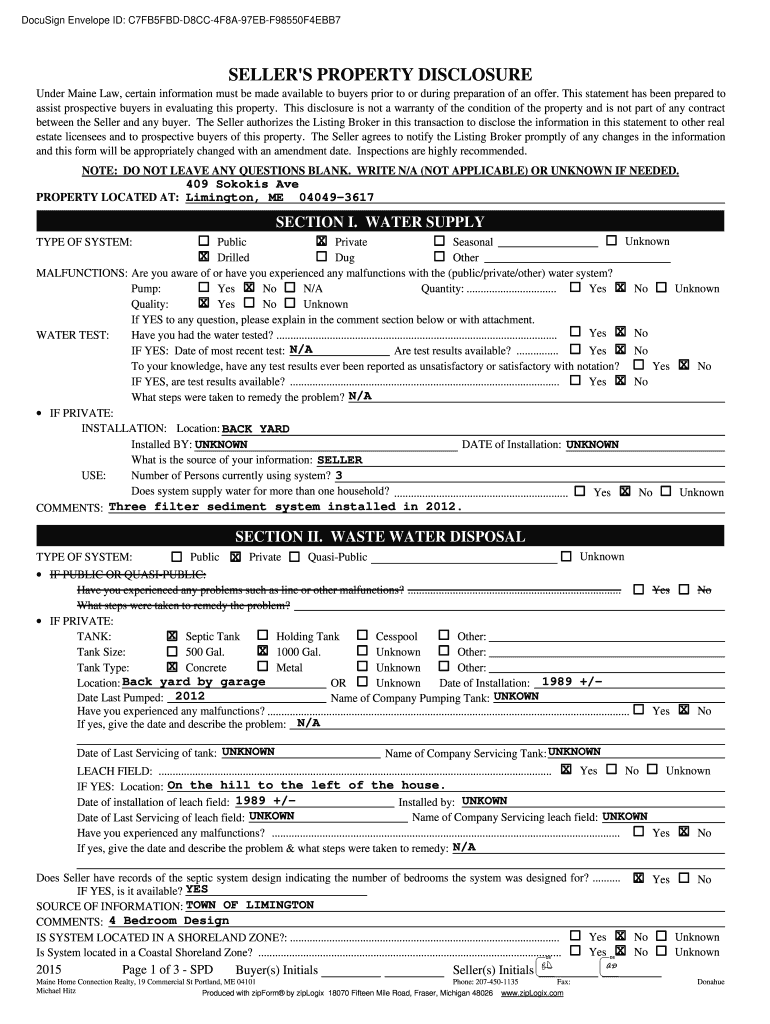

The Maine Seller's Property Disclosure Form is a legal document that sellers of residential real estate in Maine are required to complete. This form provides potential buyers with essential information regarding the condition of the property, including any known defects or issues. The disclosure aims to promote transparency in real estate transactions, ensuring that buyers are informed about the property's history and condition before making a purchase. It is important for sellers to provide accurate and complete information, as failure to do so can lead to legal consequences.

Key elements of the Maine Seller's Property Disclosure Form

The Maine Seller's Property Disclosure Form includes several key elements that sellers must address. These elements typically cover:

- Property Condition: Sellers must disclose any known issues with the structure, systems, or appliances.

- Environmental Hazards: Information about potential hazards such as lead paint, asbestos, or radon must be included.

- Legal Issues: Any ongoing legal disputes related to the property should be disclosed.

- Renovations and Repairs: Sellers should detail any significant renovations or repairs made to the property.

Providing this information helps protect both the seller and the buyer during the transaction process.

Steps to complete the Maine Seller's Property Disclosure Form

Completing the Maine Seller's Property Disclosure Form involves several straightforward steps:

- Gather Information: Collect all relevant details about the property, including past repairs, renovations, and known issues.

- Fill Out the Form: Carefully complete each section of the form, ensuring that all information is accurate and thorough.

- Review the Form: Double-check the completed form for any omissions or errors before signing.

- Sign and Date: Both the seller and any co-owners must sign and date the form to validate it.

Following these steps ensures that the form is completed correctly and meets legal requirements.

Legal use of the Maine Seller's Property Disclosure Form

The Maine Seller's Property Disclosure Form is legally binding when properly executed. Sellers must provide this form to potential buyers as part of the real estate transaction process. If a seller fails to disclose known issues, they may face legal repercussions, including lawsuits for misrepresentation. It is crucial for sellers to understand their obligations under Maine law and to complete the form honestly and thoroughly.

How to obtain the Maine Seller's Property Disclosure Form

Sellers can obtain the Maine Seller's Property Disclosure Form through various sources. Typically, real estate agents provide the form as part of their services. Additionally, the Maine Association of Realtors offers downloadable versions of the form on its website. Sellers can also access the form through legal and real estate offices that specialize in property transactions. Ensuring that the most current version of the form is used is important for compliance with state regulations.

Digital vs. Paper Version

The Maine Seller's Property Disclosure Form can be completed in both digital and paper formats. Digital completion offers several advantages, including easier storage, the ability to share the form electronically, and enhanced security features. On the other hand, some sellers may prefer a paper version for its simplicity and familiarity. Regardless of the format chosen, it is essential to ensure that the form is filled out accurately and in compliance with Maine's legal requirements.

Quick guide on how to complete seller s property disclosure maine real estate

Complete Maine Seller's Property Disclosure Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Maine Seller's Property Disclosure Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

How to modify and eSign Maine Seller's Property Disclosure Form with ease

- Acquire Maine Seller's Property Disclosure Form and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that reason.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device of your choosing. Modify and eSign Maine Seller's Property Disclosure Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I find property owners willing to sell their real estate with seller financing?

First lets go over that actual logistics of an owner financed deal. There are a couple ways you could buy with owner financing.One option is a Land Contract: In this scenario the current owner or seller keeps the deed in their name. They sign a purchase contract with the buyer with agreed upon terms and the title will not transfer until the terms have been completed, usually years down the road. This scenario is much safer for the seller as the seller has an easier job of taking the property back if the buyer defaults on the payment arrangements.The second option is for the buyer to purchase the property with a private money mortgage from the seller. In this scenario title transfers just like it would with a traditional sale. The seller acts just like a bank would and places a recorded mortgage on the property. This scenario is better for the buyer as title is immediately placed into their name and they do run the risk of the seller being able to place additional liens or encumbrances on the title like the seller would be able to do in a land contract scenario. Now that we got that out of the way we can get into finding owners who are willing to sell you properties via owner financing. Direct mail and online advertising campaigns telling people that you buy houses is the best way to get in front of these sellers. You will want to target owners who own properties free and clear. If there is an existing mortgage on the property it just won't be a good use of your time shaking that tree.

-

How do you approach a seller to get their property under contract when wholesaling in real estate? What do you offer? How much do you offer?

How do you approach a seller to get their property under contract when wholesaling in real estate? What do you offer? How much do you offer?How do you approach a seller?Most wholesalers make an initial approach through some sort of marketing. I generally use postcards. Some people use letters, either regular letters or “yellow letters.” Many rely largely or partially on leads from their websites. In some areas, “driving for dollars” can work.The reason is that relatively few people are interested in selling at any specific time. Beyond that, relatively few of those are in situations or conditions where they’d seriously consider the (generally) low offer from a wholesaler versus the higher amount they could receive by listing with an agent.So which makes more sense: Make 1,000 phone calls and have 6 people say “maybe”? Or send out a 1,000 postcards or letters and have 4 people call you and say “maybe”? (I’m giving a higher response rate to the direct contact because you’re more likely to get a “maybe” or even a “yes” that way.) Consider:Do you have time to make 1,000 phone calls?Can you locate the phone numbers of 1,000 prospects?What is your expense—in time spent and in locating the phone numbers—for those prospects?As a result, it’s generally much more efficient to do an initial marketing effort and then follow up with people who respond.From that point, it’s easy. They’ve contacted you and presumably provided a phone number (or two). You pick up the phone, call the number, and say:“Hello. May I please speak to Mr. Smith.” If the person who answers isn’t Mr. Smith, you say, “I’m returning Mr. Smith’s call about his property at 123 Main Street.” If it is Mr. Smith, you say, “Hi. I’m Delroy Jones. I’m returning your call about your property at 123 Main Street.”Then you get the person to talk a bit about the house. Then you move into why the person wants to sell. Listen to every word, every sentence. Listen for the hesitations. You’ll learn a huge amount just by listening. If Smith doesn’t mention a specific amount, you can ask, “Do you have any figure in mind—a ballpark figure is fine—about what you might consider selling your house for?” Unless the seller is absolutely firm that he/she wants “full price” with some high number for the property, you then make an appointment to take a look at the property.What do you offer? How much do you offer?You offer an amount that a rehabber will pay you minus your wholesaling fee. And that means you need to have a pretty good idea of what rehabbers are willing to pay for the property.The classic formula isMAO=(ARV*0.7)+repair costsMAO=Maximum Allowable OfferARV=After-Repair ValueThat means you’ll need to know what the after-repair value will be. You’ll need a decent idea of the repair costs. And that 70% figure may vary somewhat depending on geography, price of the home, and how hot or cold the market is. In a hot high-priced market you can go to 75% or even a bit higher. In a cooler or lower-priced market, you might be at 65%.Example: The house, when fully fixed up, will sell for $500,000. That’s its ARV.Repair costs—the money to get the house from its current condition to great ARV condition—are $50,000.The MAO is ($500,000*0.7)-$50,000.That equals $300,000.Now subtract your wholesaling fee. Let’s say that’s $10,000.Your MAO—the highest offer you can make and the highest price you can accept—is $290,000.What do you offer? $290,000 or less. Most wholesalers would offer less in order to give themselves some negotiating room. Something like $271,560. (See some books on negotiating—I like the ones by Roger Dawson—on why you’re offering $271,560 rather than perhaps $270,000.)In a nutshell, then, determine what a rehabber will pay. Subtract your wholesaling fee from that. Make the number an odd, specific one, likely a bit lower than the rehabber’s price minus your wholesaling fee. That’s your starting offer.

-

How do I form a real estate investor group to invest into commercial properties?

Commercial real estate of you create new apartments in the sun belt.. It's basically, location, location, location and also cost, quality, and timing to the customer. I moved into a new. Apt complex. The owner cut allot of corners and built the development with allot of cheap labor. He built a website so the tenants could pay automatically. He has. A clubhouse with pool and fitness center. He just sold it after losing it up, for 55 million dollars. He had a good property manager, and loaded the buildings while he was finishing the others. I hear they're dividing up the Waldorf Asteria into condos. Astoria was named after John David Astor ergo had a fur trading company and built the New York Library. Blank Stone it's the largest property owner in the country. Simon Properties tried to by Taubman but Michigan would not let them. Read Rich Dad / Poor Dad. They have their own commercial real estate group. The author can give you advice. Commercial real estate id's chancey if you don't know what you are doing. I would invest with that rich dad poor dad group..Kawasaki sounds honest. He's also a former Vietnam Pilot.

-

Can someone provide me the property disclosure form which is to be filled out by the employees of the UP government as per the instructions by the new CM?

It will be available in the UP Government website. Further you can email or tweet to the Chief Minister of UP requesting for the particular information. The CM is a committed social worker and leads the life a yogi, so everything is transparent about him and his Government.

-

How likely is it for me to win a lawsuit where a seller wants to back out of a signed commercial real estate offer/contract?

Obligatory legalese: I’m not a lawyer and you should consult one for legal advice.Generally speaking, if you have performed as specified in the contract, including putting in deposit, removing any applicable contingencies, and informing seller of your intent to close, then I think you have a pretty good case.However, in practical terms, it’s not clear if you should go to court. Lawyers are expensive and, depending on the contract and the state you’re in, you may not be able to get back your expenses, even if you win. And any case, even a winning one, is going to take a long time to complete; is it really worth your time and aggravation?

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

Hi. Anyone familiary with owning real estate in a different state? I own a property in Texas and recently just moved to Arizona. Is there any paperwork I should fill out with Texas?

Each state has different laws regarding tax liabilities, etc. Speak with an attorney and a tax professional in your state of residence, as well as the other state(s) in which you own real estate to learn about the implications. All the best to you!

-

Real Estate: How do I best structure a rental property if the bank refuses to title it to an LLC but I still want to operate it out of an LLC?

The bank doesn’t have anything to do with the title to the property.The bank makes loans.What you seem to be saying is that you are buying the property with a partner and you want the bank to loan money to an LLC.Why would the bank do that?The bank needs a first lien on the property to secure the loan. Only the owner of the property can give the bank a first lien. That is you and your partner.If you are saying that you want to create a Limited Liability Company (LLC) with you and your partner as the sole owners, and then have the LLC purchase the property, and you want the bank to loan the money to the LLC to purchase the property, then the answer is simple.The bank is the one who makes the decision about loaning money.If the bank is not comfortable loaning money to a company that, by its very nature and name, has no liability for paying it back, beyond foreclosure on the property, then the bank will not loan the money.The bank would prefer that you and your partner borrow the money.That way, if you do not pay it back, the bank will foreclose on the property and sell it at auction and apply the net proceeds to satisfy your loan.And then, the bank will sue you for the remaining balance and get a deficiency judgment against you for the unpaid part of the loan.And that’s why banks will not loan to an LLC, but will loan to the owner of the LLC.Plus, and I don’t want to scare you with this, if you try to pull some stunt to get around this, you are operating in the area that is called “fraud” and you really don’t want to go there.Accept the decision of the bank, and look for a commercial loan, or to private “hard money lenders” to provide the funds.I hope this helps.Good Luck.Michael Lantrip, Author “How To Do A Section 1031 Like Kind Exchange.”

-

Is my real estate agent being honest? He said he has to pay $100 to Zillow each time someone fills out the contact listing agent form on my house. True?

Not to my knowledge. In my area, the way Zillow works is it pulls listings from the MLS (multiple listing service) unless I check a box that says the seller prohibits this. So it’s no more work for me to list your property on Zillow than in the MLS. Zillow sells real estate agents “leads” (queries about specific properties) or (in a new program) takes a % of the brokerage fee after a property has closed. Contacting agents online is free to both parties.

Create this form in 5 minutes!

How to create an eSignature for the seller s property disclosure maine real estate

How to make an electronic signature for the Seller S Property Disclosure Maine Real Estate in the online mode

How to create an eSignature for the Seller S Property Disclosure Maine Real Estate in Google Chrome

How to make an electronic signature for putting it on the Seller S Property Disclosure Maine Real Estate in Gmail

How to make an electronic signature for the Seller S Property Disclosure Maine Real Estate from your smart phone

How to make an electronic signature for the Seller S Property Disclosure Maine Real Estate on iOS

How to generate an eSignature for the Seller S Property Disclosure Maine Real Estate on Android OS

People also ask

-

What is the Maine property disclosure form 2024?

The Maine property disclosure form 2024 is a legal document required for sellers to disclose known defects and conditions of their property. This form ensures that buyers are fully aware of any issues before purchasing a property, promoting transparency in real estate transactions. Using airSlate SignNow facilitates easy eSigning, ensuring fast compliance with these requirements.

-

How can airSlate SignNow help me with the Maine property disclosure form 2024?

airSlate SignNow offers a simple, efficient platform for filling out and eSigning the Maine property disclosure form 2024. You can easily upload, edit, and send the form to potential buyers while ensuring that it meets all legal requirements. Our user-friendly interface makes managing property documents effortless.

-

Is there a cost associated with using airSlate SignNow for the Maine property disclosure form 2024?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on your usage, you can choose a plan that suits your requirements for managing documents like the Maine property disclosure form 2024. Our solutions are cost-effective and tailored to provide maximum value.

-

What features does airSlate SignNow provide for the Maine property disclosure form 2024?

airSlate SignNow provides features such as customizable templates, real-time tracking, and cloud storage, which are beneficial for managing the Maine property disclosure form 2024. Additionally, features like team collaboration and mobile accessibility empower users to work efficiently from anywhere. This flexibility enhances your document handling experience.

-

Can I integrate airSlate SignNow with other tools for the Maine property disclosure form 2024?

Yes, airSlate SignNow easily integrates with numerous applications, making it convenient to manage the Maine property disclosure form 2024 alongside your existing workflow. You can connect it with CRM systems, cloud storage solutions, and more for seamless operations. This integration enhances productivity and streamlines the document process.

-

What are the benefits of using airSlate SignNow for the Maine property disclosure form 2024?

Using airSlate SignNow for the Maine property disclosure form 2024 ensures faster turnaround times, improved compliance, and enhanced security for your documents. The ability to eSign and send documents quickly reduces delays and increases transaction efficiency. Moreover, our platform is designed to protect sensitive information, giving you peace of mind.

-

Is electronic signing of the Maine property disclosure form 2024 legally valid?

Yes, electronic signatures on the Maine property disclosure form 2024 are legally valid and recognized under the Electronic Signatures in Global and National Commerce (ESIGN) Act. Using airSlate SignNow ensures that your eSignatures meet all legal requirements, providing a secure and efficient way to complete your real estate transactions. This streamlines the process for both buyers and sellers.

Get more for Maine Seller's Property Disclosure Form

Find out other Maine Seller's Property Disclosure Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors