Ca 565 K 1 Form

What is the CA 565 K 1?

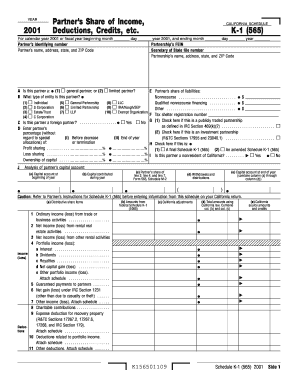

The CA 565 K 1 form is a tax document used primarily by partnerships in California to report income, deductions, and credits to the state. This form provides necessary information for each partner regarding their share of the partnership's income, which they must report on their individual tax returns. Understanding the CA 565 K 1 is essential for both the partnership and its partners to ensure compliance with California tax regulations.

How to Use the CA 565 K 1

Using the CA 565 K 1 involves several steps. First, the partnership must accurately complete the form, detailing the income, deductions, and credits allocated to each partner. Once completed, the partnership provides a copy of the CA 565 K 1 to each partner, who will then use this information when filing their personal tax returns. It is crucial for partners to retain this form for their records, as it serves as proof of their income from the partnership.

Steps to Complete the CA 565 K 1

Completing the CA 565 K 1 requires careful attention to detail. Here are the steps involved:

- Gather financial records related to the partnership's income and expenses.

- Fill out the partnership's income, deductions, and credits on the CA 565 K 1 form.

- Allocate the income and deductions to each partner based on their partnership agreement.

- Review the completed form for accuracy and completeness.

- Distribute copies of the CA 565 K 1 to each partner for their tax filings.

Legal Use of the CA 565 K 1

The CA 565 K 1 form is legally binding when used correctly. It must be filled out in accordance with California tax laws and regulations. Each partner's share of income reported on the form must match the partnership's records to avoid discrepancies during audits. Proper use of the CA 565 K 1 ensures that both the partnership and its partners remain compliant with state tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the CA 565 K 1 are critical to avoid penalties. Generally, the form must be filed with the California Franchise Tax Board by the fifteenth day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this typically falls on April fifteenth. Partners should also be aware of their individual filing deadlines to ensure they report the information accurately and on time.

Who Issues the Form

The CA 565 K 1 form is issued by the California Franchise Tax Board (FTB). The FTB is responsible for overseeing tax compliance in California and provides the necessary forms and guidelines for partnerships and their partners. It is important for partnerships to refer to the FTB for the most current version of the CA 565 K 1 and any updates to filing requirements.

Quick guide on how to complete ca 565 k 1

Effortlessly prepare Ca 565 K 1 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Ca 565 K 1 across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Ca 565 K 1 effortlessly

- Obtain Ca 565 K 1 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow efficiently takes care of all your document management needs with just a few clicks from any device. Modify and eSign Ca 565 K 1 to facilitate seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca 565 k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 565 k 1 form and why is it important?

The 565 k 1 form is a crucial tax document that reports income, deductions, and credits for partnerships. Understanding this form is essential for businesses leveraging airSlate SignNow to streamline their documentation process. With our platform, eSigning and managing the 565 k 1 becomes efficient and seamless.

-

How can airSlate SignNow help with the 565 k 1 form preparations?

airSlate SignNow simplifies the preparation of the 565 k 1 form by allowing users to fill out and eSign documents electronically. This digital approach minimizes errors and ensures compliance, saving valuable time for businesses navigating tax obligations. Users can also benefit from centralized storage and easy access to their forms.

-

What are the pricing options for airSlate SignNow when dealing with the 565 k 1 form?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes that need to manage the 565 k 1 form. Our cost-effective solutions ensure that you only pay for what you need, while gaining access to essential features that enhance document management and eSigning processes.

-

Can I integrate airSlate SignNow with other software for handling the 565 k 1 form?

Yes, airSlate SignNow provides seamless integrations with various accounting and tax software, making it easy to manage the 565 k 1 form. This integration allows you to import data directly from your accounting software, reducing manual entry and minimizing errors for enhanced efficiency.

-

What features does airSlate SignNow offer to enhance my experience with the 565 k 1 form?

airSlate SignNow comes equipped with a range of features tailored to help businesses handle the 565 k 1 form effectively. Key features include customizable templates, bulk sending, reminders for signatures, and real-time tracking of document status, ensuring a smooth eSigning experience.

-

Is airSlate SignNow legally binding for the 565 k 1 form?

Absolutely! Documents signed through airSlate SignNow, including the 565 k 1 form, are legally binding and comply with applicable electronic signature laws. This gives users peace of mind knowing that their signed documents are recognized as valid by regulatory authorities.

-

How secure is airSlate SignNow when managing the 565 k 1 form?

Security is a priority at airSlate SignNow, especially when handling sensitive documents like the 565 k 1 form. We provide enterprise-grade security measures, including data encryption and secure server infrastructure, ensuring that your information remains protected throughout the eSigning process.

Get more for Ca 565 K 1

Find out other Ca 565 K 1

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors