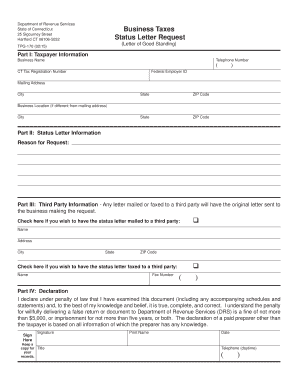

TPG 170 Business Taxes Status Letter Request Business Taxes Status Letter Request Ct Form

What is the TPG 170 Business Taxes Status Letter Request?

The TPG 170 Business Taxes Status Letter Request is a formal document utilized by businesses in Connecticut to request verification of their tax status from the state’s tax authority. This letter serves as an official confirmation of a business's tax compliance and standing, which may be required for various purposes, including loan applications, business transactions, or regulatory compliance. It is essential for businesses to maintain accurate tax records, and this letter acts as a crucial tool in demonstrating their adherence to tax obligations.

How to Use the TPG 170 Business Taxes Status Letter Request

Using the TPG 170 Business Taxes Status Letter Request involves several straightforward steps. First, ensure that you have all necessary information, such as your business identification number and relevant tax details. Next, complete the form accurately, providing all required information. Once filled out, submit the request to the appropriate state tax authority, either electronically or via mail, depending on the submission options available. It is important to keep a copy of the submitted request for your records.

Steps to Complete the TPG 170 Business Taxes Status Letter Request

Completing the TPG 170 Business Taxes Status Letter Request requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including your business identification number and any previous tax filings.

- Fill out the form with accurate and complete information, ensuring all sections are addressed.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, whether online or by mail.

Legal Use of the TPG 170 Business Taxes Status Letter Request

The TPG 170 Business Taxes Status Letter Request is legally recognized as a formal request for tax status verification. It is essential for businesses to understand that this document must be filled out correctly to ensure its legal validity. Compliance with state regulations regarding tax requests is crucial, as improper handling may lead to delays or complications in obtaining the necessary tax status confirmation.

Required Documents for the TPG 170 Business Taxes Status Letter Request

When preparing to submit the TPG 170 Business Taxes Status Letter Request, certain documents may be required to support your application. These may include:

- Your business identification number.

- Previous tax returns or filings.

- Any correspondence from the tax authority related to your business taxes.

Having these documents ready can facilitate a smoother process when requesting your tax status letter.

Who Issues the TPG 170 Business Taxes Status Letter Request?

The TPG 170 Business Taxes Status Letter Request is issued by the Connecticut Department of Revenue Services. This agency is responsible for managing tax compliance and providing necessary documentation to businesses operating within the state. It is important to ensure that your request is directed to the correct department to avoid any processing delays.

Quick guide on how to complete tpg 170 business taxes status letter request business taxes status letter request ct

Complete TPG 170 Business Taxes Status Letter Request Business Taxes Status Letter Request Ct with ease on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle TPG 170 Business Taxes Status Letter Request Business Taxes Status Letter Request Ct on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign TPG 170 Business Taxes Status Letter Request Business Taxes Status Letter Request Ct effortlessly

- Find TPG 170 Business Taxes Status Letter Request Business Taxes Status Letter Request Ct and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign TPG 170 Business Taxes Status Letter Request Business Taxes Status Letter Request Ct and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tpg 170 business taxes status letter request business taxes status letter request ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TPG 170 Business Taxes Status Letter Request?

The TPG 170 Business Taxes Status Letter Request is a formal document requested by businesses in Connecticut to verify their tax filing status. Utilizing airSlate SignNow, you can easily create and send this letter electronically, ensuring a smooth and efficient process.

-

How can airSlate SignNow help with the TPG 170 Business Taxes Status Letter Request?

airSlate SignNow offers an intuitive platform for creating, signing, and managing the TPG 170 Business Taxes Status Letter Request. With customizable templates and eSignature capabilities, businesses can streamline their documentation processes and save time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to fit various business needs. By choosing airSlate SignNow for your TPG 170 Business Taxes Status Letter Request management, you'll benefit from a cost-effective solution without compromising on features.

-

Is airSlate SignNow secure for handling sensitive documents like the TPG 170 Business Taxes Status Letter Request?

Yes, airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive documents like the TPG 170 Business Taxes Status Letter Request. You can rest assured knowing that your information is safe and confidential.

-

Can I integrate airSlate SignNow with other business applications?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications, enhancing your workflow when handling documents like the TPG 170 Business Taxes Status Letter Request. This ensures that your processes are more efficient and connected.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSignature, custom templates, document collaboration, and audit trails. These features are particularly useful for managing the TPG 170 Business Taxes Status Letter Request, making it easy to track changes and obtain approvals swiftly.

-

How long does it take to prepare a TPG 170 Business Taxes Status Letter Request using airSlate SignNow?

Creating a TPG 170 Business Taxes Status Letter Request with airSlate SignNow is quick and straightforward. You can prepare and send the document within minutes, allowing you to focus on other important business tasks without delay.

Get more for TPG 170 Business Taxes Status Letter Request Business Taxes Status Letter Request Ct

Find out other TPG 170 Business Taxes Status Letter Request Business Taxes Status Letter Request Ct

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT