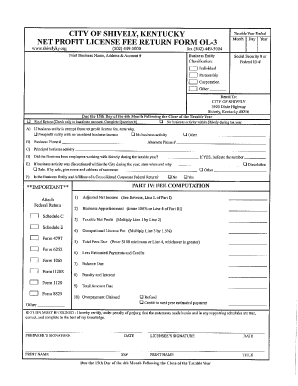

NET PROFIT LICENSE FEE RETURN FORM OL 3 Om 3y Ear

What is the city of Mayfield KY net profit license fee return?

The city of Mayfield, Kentucky, requires businesses to file a net profit license fee return to determine their net profit for the year. This form is essential for calculating the applicable license fee based on the business's earnings. It is typically filed annually and is crucial for local tax compliance. The net profit license fee return ensures that businesses contribute fairly to the local economy based on their financial performance.

Steps to complete the city of Mayfield KY net profit license fee return

Completing the net profit license fee return involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, balance sheets, and any other records that detail your business's earnings.

- Calculate Net Profit: Determine your net profit by subtracting allowable expenses from your total income. This figure will be used to assess your license fee.

- Fill Out the Form: Accurately complete the net profit license fee return form, ensuring all figures are correct and supported by your financial records.

- Review for Accuracy: Double-check your calculations and information to avoid errors that could lead to penalties.

- Submit the Form: File the completed form by the designated deadline, following the submission methods outlined by the city.

Filing deadlines for the city of Mayfield KY net profit license fee return

It is important to be aware of the filing deadlines for the net profit license fee return. Typically, businesses must submit their returns by April 15 of the following year. However, it is advisable to check for any updates or changes to deadlines each tax year, as local regulations may vary.

Required documents for the city of Mayfield KY net profit license fee return

When preparing to file the net profit license fee return, businesses should have the following documents ready:

- Income statements detailing total revenue.

- Expense reports outlining all business-related costs.

- Previous year’s tax returns for reference.

- Any additional documentation that supports your financial claims.

Penalties for non-compliance with the city of Mayfield KY net profit license fee return

Failure to file the net profit license fee return on time can result in penalties. Businesses may face fines or interest on unpaid fees, which can accumulate over time. Additionally, non-compliance may lead to further legal action or restrictions on business operations within the city. It is essential to adhere to filing requirements to avoid these consequences.

Digital vs. paper version of the city of Mayfield KY net profit license fee return

Businesses have the option to complete the net profit license fee return either digitally or on paper. The digital version allows for easier submission and record-keeping, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is crucial to ensure that all information is accurately reported and submitted by the deadline.

Quick guide on how to complete net profit license fee return form ol 3 om 3y ear

Complete NET PROFIT LICENSE FEE RETURN FORM OL 3 Om 3y Ear effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without any delays. Manage NET PROFIT LICENSE FEE RETURN FORM OL 3 Om 3y Ear on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign NET PROFIT LICENSE FEE RETURN FORM OL 3 Om 3y Ear with ease

- Locate NET PROFIT LICENSE FEE RETURN FORM OL 3 Om 3y Ear and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a traditional handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Forget about mislaid or lost documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign NET PROFIT LICENSE FEE RETURN FORM OL 3 Om 3y Ear and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the net profit license fee return form ol 3 om 3y ear

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Mayfield KY net profit license fee return process?

The city of Mayfield KY net profit license fee return process requires businesses to calculate their net profits and submit the appropriate fee. You must file returns annually or quarterly based on your business's revenue. airSlate SignNow can streamline this process by allowing you to eSign and send your documents efficiently.

-

How does airSlate SignNow help with the city of Mayfield KY net profit license fee return?

airSlate SignNow simplifies the city of Mayfield KY net profit license fee return by providing a platform for businesses to eSign necessary documents securely. With its user-friendly interface, you can manage your returns quickly, ensuring compliance with the city's regulations while saving time and resources.

-

What features does airSlate SignNow offer for managing city of Mayfield KY net profit license fee returns?

airSlate SignNow offers features like customizable templates, automated workflows, and secure cloud storage to help manage the city of Mayfield KY net profit license fee returns. These tools ensure that your documentation is not only compliant but also easily accessible any time you need to reference prior returns.

-

Is there a cost associated with using airSlate SignNow for city of Mayfield KY net profit license fee returns?

Yes, there is a pricing structure for using airSlate SignNow, which is designed to be cost-effective for businesses of all sizes. By utilizing airSlate SignNow for your city of Mayfield KY net profit license fee return, you can potentially save on administrative costs associated with traditional paper-based processes.

-

Can I integrate airSlate SignNow with my accounting software for city of Mayfield KY net profit license fee returns?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, allowing you to streamline your city of Mayfield KY net profit license fee return process. These integrations help you maintain accurate financial records and simplify your filing process.

-

What benefits does airSlate SignNow provide for eSigning the city of Mayfield KY net profit license fee return?

Using airSlate SignNow for eSigning the city of Mayfield KY net profit license fee return offers several benefits, including faster turnaround times, enhanced security, and reduced paper usage. This not only accelerates the filing process but also ensures that your sensitive information remains protected.

-

How do I get started with airSlate SignNow for my city of Mayfield KY net profit license fee return?

Getting started with airSlate SignNow is easy; simply create an account on the platform and explore its features. You can begin by uploading your city of Mayfield KY net profit license fee return documents, customizing templates, and inviting team members to collaborate. Comprehensive tutorials are available to guide you through the process.

Get more for NET PROFIT LICENSE FEE RETURN FORM OL 3 Om 3y Ear

- Eng1 medical form pdf

- Sh02 form

- Vaccination consent form for diphtheria tetanus firstcommunityhealthcare co

- Post office cheque authority card form

- The completed form should be sent immediately to the head of field delivery englandscotlandwales for the area

- Macmillan sponsorship form

- Direct debit form pdf

- 2880 certificate and motion for default120120 form

Find out other NET PROFIT LICENSE FEE RETURN FORM OL 3 Om 3y Ear

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation