Schedule K 1 565 Partner's Share of Income, Deductions Ftb Ca Form

What is the Schedule K-1 (565) Partner's Share of Income, Deductions FTB CA?

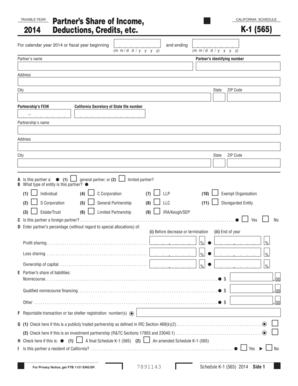

The Schedule K-1 (565) is a tax form used in California to report a partner's share of income, deductions, credits, and other tax-related items from a partnership. This form is essential for partners in partnerships, limited liability companies (LLCs), and certain other business structures to accurately report their income on their personal tax returns. The California Franchise Tax Board (FTB) requires this form to ensure that all income earned by partners is reported and taxed appropriately.

How to Use the Schedule K-1 (565) Partner's Share of Income, Deductions FTB CA

To use the Schedule K-1 (565), partners must first receive the form from the partnership or LLC in which they hold an interest. This form will detail the partner's share of the entity's income, deductions, and credits for the tax year. Partners should carefully review the information provided on the K-1 to ensure accuracy before using it to complete their individual tax returns. The data reported on the K-1 will be incorporated into the partner's Form 540 or 1040, depending on their residency status.

Steps to Complete the Schedule K-1 (565) Partner's Share of Income, Deductions FTB CA

Completing the Schedule K-1 (565) involves several key steps:

- Gather all necessary financial information from the partnership or LLC.

- Fill out the partner's identifying information, including name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and credits as provided by the partnership.

- Ensure all amounts are accurately reflected, as discrepancies can lead to issues with the FTB.

- Submit the completed K-1 to the FTB along with the partner's individual tax return.

Key Elements of the Schedule K-1 (565) Partner's Share of Income, Deductions FTB CA

The Schedule K-1 (565) includes several key elements that partners need to understand:

- Partner Information: Includes the partner's name, address, and identification number.

- Partnership Information: Details about the partnership, including its name and identification number.

- Income and Deductions: Specific amounts that represent the partner's share of the partnership's income, deductions, and credits.

- Tax Year: The tax year for which the K-1 is being issued, which is crucial for accurate reporting.

Legal Use of the Schedule K-1 (565) Partner's Share of Income, Deductions FTB CA

The Schedule K-1 (565) is legally binding and must be completed accurately to comply with California tax laws. Partners are responsible for reporting the information from the K-1 on their tax returns. Failure to report the income or discrepancies in the information can lead to penalties and interest charges from the FTB. It is essential for partners to retain a copy of the K-1 for their records and for any future audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-1 (565) typically align with the partnership's tax return deadlines. Partnerships must provide K-1 forms to their partners by March 15 for calendar year filers. Partners should ensure they receive their K-1 in time to incorporate it into their individual tax returns, which are generally due on April 15. It is advisable to verify specific deadlines each tax year, as they may vary.

Quick guide on how to complete schedule k 1 565 partners share of income deductions ftb ca

Complete Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Handle Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and eSign Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca without hassle

- Obtain Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional signature in ink.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 565 partners share of income deductions ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca?

Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca is a tax form used by partnership entities to report each partner's share of income, deductions, and credits. It is essential for tax compliance and helps partners accurately report their earnings to the Franchise Tax Board in California.

-

How does airSlate SignNow help in managing Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca documents?

airSlate SignNow streamlines the management of Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca documents by allowing users to easily create, send, and eSign forms electronically. The platform ensures that your documents are secure and compliant with legal standards, reducing the hassle of paperwork.

-

What features does airSlate SignNow offer for preparing Schedule K 1 565 documents?

airSlate SignNow offers various features for preparing Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca documents, including customizable templates, automated workflows, and real-time collaboration. These features enhance efficiency and ensure that your forms are accurate and ready for submission.

-

Is airSlate SignNow cost-effective for managing Schedule K 1 565 forms?

Yes, airSlate SignNow is a cost-effective solution for managing Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca forms. With flexible pricing plans, businesses of all sizes can access powerful eSigning and document management tools without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software for Schedule K 1 565 templates?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing seamless access to your Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca templates. This integration simplifies the process of managing financial documents and ensures accurate data transfer.

-

What are the benefits of using airSlate SignNow for Schedule K 1 565 document eSigning?

Using airSlate SignNow for eSigning Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca documents provides several benefits, including enhanced security, increased speed of approvals, and reduced paper usage. Digital signatures are legally binding and help to expedite the tax preparation process.

-

How does airSlate SignNow enhance the security of Schedule K 1 565 forms?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance protocols for all Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca documents. This ensures that sensitive financial information remains confidential and secure throughout the signing process.

Get more for Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca

- In the district court of the judicial isc idaho 6969090 form

- Illinois national guardsmansamp39s and naval illinois secretary of state form

- Transcript request form dupage county illinois dupageco

- Claimed form

- Subpoena subpoena duces tecum dekalbcountyorg form

- Managing cases with pro se litigants ingov form

- No 17 1351 us case law justia in form

- No contact order supplement to confidential form for multiple protected parties in

Find out other Schedule K 1 565 Partner's Share Of Income, Deductions Ftb Ca

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free